Micro-LED Madness

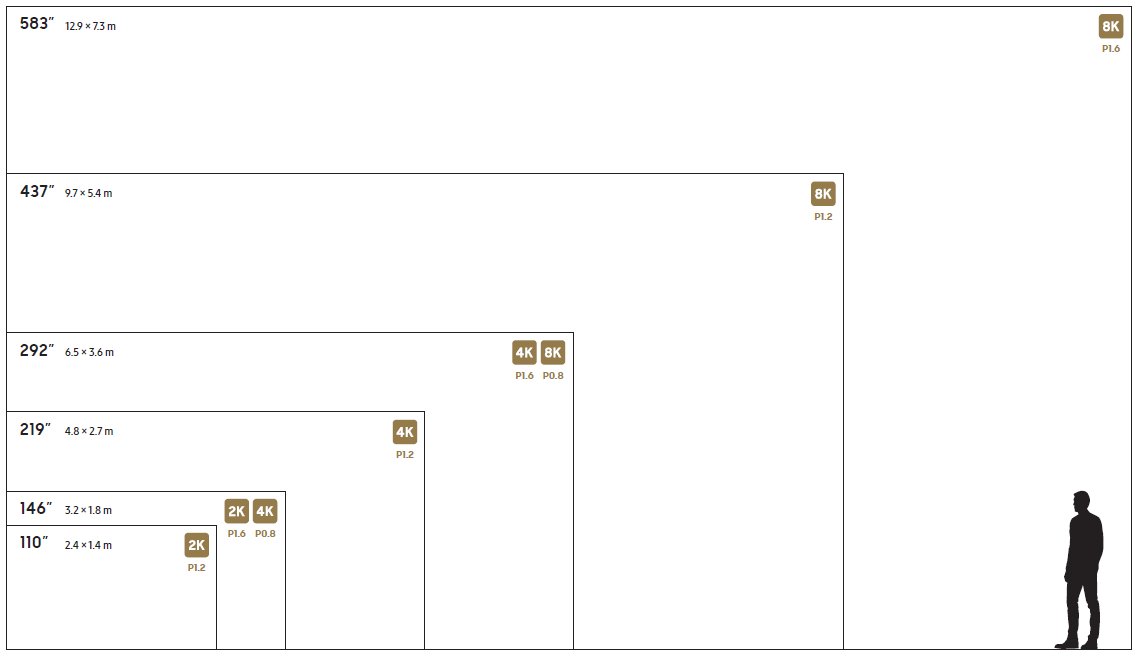

Micro-LEDs, while they are even smaller versions of typical LEDs, do not operate as part of an LCD display. In fact they are more like OLEDs in that they are self-emitting, producing light that you see directly. They are not ‘gated’ but turn on and off individually. Further, while mini-LEDs might number in the thousands in an LCD display, the number of micro-LEDs is in the millions, with three for each pixel. That comes to 24.75m micro-LEDs for a 4K display and 99.53m LEDs for an 8K display, and logic says that as the display gets smaller, all of those small LEDs are packed more closely, so producing a micro-LED TV gets ‘easier’ as the display gets larger.

We note also that in mini-LED backlights while there are a few thousand LEDs, they are usually configured in ‘strings’, with a ‘string’ being a number of LEDs that operate as one, meaning they go on and off together creating a ‘zone’. Each zone needs driver circuitry to operate, so the complexity of the backlight circuitry is dependent on the number of zones rather than the number of LEDs. In micro-LED displays, each sub-pixel has its own control circuitry, so the TFT (thin-film transistor) complexity is far greater for micro-LEDs (many millions vs. a few hundred) than for mini-LEDs, vastly increasing the chance for bad components, increasing power consumption, and increasing heat, all of which are issues facing micro-LED display development, and we didn’t even mention the elephant in the room.

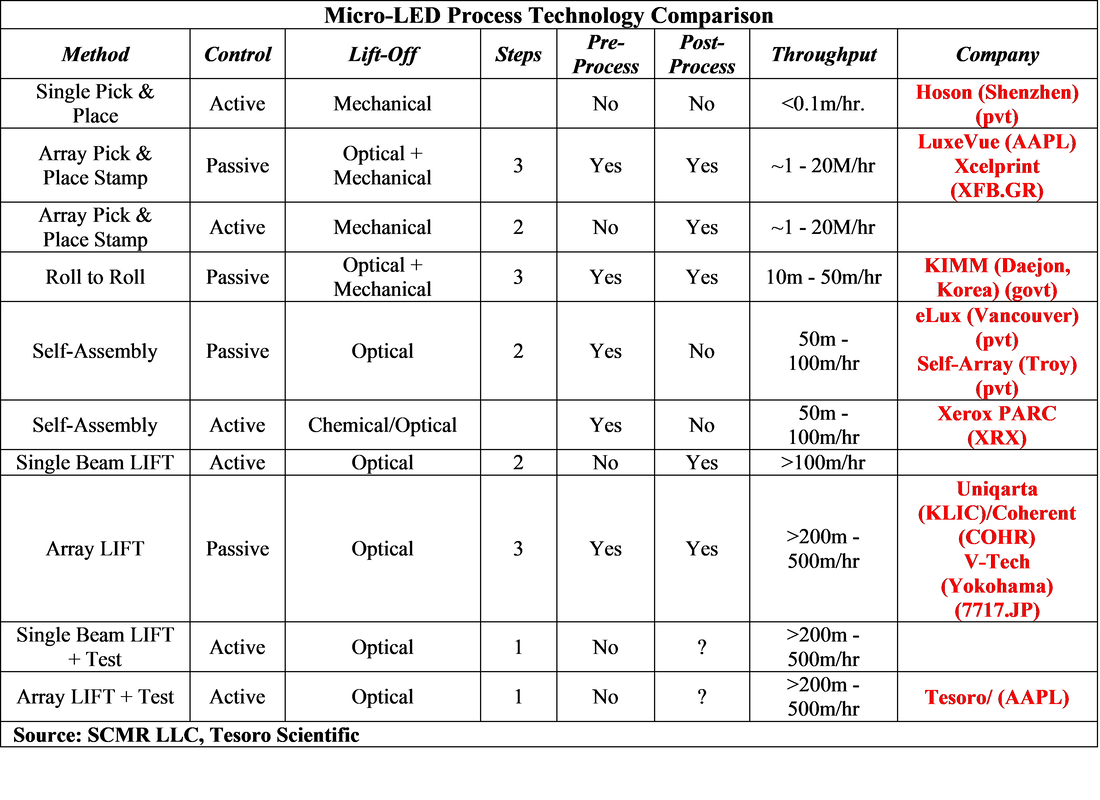

The elephant in the room here is logistics. Moving hundreds of LED dies from a wafer to a substrate for mini-LED backlights presents some issues and tools have been developed to handle such a task, such as the Pixalux™ from Kulicke & Soffa (KLIC), but going from moving a few thousand small LEDs to moving many millions of LEDs that can be as small as 20um (0.000787”) is a completely different ballgame. As an aside, assuming a 0.99999% transfer success rate for a 4K micro-LED screen still presents 248 bad micro-LEDs on average, each of which has to be removed and replaced, aside from testing each micro-LED for quality.

So who would spend billions of dollars to develop such a difficult display technology? Almost everyone, because LCD technology has some very limiting restrictions and while LCD displays will be around for many more years, self-emitting light sources are the ‘way of the future’. OLED displays (self-emitting) have become an integral part of the display industry and display manufacturers are always looking for technologies that will allow them to reduce the complexity of display production, and self-emitting materials eliminate the need for a backlight and in some cases the need for a color filter. While the challenges facing micro-LED production seem quite daunting, the challenges facing OLED display production were also formidable but have been overcome and eventually micro-LED displays will become a part of the display infrastructure.

Of course timing is everything in the CE space, so there are a few companies that have been pushing ahead in the development of micro-LED technology, led, not surprisingly by Samsung Electronics, who has the capabilities to produce both semiconductors and displays, and is expanding its plans for micro-LED commercialization. Samsung originally came out with a modular product called ‘The Wall’, which is a relatively low (960 x 540) resolution RGB Micro-LED system that has a pixel pitch (distance between LEDs, center to center) of 0.84mm and has no visible border around each module or cabinet, as a configuration of 12 modules is called. This allows the cabinets to be stacked in almost any configuration, but we note this is a big system, with the cabinets about 3” deep and generating the equivalent heat to ~six 60W incandescent light bulbs, so the potential customer tends to be a commercial venue .

In order to develop such products for mass production, Samsung has been building a supply chain specific to micro-LEDs and will be using China’s Sanan Optoelectronics (600703.CH) as a micro-LED supplier for the 110” and 99” versions, but will shift to PlayNitride (pvt) for the 88” and 76” micro-LEDs. In 2018 Samsung signed a long-term micro-LED development agreement with Sanan, who recently completed a $1.8b mini/micro-LED production plant in Hubei and is an investor in PlayNitride. Sanan has also been a mini-LED supplier to both Apple (AAPL) and TCL (000100.CH). AU Optronics (AUOTY) is said to be the supplier of the control circuitry for the line, and has been working with Apple to develop its own micro-LED technology, although with LED supplier Ennostar (3714.TT) primarily.

While we expect Samsung’s micro-LED TVs will remain in the rarified atmosphere of TVs that cost five figures for some time, Samsung’s commitment to the technology is telling, and reflects, to a degree, the general Samsung philosophy that LCD technology is heading into its twilight. Samsung affiliate Samsung Display (pvt) has been reducing its exposure to LCD large panel production, and if it were not for the massive price increases seen over the last year in large panel LCD prices, would likely have been out of that business at the end of last year, leaving parent Samsung Electronics to procure large panel LCD displays on the open market and focusing itself further on developing small panel OLED and a new large panel OLED/QD technology.

In the case of micro-LEDs, Samsung Electronics can choose to directly build or control as much of this relatively new supply chain as it wants, and with a potentially very large customer in the wings (Apple), they seem willing to step up their commitment to at least this early stage of the technology. There are many hurdles that must be met to make micro-LEDs a viable commercial display technology and there is no guarantee that such efforts will be successful, but Samsung has made such ‘blind’ commitments before that have proved ultimately successful and it looks like they are heading in the same direction now. Whether this will ultimately wind up generating a new technology and supply chain remains to be seen, but having Samsung pushing the technology and commercialization envelope is certainly a plus, and having another CE behemoth watching those moves, gives those in the new supply chain a bit of encouragement.

RSS Feed

RSS Feed