More Fun With Data – Smartphone Cameras

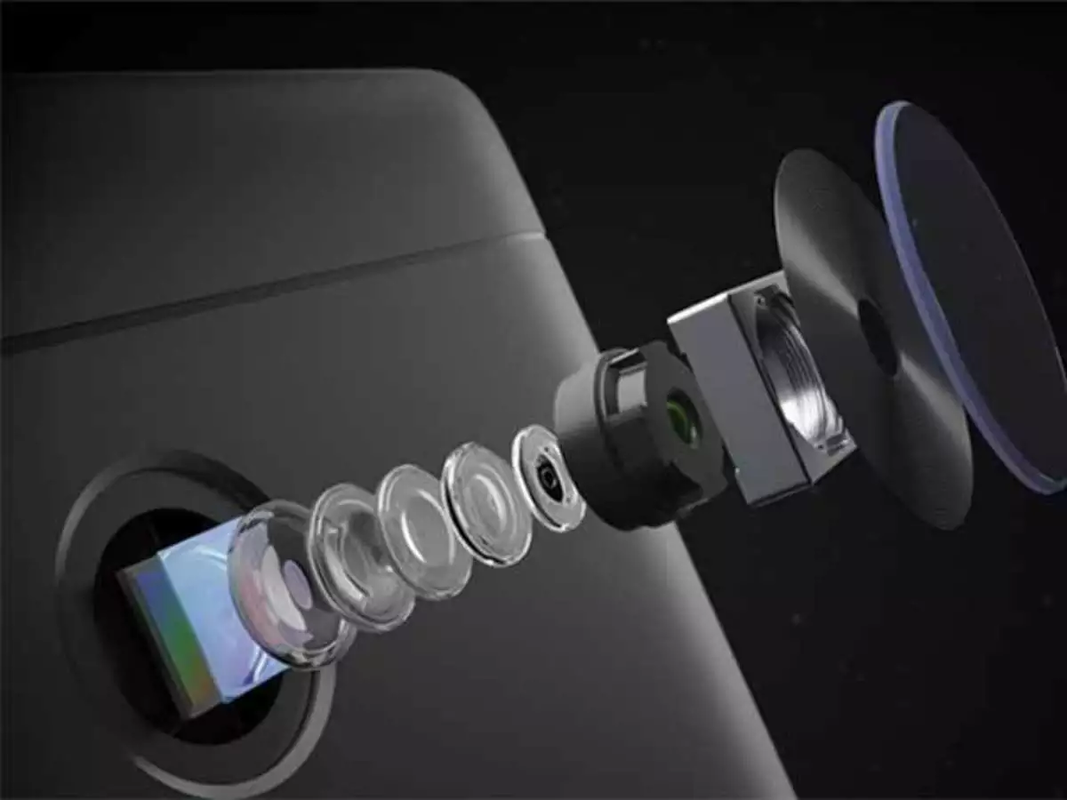

We believe much of the smartphone industry’s push to add multiple cameras on smartphones was generated by the industry itself and less so by consumers, so the lesser share of 4 or more main cameras last year strikes us a good thing, but at the same time the resolution of smartphone cameras has also improved, a more important metric than the number of cameras on a device. It is estimated that in 2021 more than 50% of main cameras fell within the 13Mp to 48Mp range, while ~20% were 49Mp to 64%, and those numbers are limited a bit by the iPhone, whose main cameras have relatively small pixel counts (12Mp) that are enhanced by software and TOF. Last year there were 32 models, representing 5.6% of all smartphone models that had main cameras with over 100Mp, up from 10 in 2020, so we see the trend moving to quality rather than quantity.

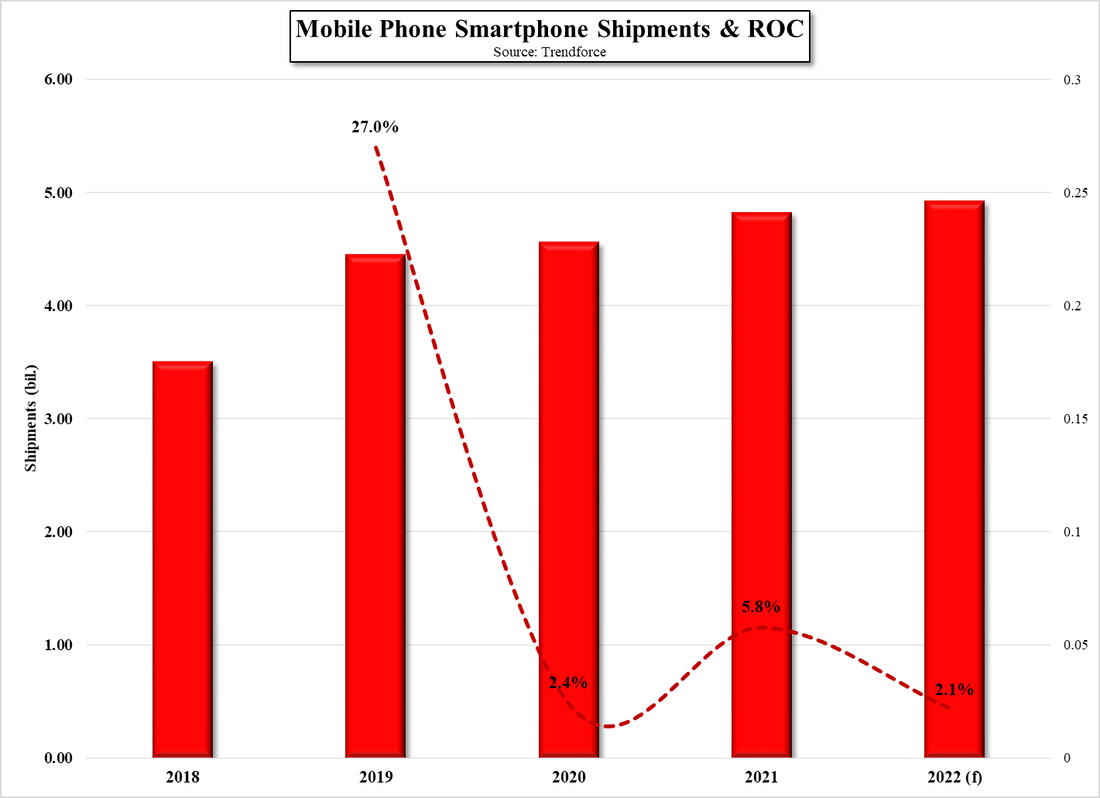

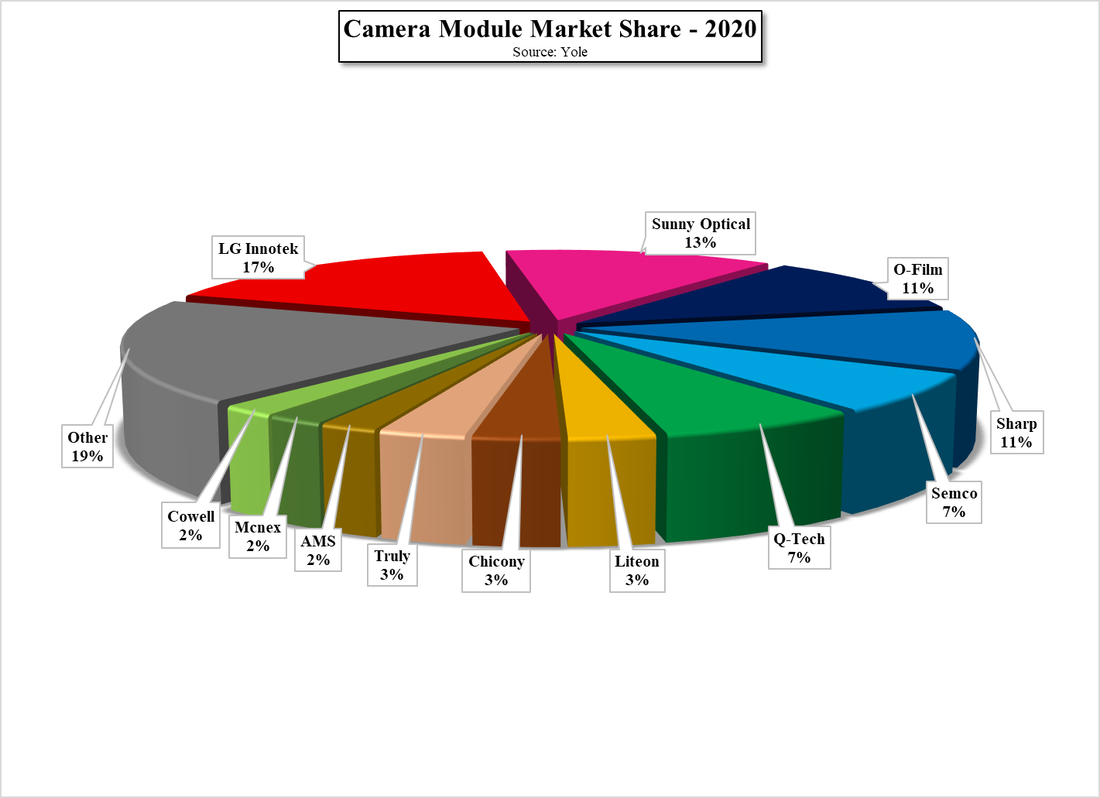

That’s the good news, but we are concerned about the growth rate of the mobile camera market in light of the change in focus, and while camera module shipments increased by 5.8% last year, expectations are closer to 2% to 2.5%, which seems a bit low but at least is reflective of what we expect will be the continued focus on mid-tier and low-end phones where camera counts are a more sensitive issue and higher quality cameras on flagship and foldables. Some of this has already been revealed in relatively weak forecasts for some Chinese camera component manufacturers, but the sales of the camera modules last year grew by 8.2% and is expected to see a CAGR (2020 – 2026) of 14.8% through 2026, with the slowest growing sub-segment, image sensors, still growing at a CAGR of 6.7% over the period. Leaders in the module space (2020) are LG Innotek (011070.KS), Sunny Optical (2382.HK), O-Film (002456.CH), Sharp (6753.JP), and Semco (009150.KS), as indicated in Fig. 3.

RSS Feed

RSS Feed