Fun with Data – Raw Materials

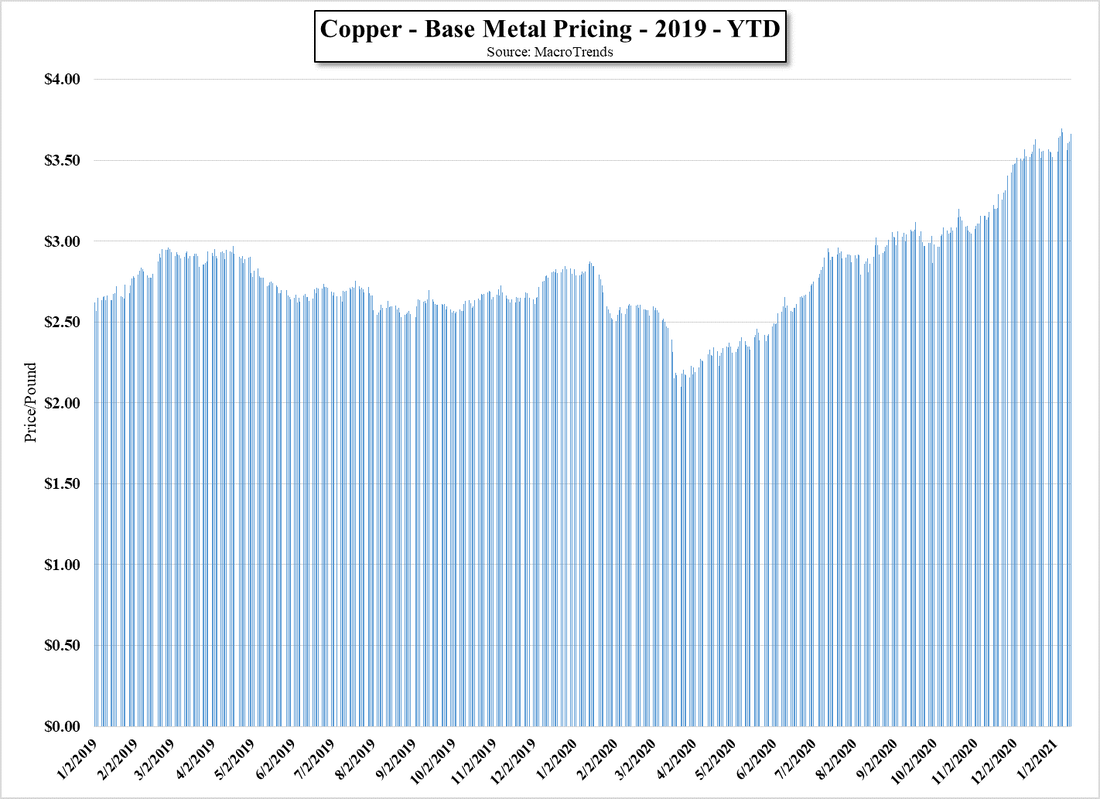

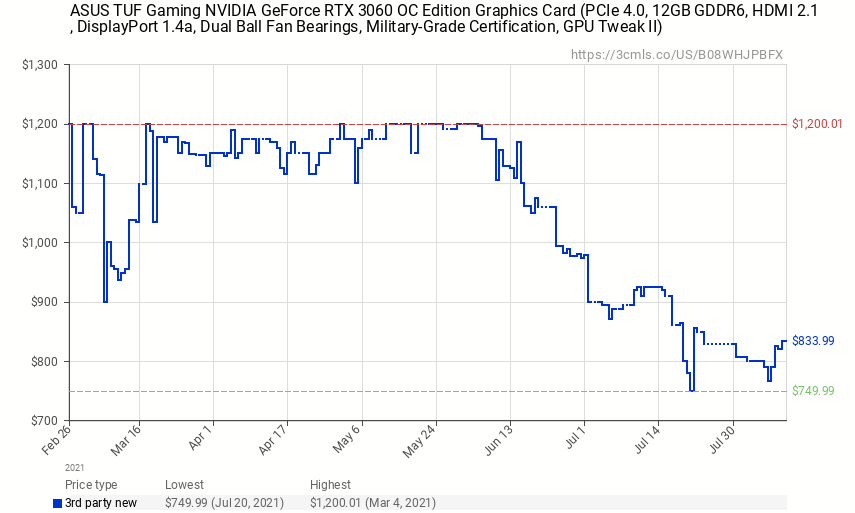

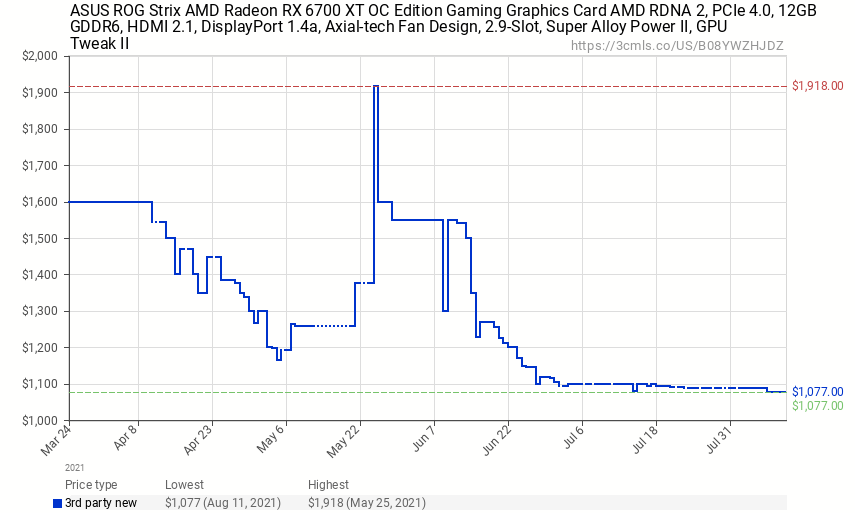

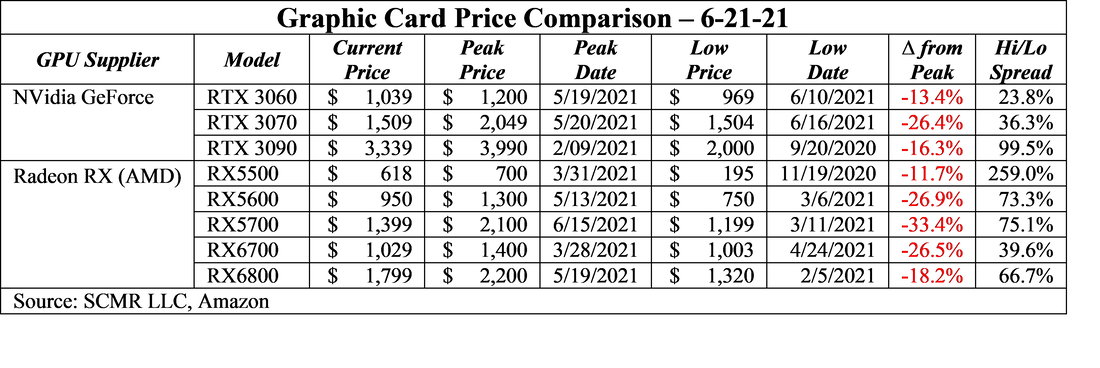

3Q, the seasonal build period for CE devices would typically be the quarter in which production gears up and raw material inventories are replenished toward strong holiday demand, and while we are still in an ‘unprecedented’ environment, we expect 3Q to be a bit less frenetic, with weaker demand from TVs and smartphones pushing a bit less on CE raw material prices. Consumer Electronics production does generate significant demand for some materials, particularly Indium and some rare earths, and while copper is a key raw material for most CE products, there are other drivers that could offset any weakness in CE demand. While current CE device inventory builds in raw material prices that were seen in May and June, some of that pressure might ease a bit in 3Q and give CE brands a bit of margin breathing room that will be needed to attract consumers at current higher device prices. Will it be enough to make a difference or will blended inventory pricing mitigate any raw material price reductions? The Magic 8 Ball says’ “Reply Hazy. Try Again Later”, say, in 30 days.

RSS Feed

RSS Feed