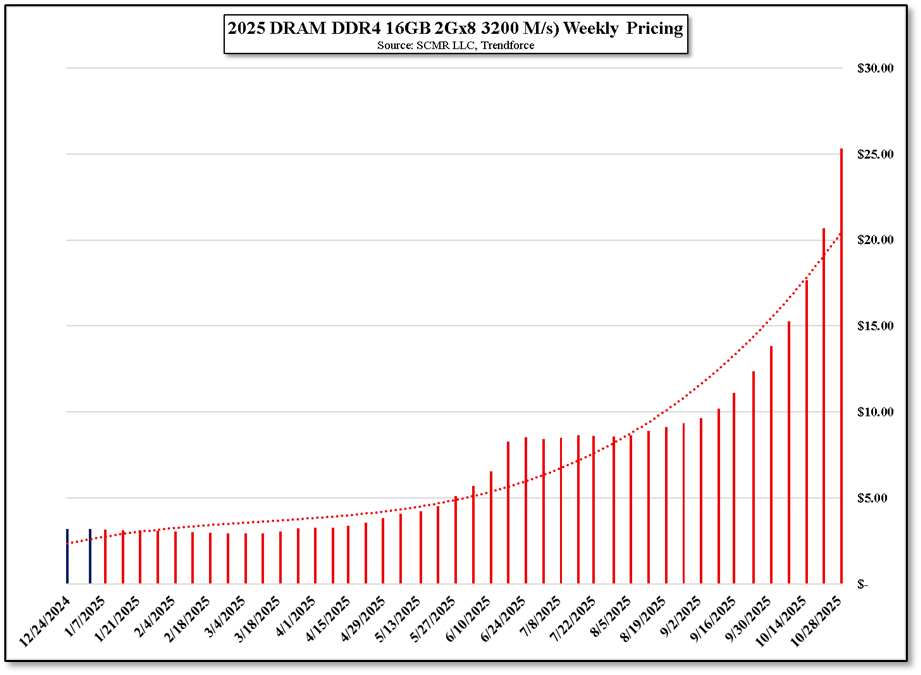

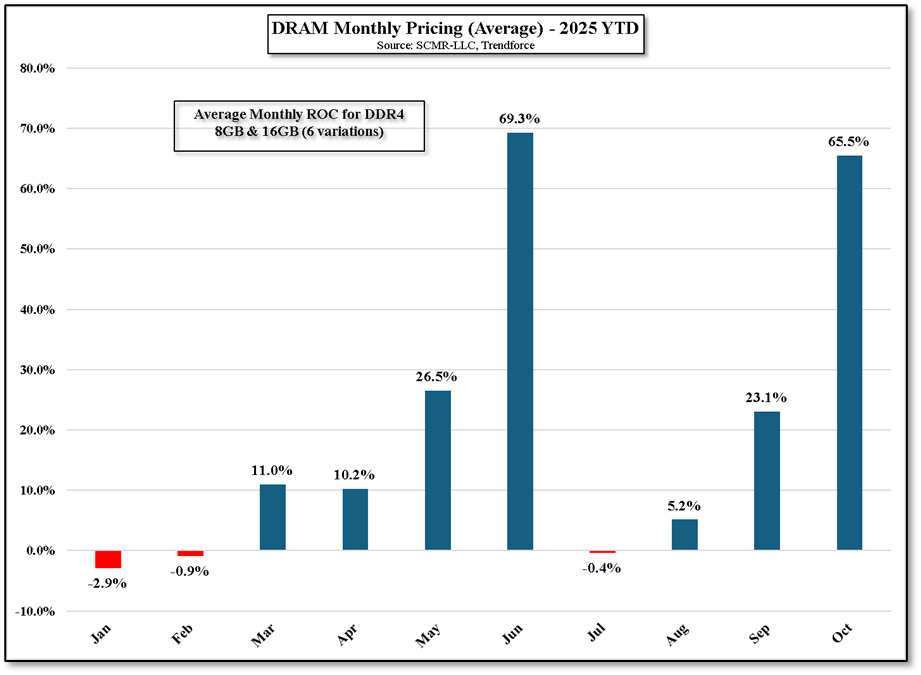

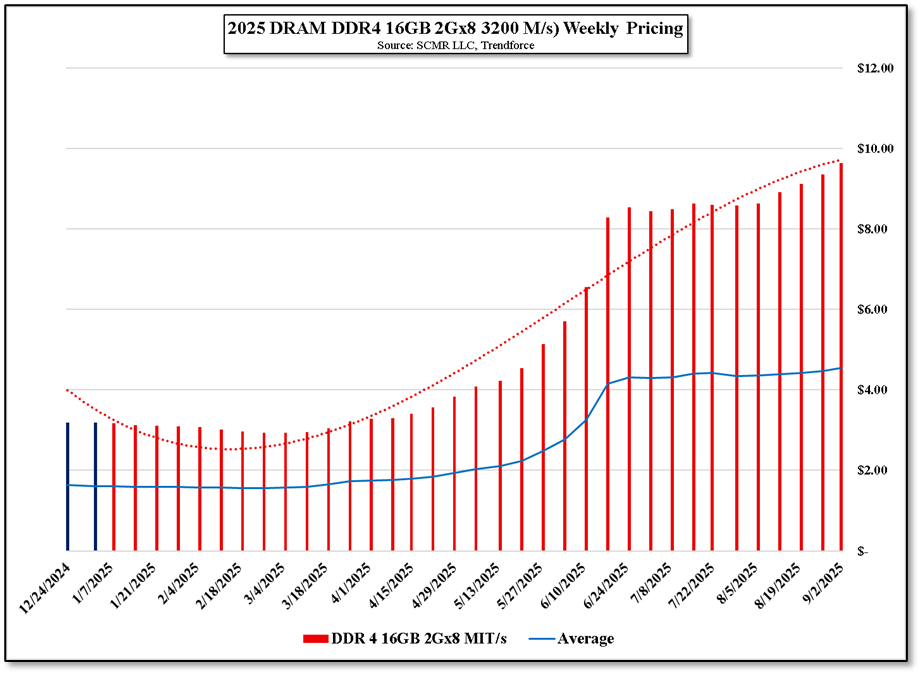

Memory Prices Continue to Rise

Rather than speculate on whether the rally runs out of steam before the end of the year we focus more on how CE companies will deal with these massive price increases and whether they will get passed on to consumers next year or whether CE companies will eat the increase and deal with additional margin compression. We expect the effect will be relatively small this year, perhaps reducing discounts a bit during the holidays, but at some point the effects of AI data center growth will force CE brands to pass on some of those increases to consumers in 2026.

RSS Feed

RSS Feed