Gen 8.6 OLED Fab Race Dominance: China’s CSOT Ink-Jet vs. Samsung FMM

Competition in the OLED display space goes far beyond product specifications and styles. Each panel producer must find a way for display differentiation to secure a significant market presence. Brands capitalize on these technological differences to demonstrate expertise. While CE brands have their own focus on differentiation, if they can generate a more distinct product at the basic level they can use it to point out how different their technology is from others. Samsung Display (pvt) is among the biggest proponents of this concept, years ago ending all LCD display production and focusing almost exclusively on OLED displays. This has served them well as they have been able to dominate the OLED display space for years, but over time it is inevitable that other producers make inroads and that difference is no longer unique.

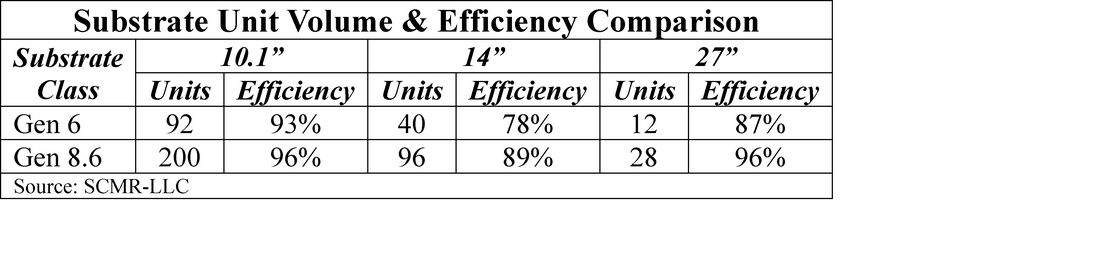

As the display industry looks toward shifting focus away from a heavy reliance on TV panel production, the necessity for more specialized Gen 8.6 OLED display fabs that can produce OLED IT products (Monitors, Laptops, and Tablets) in a high volume setting becomes essential. Instead of substrates that are 2.775 m2 (Gen 6), these new fabs use substrates that are 5.65 m2, twice as large in area, not only more than doubling the unit volume per sheet but improving the efficiency (Glass Usage/Glass Area) of the substrate..

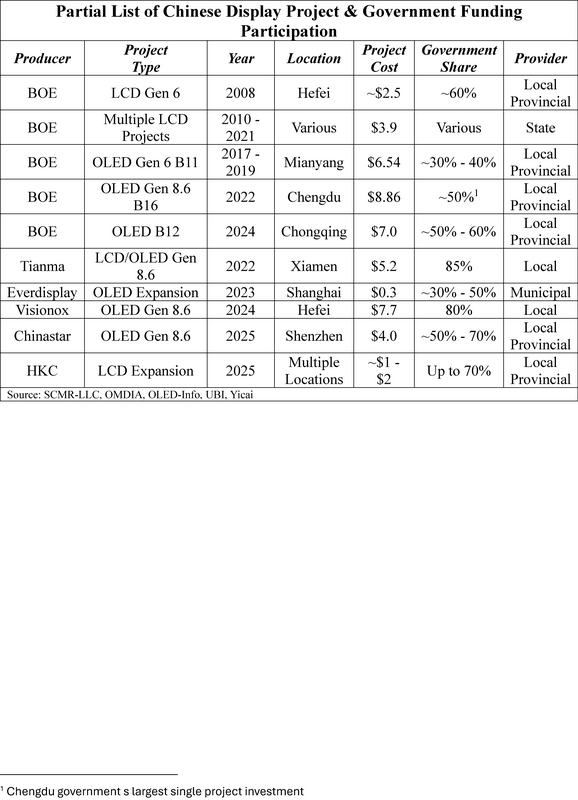

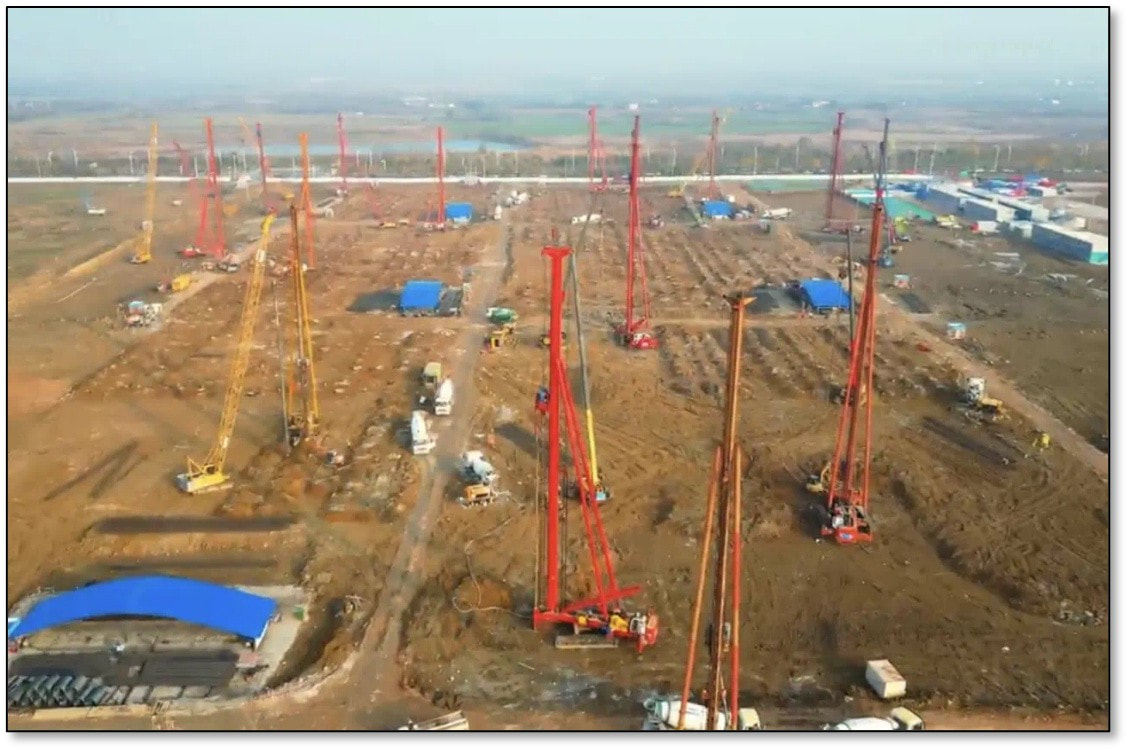

There are four such Gen 8.6 OLED fab projects at various stages of development across the display industry. Both Samsung Display and China’s BOE (200725.CH) are heading toward the last stages of equipment installation, while Visionox (002387.CH) is still in the construction phase and Chinastar (000100.CH) broke ground on their project in October of this year. These are large and expensive projects.

Samsung Display – Their Gen 8.6 fab, designated A6, is built on the site of a former LCD fab. It is expected to cost between $3 billion and $3.1 billion US and has an expected capacity of 15,000 sheets/month

BOE – BOE’s Gen 8.6 fab in Chengdu, designate B16, is expected to cost between $9.0 billion and $9.9 billion, with an expected capacity of 32,000 sheets.

Visionox – The Visionox Gen 8.6 fab project in Hefei, is expected to cost $7.7 billion and have a total capacity of 32,000 sheets/month.

Chinastar – Chinastar’s Gen 8.6 fab, dubbed T8 (Guangzhou) is expected to cost between $4.1 billion and $4.5 billion with an expected capacity of 22,500 sheets, although the company has hinted it could be doubled to 45,000 sheets/month.

Large Process Differences

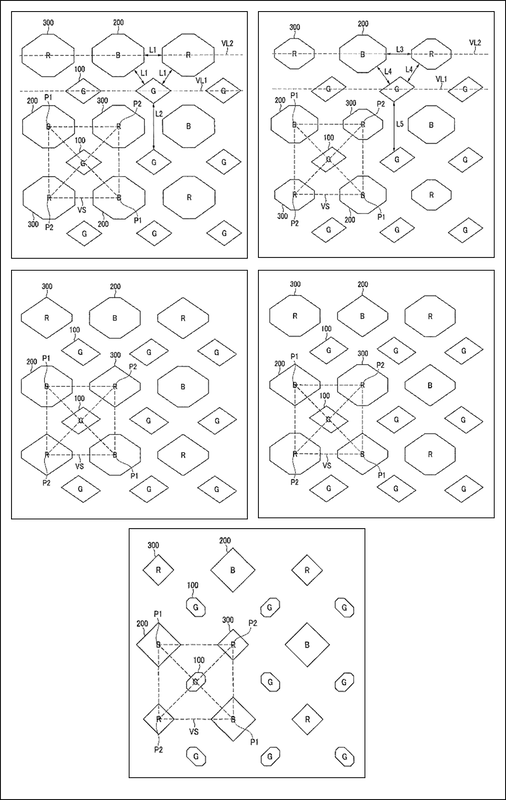

Based on these specifications, the differentiation between suppliers seems minimal, but that is definitely not the case. Typically OLED displays are produced using large deposition chambers where OLED materials are vaporized and passed through fine metal masks (think – screens) that precisely place the materials on a substrate. These are very expensive tools (hundreds of millions) as are the masks. Given that the OLED materials are not only placed on the substrate but also attach to the chamber walls and build up on the masks, the tool needs to be taken offline and cleaned regularly, while the masks must be constantly replaced. This leads to a relatively mature but inefficient process, however one that is well-known to both SDC and BOE from their Gen 6 OLED display fabs.

Visionox is approaching the Gen 8.6 OLED process differently, basing its fab on the use of photolithography to place OLED materials. It is a new display technology that has never been used for large-scale production, so a successful project could separate Visionox from BOE and SDC, giving them a competitive advantage. Chinastar is also taking a new route but has settled on using ink-jet printing as its deposition method, a technique that is used by others for parts of the OLED display production process, but not for the key deposition steps. Again, a successful project would put Chinastar in a class by itself.

Risk

Why would two of the four panel producers involved in Gen 8.6 OLED display production take such a massive risk? They have no choice. Both Samsung Display and BOE are OLED giants, with multiple fabs and years of production experience. Neither Visionox nor Chinastar have the OLED resources and experience to compete directly with these two leaders, making it difficult for them to become suppliers to large CE brands who must be assured that capacity and yield will be there when they need it. Samsung and BOE will eventually refine their Gen 8.6 processes and present customers with a reliable supply of OLED IT products, forcing Visionox and Chinastar to rely more of product differentiation than competing on volume and yield.

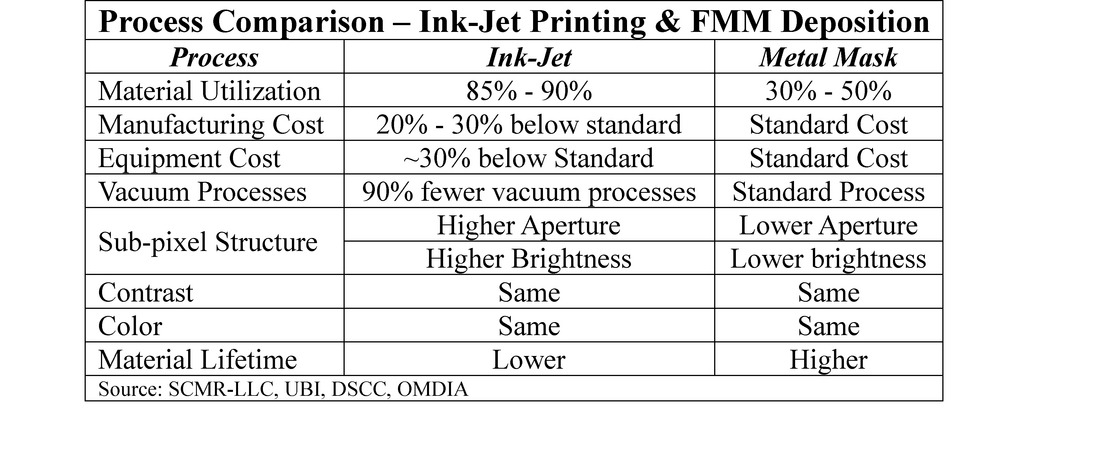

Aside from the process differentiation, there is the matter of cost. Not the cost of the fab, which will get depreciated over time, but the cost of producing the panels themselves. As noted, the deposition process used by SDC and BOE is wasteful. Up to 70% of the OLED materials are wasted as the materials collect on the inside of the chamber and on the mask. The process itself must be done under high vacuum conditions to keep OLED material molecules from colliding with gas molecules, and while the OLED materials must be heated to vaporize them, the substrate and the mask must maintain a cooler temperature to prevent expansion that would misalign the materials. The vacuum makes the process cumbersome in that the chamber must be pressurized and depressurized each time a sheet enters the system while low pressure must be precisely maintained throughout the process, slowing throughput and complicating substrate transfers.

While the lithographic process is still being developed, Chinastar’s ink-jet printing process is a bit more mature, as it is used to encapsulate OLED displays and to deposit quantum dot materials in SDC’s QD/OLED process. This makes the process easier to cost out when comparing it to metal mask deposition. theoretically, the processes compare like this:

The pivot toward Gen 8.6 OLED fabs marks a critical inflection point where the fierce competition among display producers moves beyond product style and focuses squarely on manufacturing process differentiation. The shift from 2.775m2 substrates (Gen 6) to 5.05m2 substrates is not just a 2X scale-up; it's a fundamental change that more than doubles unit volume and significantly improves material efficiency for high-demand IT products (laptops, monitors, tablets).

While industry leaders Samsung Display (SDC) and BOE leverage their experience with the mature but costly Fine Metal Mask (FMM) Evaporation process, their massive capital expenditure (up to $9.9 billion) and process inefficiency present a vulnerability. The FMM approach's reliance on high vacuum, constant mask replacement, and up to 70% material waste creates a high-cost structure that will eventually be challenged.

Conversely, Visionox and China Star (CSOT) are making a necessary and high-stakes bet on FMM-free technologies:

- Visionox with its new, photolithography-based process (ViP).

- CSOT with its Ink-Jet Printing (IJP) method.

Ultimately, the successful execution of these Gen 8.6 projects will determine the future hierarchy of the global display market. For established giants, success means solidifying supply dominance with reliable volume. For challengers like Visionox and CSOT, success requires proving the viability and reliability of their innovative processes. This technological diversification is not merely an option but a strategic imperative that will redefine the cost structure, supply dynamics, and competitive landscape of the premium IT display segment for the next decade.

RSS Feed

RSS Feed