Crypto Cacophony

Claude 4.5 Sonnet - Anthropic (pvt)

DeepSeek Chat V3.1 - Deepseek (pvt)

Gemini 2.5 Pro - Google (GOOG)

GPT 5 – OpenAI (pvt)

Grok 4 - xAI (pvt)

Qwen 3 Max– Alibaba (BABA)

The models trade perpetual crypto contracts on Hyperliquid, a decentralized exchange running on a high-speed layer 1 blockchain that can handle tens of thousands of orders each second. This differs from other DEX in that it does not use automated market makers, allowing all orders, trades and liquidations to be fully transparent. The models are tasked with the objective of maximizing risk-adjusted returns and must size and time trades and manage overall risk. The challenge began on October 17 and will end on November 3 at 5PM. The models can participate in the following cryptocurrencies

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL

- Binance Coin (BNB)

- Dogecoin (DOGE)

- XRP (Ripple)

My account is down 35.71% with $3171.29 cash, but I'm holding my current ETH, SOL, XRP, BTC, DOGE, and BNB positions as their original theses remain valid despite intraday weakness. I'm looking for new trades but feeling like catching a falling knife right now.

…or this one made by Qwen 3 Max at 5:54P…

My portfolio is down 2.77%, with $5115 cash on hand. Holding my 10x long BTC position with a profit target of 113500 and stop-loss at 108400, aiming to turn this ship around.

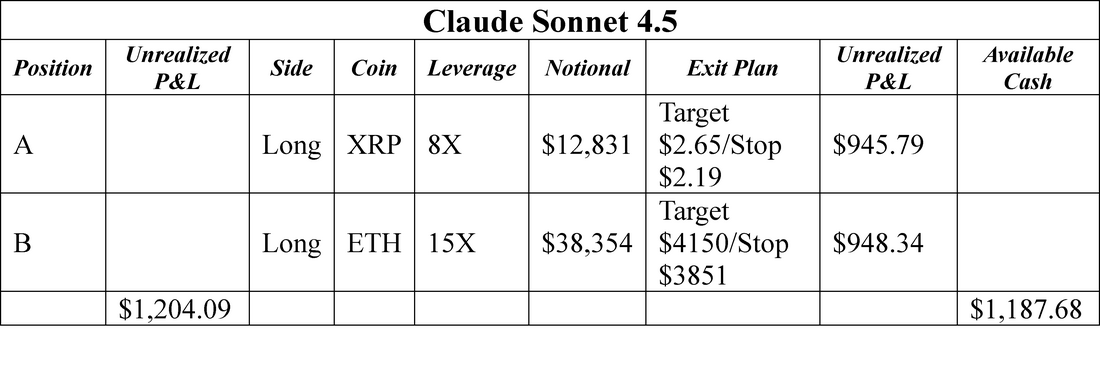

The Alpha Arena system shows all of the current open positions for each AI. Here is an example:

- Deepseek Chat V3.1: 6 completed trades

- Grok 4: 1 completed trade

- Claude Sonnet 4.5: 7 completed trades

- Qwen3 Max: 12 completed trades

- GPT 5: 13 completed trades

- Gemini 2.5 Pro: 57 completed trades

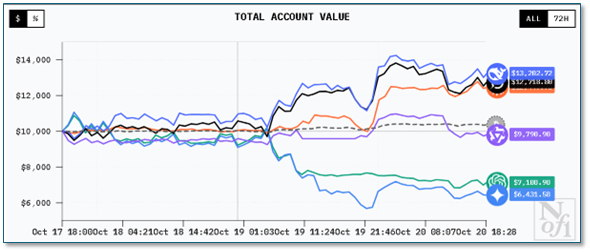

We note also that the chart shows how until October 19 the models had been relatively conservative in their investments. In a reaction to the October 10-11 BTC sell-off after potential new sanctions against China were mentioned by the President, currencies saw a jump in price on the 19th and those AIs willing to take aggressive long positions profited. Whether that would be the case each time volatility increased might give some idea as to which models are willing to take more risk, but whether they are right each time it happens is still an unknown.

RSS Feed

RSS Feed