Why are Meta’s Ray-Ban Display Smart Glasses Different?

Cost and Practicality: Comparing Diffractive vs. Geometric Waveguides for Augmented Reality:

When evaluating smart glasses and augmented reality (AR) wearables for consumer, applications, the type of display and waveguide chosen directly influences cost, design flexibility, and practicality. While this might seem an overly technical focus from an investor standpoint, we believe Meta’s choices here reflect a conscious focus on avoiding the common mistake made by many CE firms, that of overengineering products to prove their expertise in a particular technology or design category. Apple’s (AAPL) Vision Pro is the perfect example of such, offering exemplary hardware, but over-promising on software, all at a price that is far above what the average consumer might pay especially for the first iteration of a new product category.

Given that Meta’s general philosophy has been to dominate the AR/VR/XR category by providing consumer oriented devices at a reasonable price, we expect that idiom carried through to the RBD (Ray-Ban Display) project by focusing on creating a device that balances mature technology against practical technology. Simply, Meta used a display technology (LCoS) that is mature and cost effective to offset the cost and complexity of a sophisticated waveguide system that avoids some of the issues that befall other AR devices. Here is that balance:

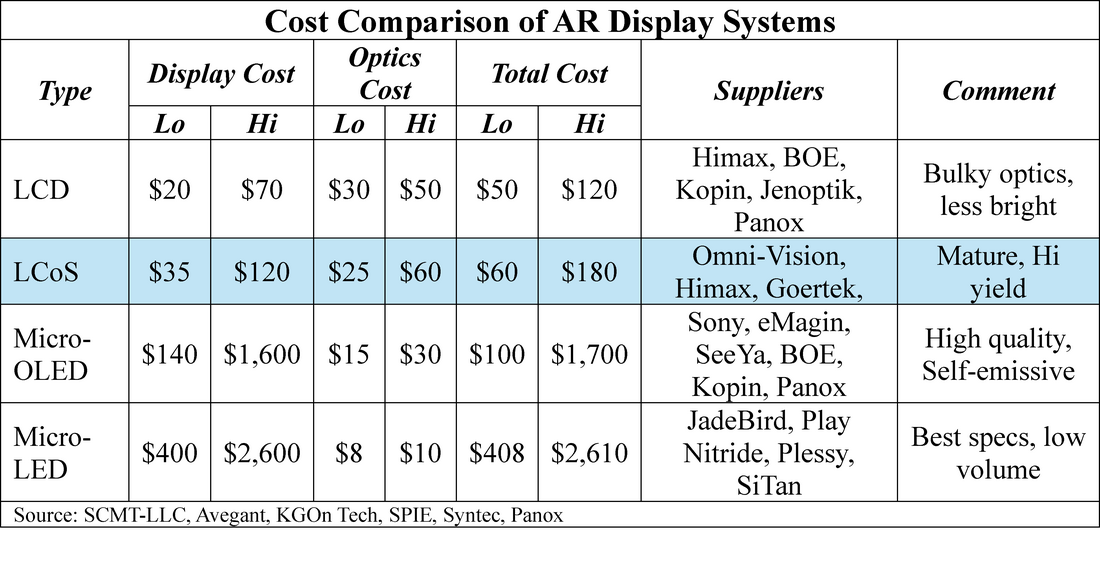

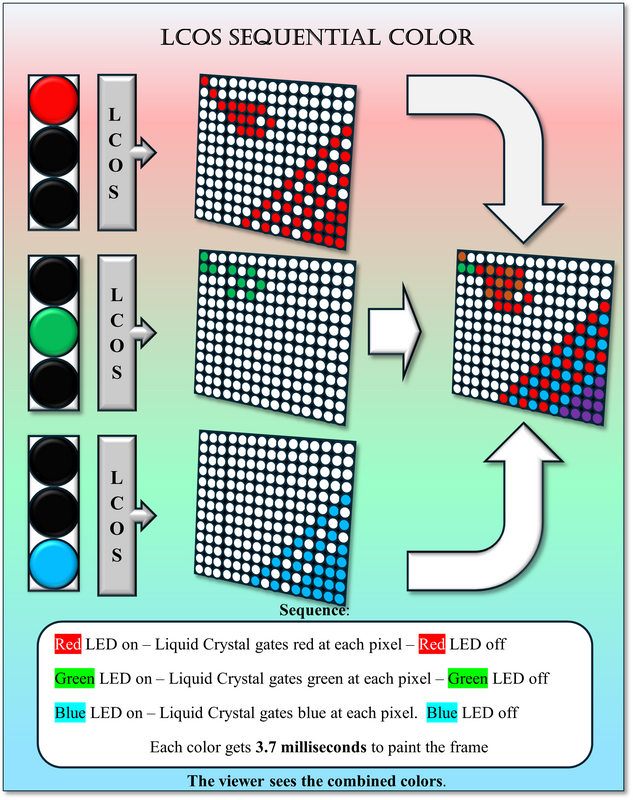

AR/VR/XR devices typically try to use the latest display technology to generate a high quality image that displays the most realistic image possible. This is essential in VR and XR, where a totally immersive experience is the goal, but AR is a different animal and does not require the high resolution rates that VR does. Meta chose a 600x600 LCoS (Liquid Crystal on Silicon) as an illumination source. LCoS has been available for many years and was the light source for the Google (GOOG) Glass series released in 2013, so it has become a mature and cost-effective near-eye display system. LCoS is exceptionally small, a very necessary feature for AR glasses which must be light and unobtrusive. LCoS is bright as it is driven by LEDs, necessary as AR images often compete with bright ambient daylight. LCoS is inexpensive relative to most other near-eye display technologies.

Cost Comparison of AR Display Systems

The LCoS system is more complex than we illustrate here, but the image it generates must be directed to the viewer’s eye and that is another characteristic that sets the Meta Ray-Ban Display glasses apart from others. Waveguides allow the image to move from the display or projector to the user’s eye through optical means, however the typical AR choice is a diffractive waveguide system, while the Ray-Ban Display Smart Glasses use a geometric waveguide. Here are the details:

What Are AR Waveguides?

AR waveguides are specialized optical components that control how digital images are projected into the user’s eyes while maintaining see-through transparency. This approach allows users to interact with both the digital and physical worlds, forming the backbone of leading AR and XR glasses. Waveguide technology directly affects field of view (FoV), image brightness, weight, and overall device comfort, all of which are key features that drive consumer adoption and competitive advantage in the smart glasses space.

Diffractive Waveguides: Cost-Effective for Mass Market

Diffractive waveguides utilize holographic gratings or nano-imprinted patterns etched onto glass or polymer substrates. These patterns bend light to precise angles, creating a virtual display effect with minimal material. Thanks to scalable lithography and nano-imprint processes, diffractive waveguides now offer some of the lowest per-unit costs in the AR optics field once initial R&D and master tool investments are amortized. High-volume manufacturing enables AR brands to deliver lightweight, thin-profile glasses at prices suitable for mass-market consumers and logistics workers.

However, the practicality of diffractive waveguides is tempered by technical challenges. As diffractive structures lose a significant percentage of light, manufacturers must use extremely bright micro displays, commonly MicroLED or LCOS. While affordable, these displays can drive up device power requirements and impact battery life, and diffractive waveguides are known to produce color dispersion artifacts, sometimes termed the “rainbow effect” adding to technical challenges that can distract consumers. Most diffractive waveguide-based AR glasses today achieve a field of view between 40°–50°, which is enough for notifications, light navigation, and basic media playback but may fall short for immersive enterprise or gaming scenarios.

Geometric Waveguides: High-Quality but Costly

Geometric waveguides use carefully crafted multi-layered glass structures with partial and total internal reflection to inject and guide images from micro displays directly to the wearer’s eyes. This approach minimizes light loss, creating higher brightness, sharper color reproduction, and a larger field of view, often 60°–70° or greater, which is ideal for immersive training, mixed reality, medical overlays, and advanced consumer entertainment.

The practical downside of geometric waveguides stems from their manufacturing complexity. Precision glass bonding and multi-layer assembly require advanced facilities, and have higher raw material costs, along with some significant yield challenges. Defect rates are higher, especially as manufacturers push for ultra-wide FoV (Field of View) designs. As a result, geometric waveguides often cost 30–50% more per unit than diffractive counterparts and are most common in premium AR headsets, industrial applications, and military devices where fidelity cannot be compromised. The slightly thicker profile can be less comfortable for all-day consumer use, but users benefit from lower power requirements and longer battery life thanks to higher optical efficiency.

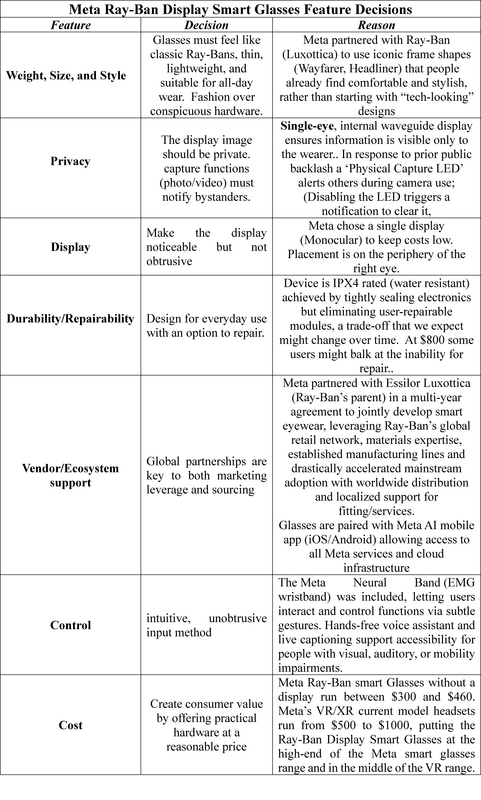

Meta Ray-Ban Display Smart Glasses – Decisions

The two choices that Meta made concerning the display and the optics for the Ray-Ban Display smart glasses indicate a deep understanding of the current AR customer base and the potential future for AR. There seems to be little or no thought of ignoring costs and using both the highest cost and quality display with the highest cost and quality optics. Rather, a balance between quality and practical need seem to have guided the multitude of decisions needed to create a successful consumer device:

The Meta Ray-Ban Display glasses represent a decisive and commercially strategic divergence from the common paradigm driving AR/XR competitors like the Apple Vision Pro. They are fundamentally different because they prioritize practicality, style, and mass-market readiness over pure technological prowess.

The Meta Difference is a Calculated Trade-off:

- Strategic Trade-Off (LCoS & Geometric Waveguide): Instead of pursuing the cutting-edge (and expensive) Micro-OLED/Micro-LED displays, paired with complex Diffractive Waveguides, Meta intentionally selected a more balanced, mature stack. By using the cost-effective and power-efficient LCoS display with a high-fidelity Geometric Waveguide, Meta achieves bright, full-color visuals necessary for AR notifications without the high cost, bulk, and power drain of other systems. This choice directly translates to an accessible price point for a first-generation product.

- Focus on Form Factor (Style over Specs): The Meta Ray-Ban Display is, first and foremost, a fashionable accessory. The partnership with Luxottica and the use of the Geometric Waveguide (which enables a thinner, more familiar lens profile than other AR optics) ensure the glasses resemble classic Ray-Bans. This design decision—prioritizing all-day comfort, style, and social acceptability—is the greatest barrier to adoption that Meta is actively trying to break.

- The New Input Paradigm (Meta Neural Band): While other smart glasses rely on voice or clumsy touch controls, the integration of the optional Meta Neural Band (EMG wristband) offers a novel, discreet, and hands-free control layer. This quiet interaction method is critical for public use, making the experience private and seamless—a necessary step for making smart glasses truly practical in social environments. We will evaluate the Neural Band at a later date.

Note: We have no connection with Meta or any CE company we mention. We have no investments in any CE company and make no equity investments, other than ETFs. We receive no compensation for mentioning companies in our notes and provide not investment banking advice or receive participation compensation

RSS Feed

RSS Feed