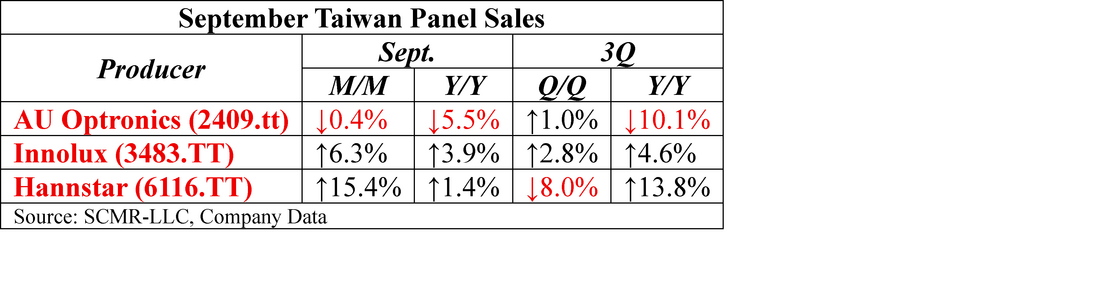

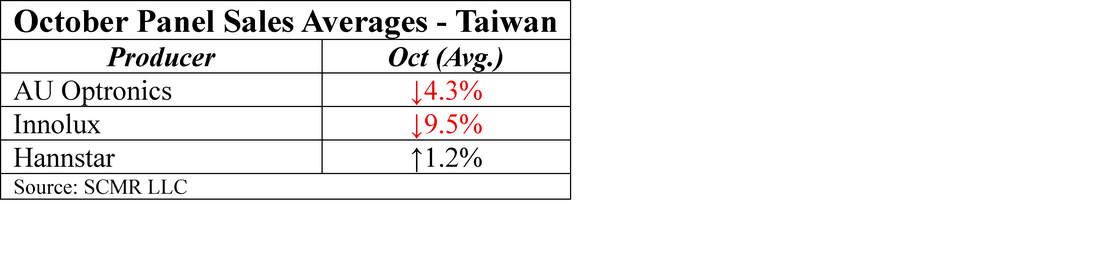

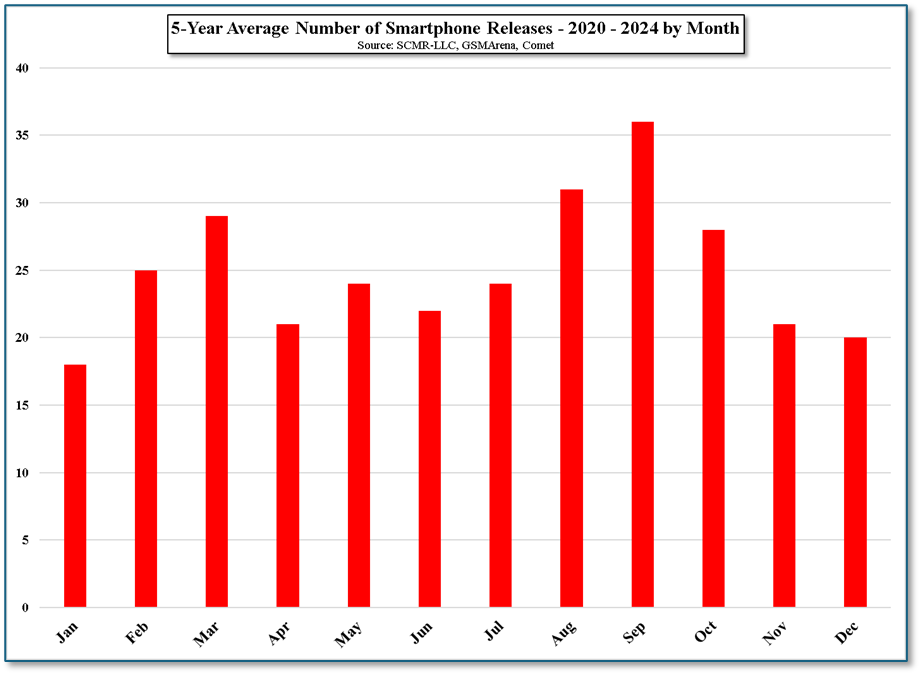

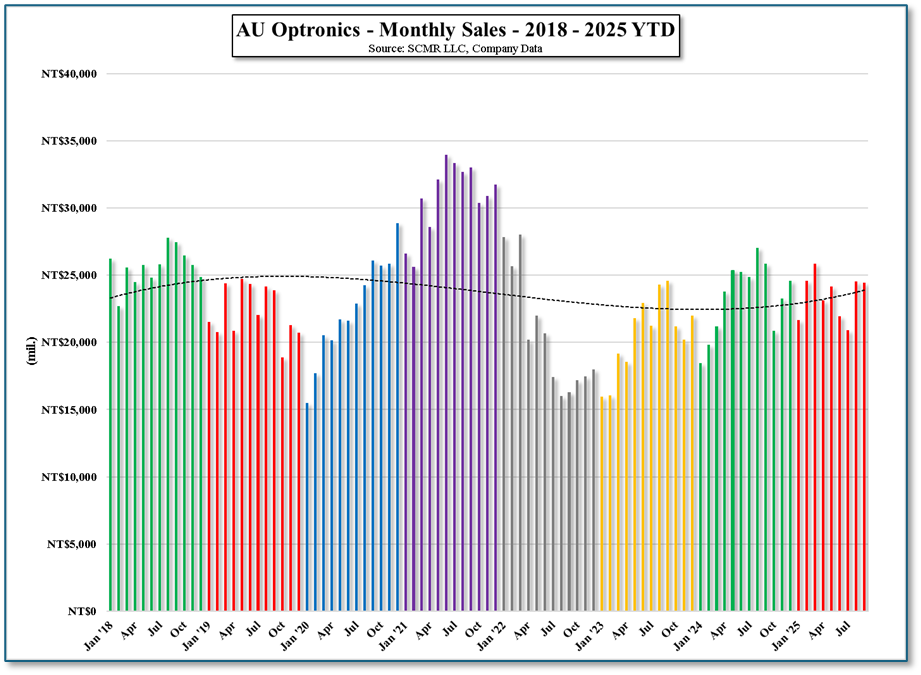

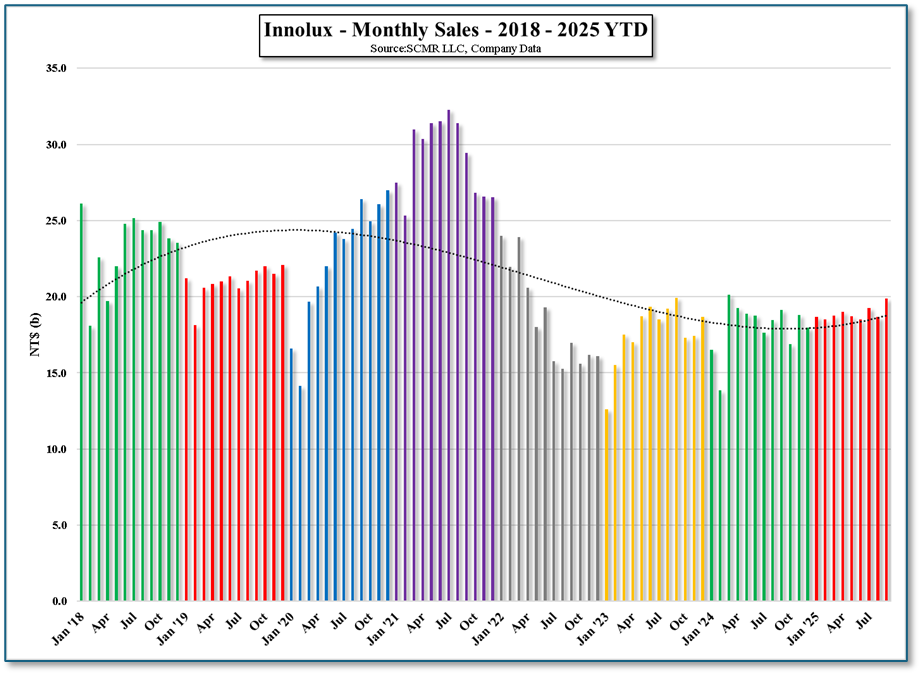

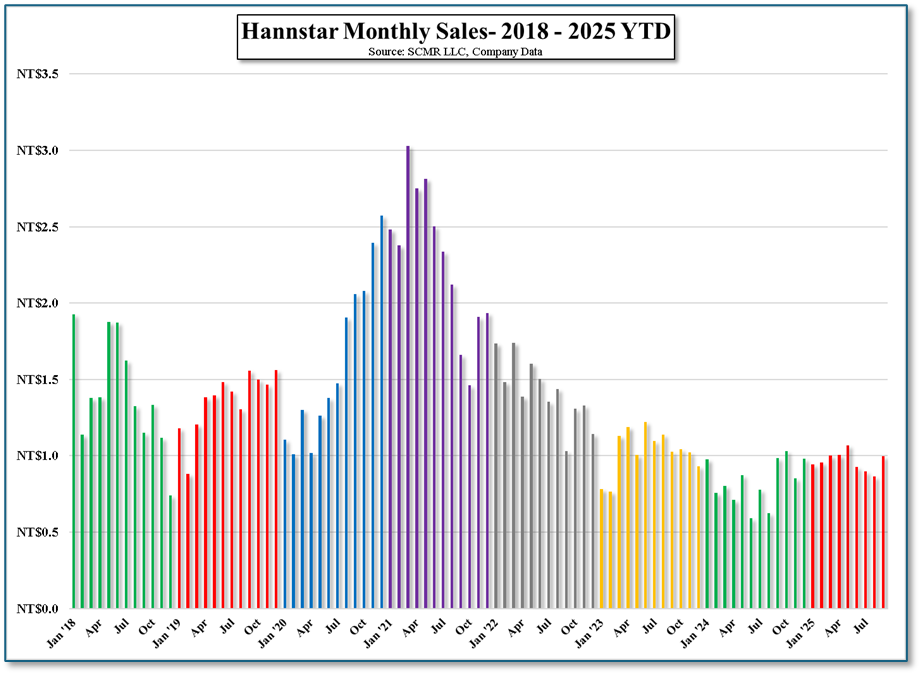

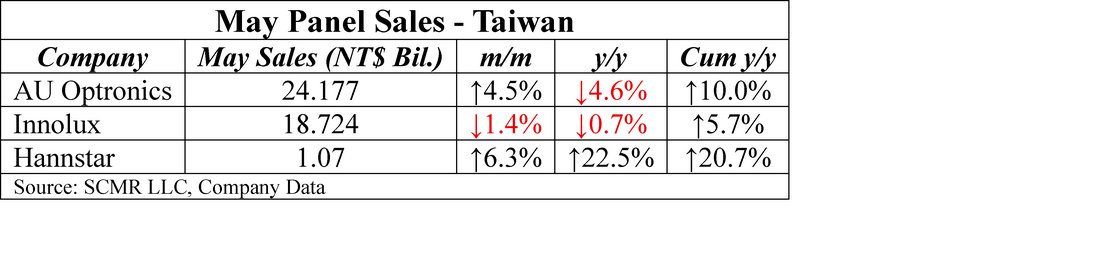

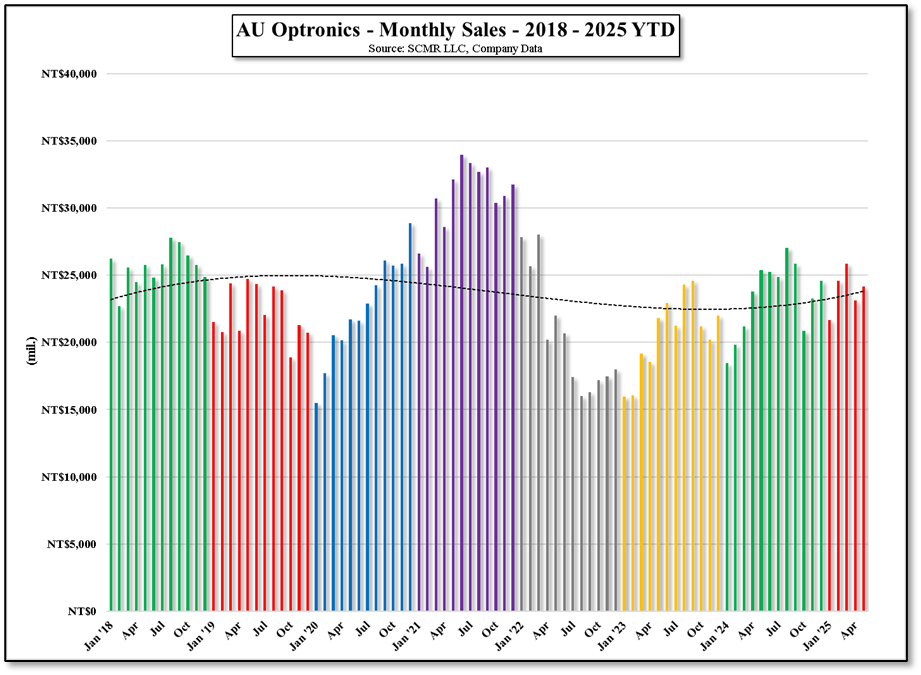

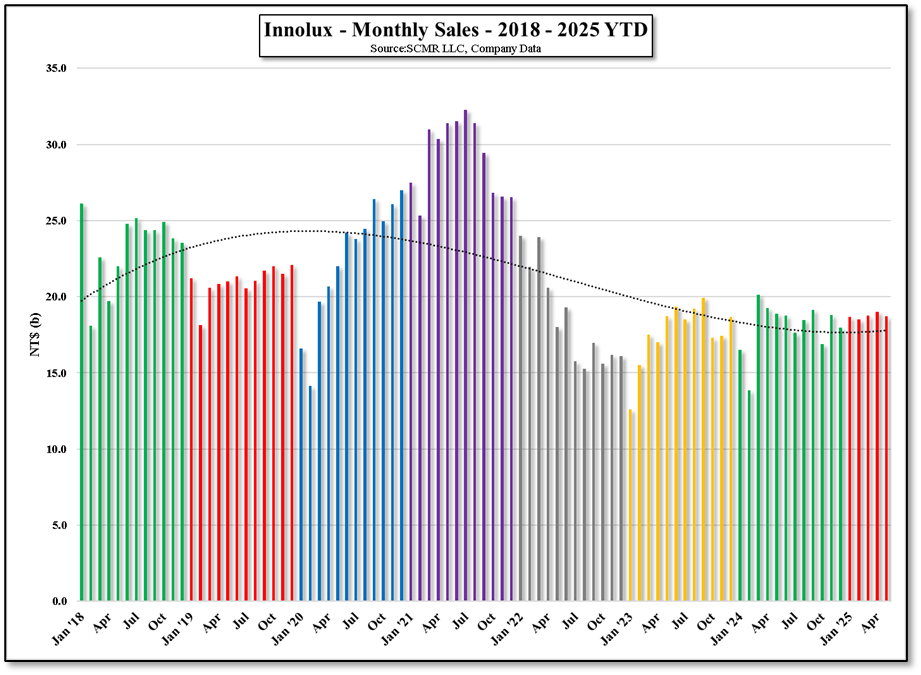

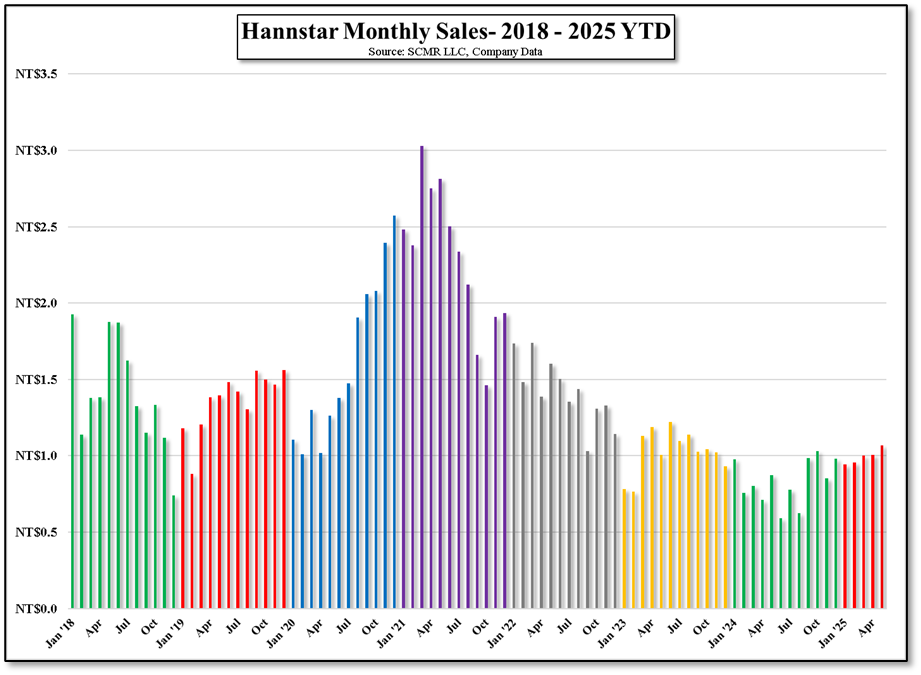

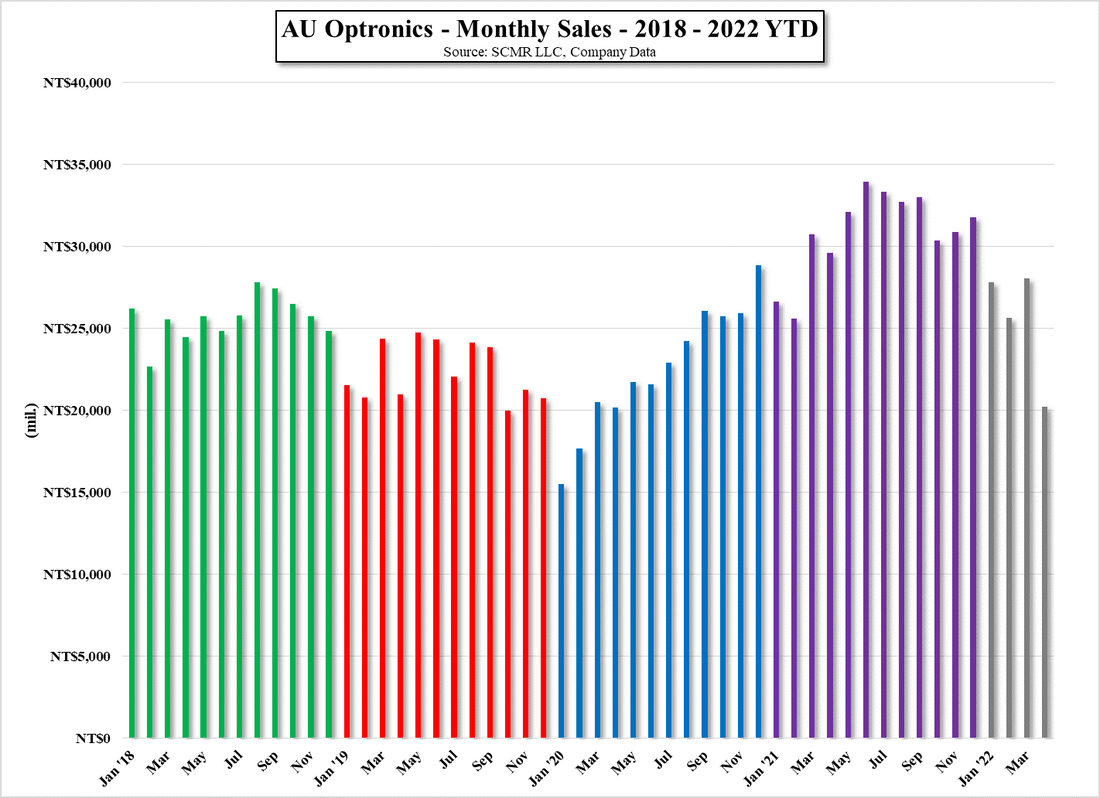

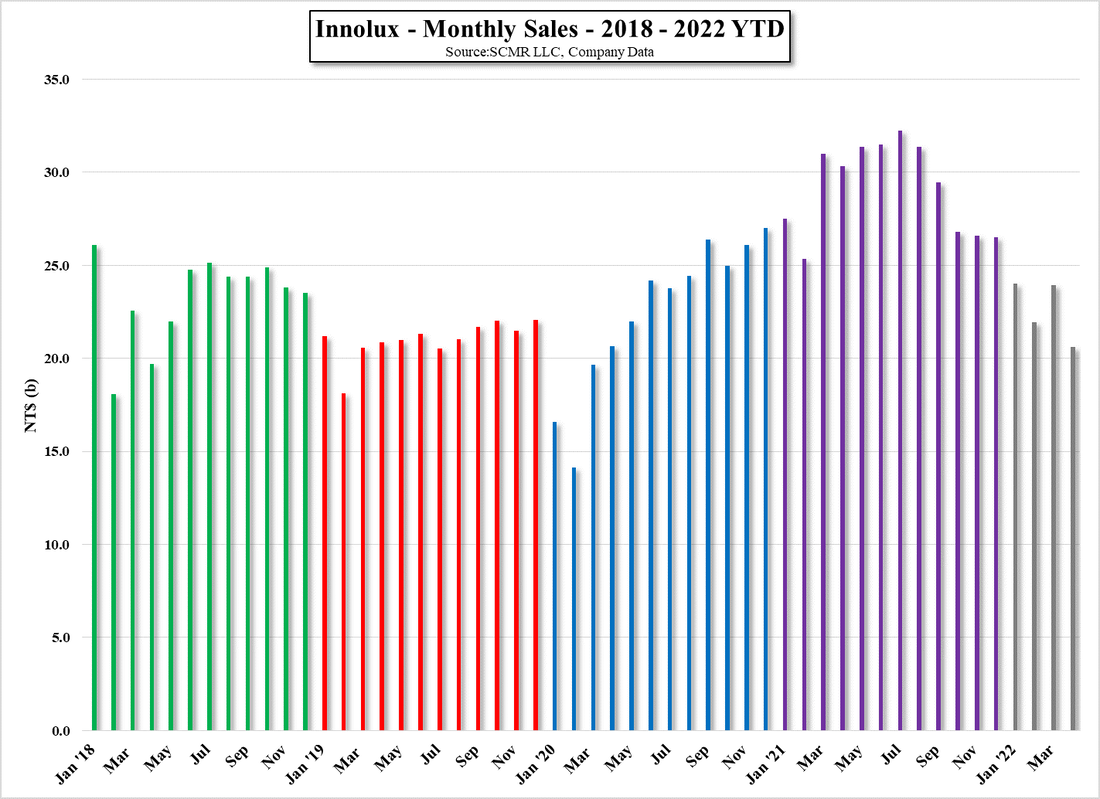

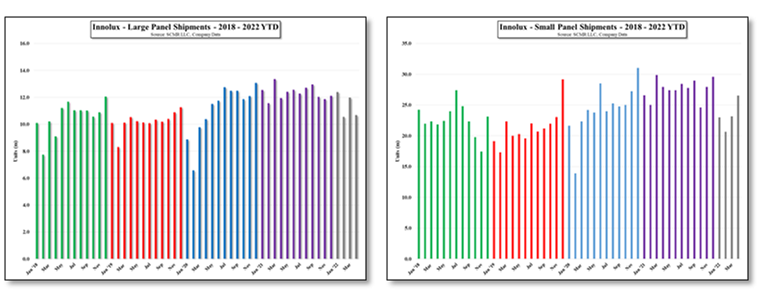

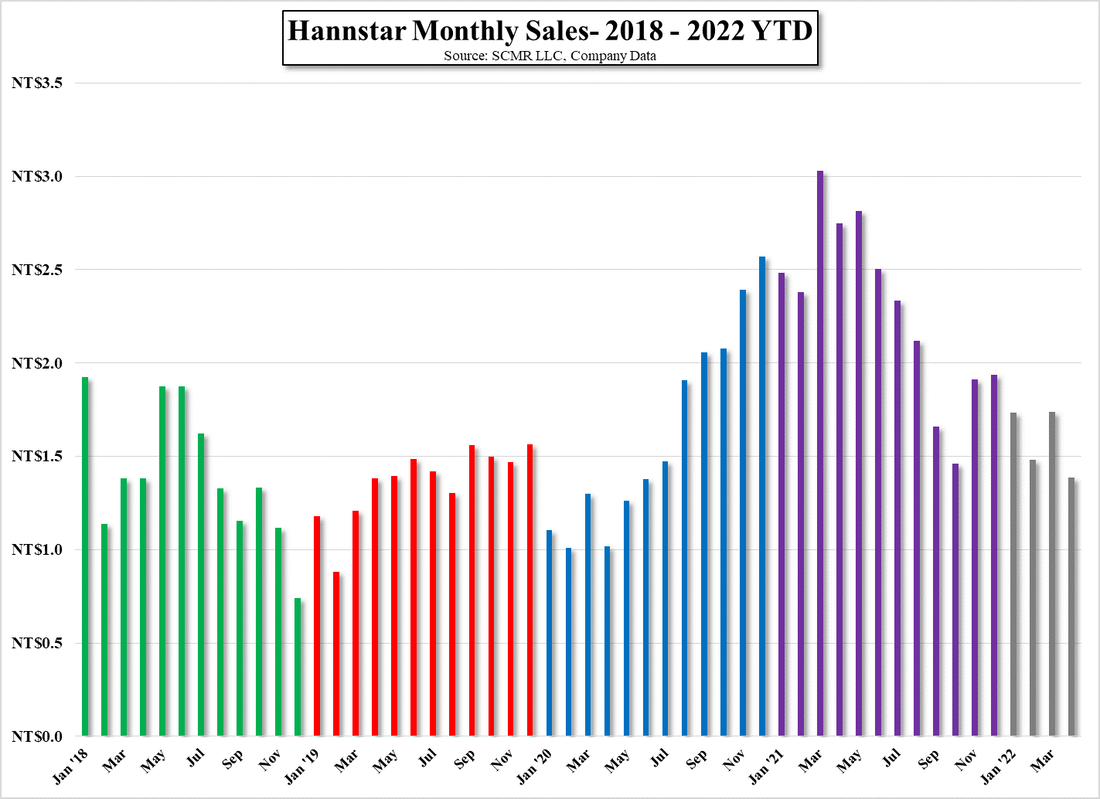

Good, But…Panel sales out of Taiwan for September were strong as expected, but that only tells a part of the story as it was well-known that on a general basis brands were filling inventory levels in anticipation of the upcoming holiday season. That said, October demand for CE product in general has been weak and we already mentioned that a number of major panel producers have scheduled utilization cutbacks for this month in order to tighten supply/demand balance. This lessens the value of the September and 3Q data as we expect a change for October. Here’s the September and 3Q sales data for the three Taiwanese panel producers: Based on 5-year averages, October is typically a down month (m/m) for the two large panel producers and an up month for Hannstar, as they are primarily a small panel producer and September is typically (5-year average) the month with the highest number of smartphone releases. Here’s what October panel sales typically look like for the three Taiwanese panel producers, so we are not expecting October to be better than the averages based on the utilization rate cuts and weak demand.

0 Comments

August in Taiwan |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed