HMO: A Potential Game Changer for Apple and Display Manufacturing

What is an OLED Backplane? Defining the Core Display Technology

These semiconductor circuits, known as thin-film transistors (TFT), are based on either silicon (two forms) or an oxide of Indium, Gallium and Zinc, each having specific and distinct characteristics that allow panel producers to fir them to the needs of the display. But before we go into why this is important, a minute on what these circuits do.

Crucial Function

- OLED pixels are made up of three sub-pixels, one red, one green, and one blue. By mixing these colors in precise proportions millions of pixel colors can be formed.

- A 4K display has 8,294,400 pixels made up of three subpixels each, for a total of 24,883,200 little dots of color that need to be told when to got on, for how long, and at what brightness level.

- The display backplane take the detailed information about the color and brightness of every pixel and translate that into a sequence of signals that tell every sub-pixel what to do. This means that every one of the 24,883,209 sub-pixels gets that information every 1/90th of a second, essentially over 2.2 billion times each second.

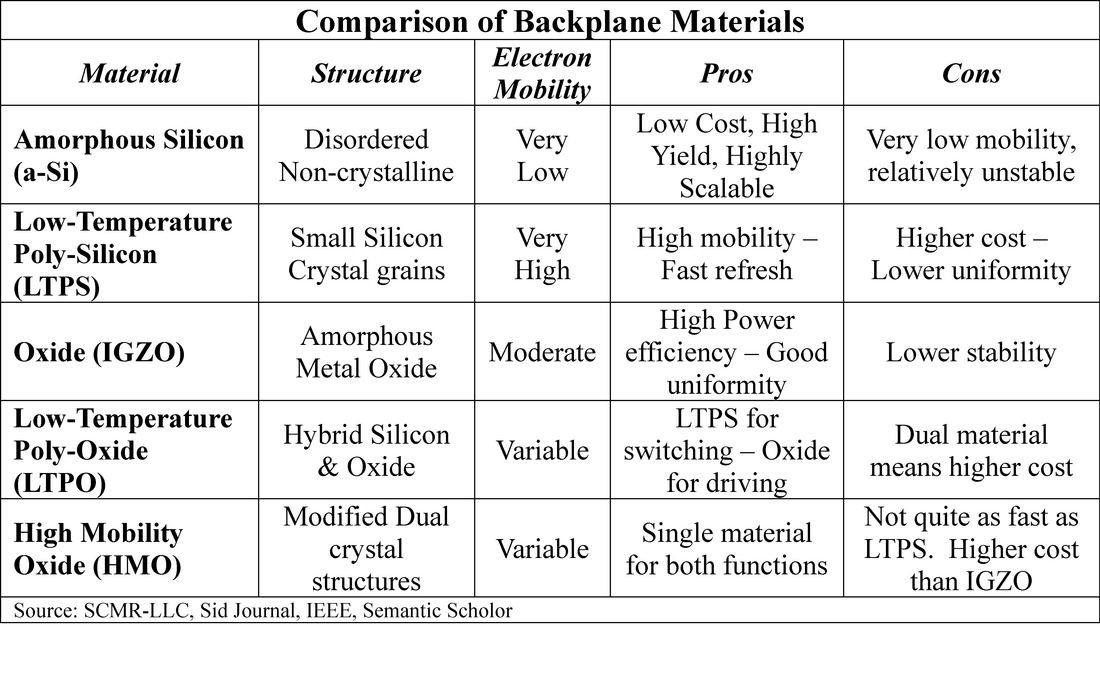

The Battle of Backplane Materials – Electron Mobility

Among the most vital characteristic of OLED backplanes is electron mobility, or the ability of an electron to move through a material. High electron mobility means that electrons can travel rapidly and that translates to higher switching speeds, essential for high resolution (more pixels) and high refresh rate displays. The structure of the material gives an indication of how easily electrons move through it, as randomness and imperfections cause electrons to lose momentum. Therefore, on a general basis, the more structured the material is, the faster electrons can move through it.

A-Si & LTPS

Amorphous materials (a-Si) have low electron mobility as they are randomly structured, but when a film of amorphous silicon is annealed with an excimer laser the silicon melts and reforms in a crystalline structure (LTPS) increasing its electron mobility along with the cost, but a necessary step for higher resolution displays.

IGZO & HMO

Rather than a silicon base, IGZO (Oxide) materials combine Indium, Gallium, Zinc, and Oxygen by bombarding it with plasma (sputtering). The material, after sputtering, is amorphous, but is then annealed, removing defects. IGZO is ideal for backplanes in mobile devices as it consumes less power than LTPS, but there is a new material on the horizon that fulfills that same low power metric but has an even higher electron mobility and is easier to produce. It is known as HMO (High Mobility Oxide) and Apple seems enamored with this material and is believed to have decided to use it for its displays once research has been completed.

HMO's core function is to be the best-of-both-worlds backplane, achieving High electron mobility (like LTPS) to support high-resolution and high refresh rates, while maintaining the ultra-low leakage current essential for superior power efficiency and Variable Refresh Rate (VRR) capability (down to 1 Hz).

The Strategic Advantage

- Cost and Simplicity - It provides a path to power-efficient VRR displays with a single oxide material, avoiding the complexity, high cost, and multiple processing steps required to fuse LTPS and IGZO on the same panel (LTPO).

- Scalability - Unlike LTPS, which is constrained by laser annealing, HMO processes are more easily applied to larger glass substrates (Gen 8 and beyond), making it suitable for larger displays like tablets, notebooks, and TVs.

- Future Standard: HMO is positioned to be the preferred backplane for future high-performance, low-power devices (including VR/AR and premium mobile), as its performance closes the gap with LTPS while simplifying manufacturing compared to LTPO.

RSS Feed

RSS Feed