AR - A New Paradigm Why We Expect Smart Glasses to Outpace VR in 2026

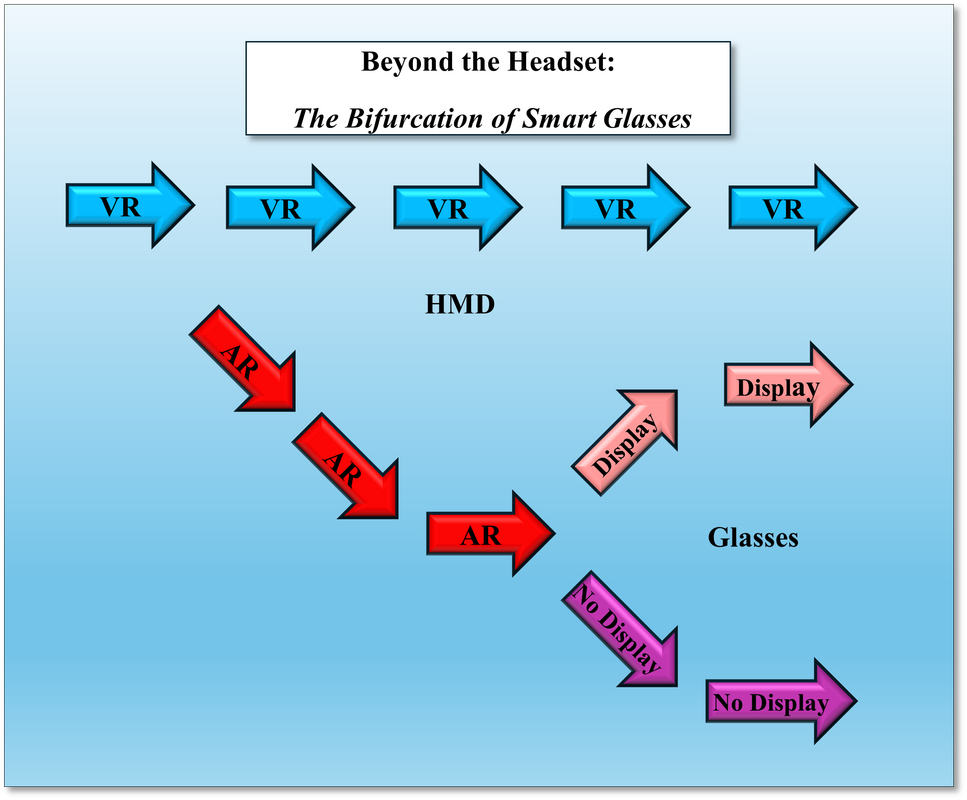

Wearing a large head-mounted display (HMD) is both cumbersome and limits where the user can access the device. Rather than immersing the user in a completely virtual world, a larger user base of ‘casual’ users that focus more on convenience and ease-of-use is more likely to generate sustainable revenue. Simply, a device that allows the user to see the both the real world and an adjunctive one together in a non-obtrusive package without Head-Mounted Display constraints, will appeal to a larger group of consumers.

While VR is still being developed and refined, the AR world blossomed in 2025 and began to develop into a broad product category while VR is a more niche CE product. It appeals to gamers and has a number of practical applications in training and maintenance, while AR, even in its relatively simple current form, has a much wider appeal. The image of board meetings with gesticulating members wearing VR headsets is now replaced with members wearing smart glasses, able to see accurate facial expressions rather than cartoonish avatars, while viewing either a physical or digital whiteboard.

There is a hitch however. The development path of AR glasses has become more complex as we see two forward paths, and while some might see these two paths as price oriented, we see them as a defining characteristic, whether the device has an internal display or whether it does not.

Smart glasses without an internal display can have a number of features, with each model and brand having a different combination and price range. The low end of the range for smart glasses with no display, typically for branded glasses like the Amazon (AMZN) Echo Frames (Gen 3) run from under $200 to over $400 depending on the features and style.

The Feature List for no-Display Smart Glasses

- Speakers – Typically speakers are built into the frames. This allows the user to hear both the speakers and ambient sound. Some smart glasses use external cancelling systems to keep others from hearing

- Microphones – Typically a number of mics that make isolating the users voice from wind and noise more easily accomplished.

- Proximity Detection – This allows media to automatically pause when the user takes off the glasses

- Pairing – This allows the user to remain connected with both a laptop and a smartphone at the same time

- POV Photography & Video – Hands-free photos and video capture (Remember this for later)

- Streaming – Direct streaming to social media platforms

- Privacy Indicator – An external LED that shows others when the camera is in use

- Voice Navigation – Real-time, turn-by-turn audio walking or driving directions

- Real-time Translation – Real-time audio foreign language translation

- Notification Reader – Audio summaries of texts, e-mails, alerts, without checking your phone

- AI – AI is available as an adjunct to a number of functions but the user can access the AI by voice at any time for queries or search.

- Prescription/ Photochromic Lenses – Most smart glasses can be fitted with prescription lenses by an optician.

- Gesture Control – Some smart glasses can be controlled with head gestures

The Display Category

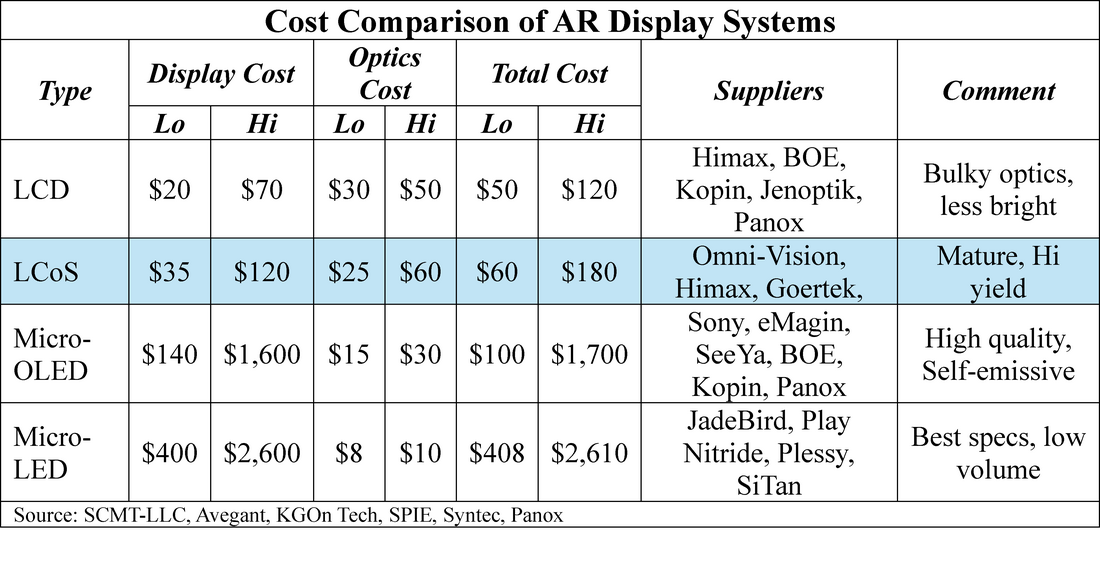

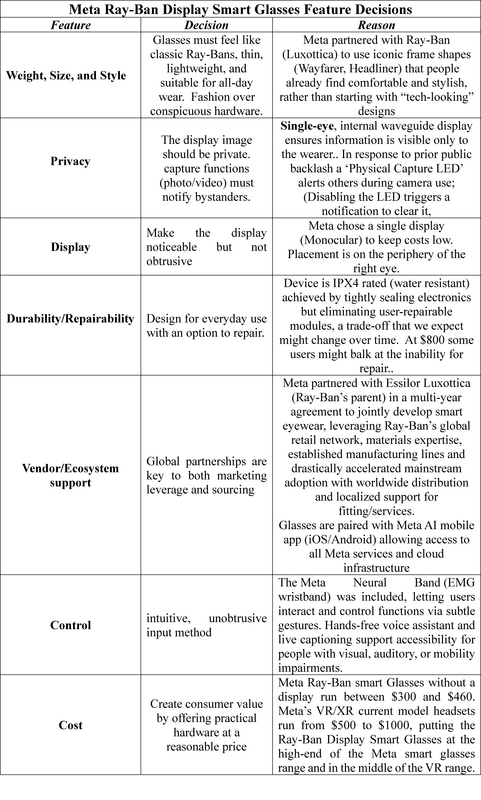

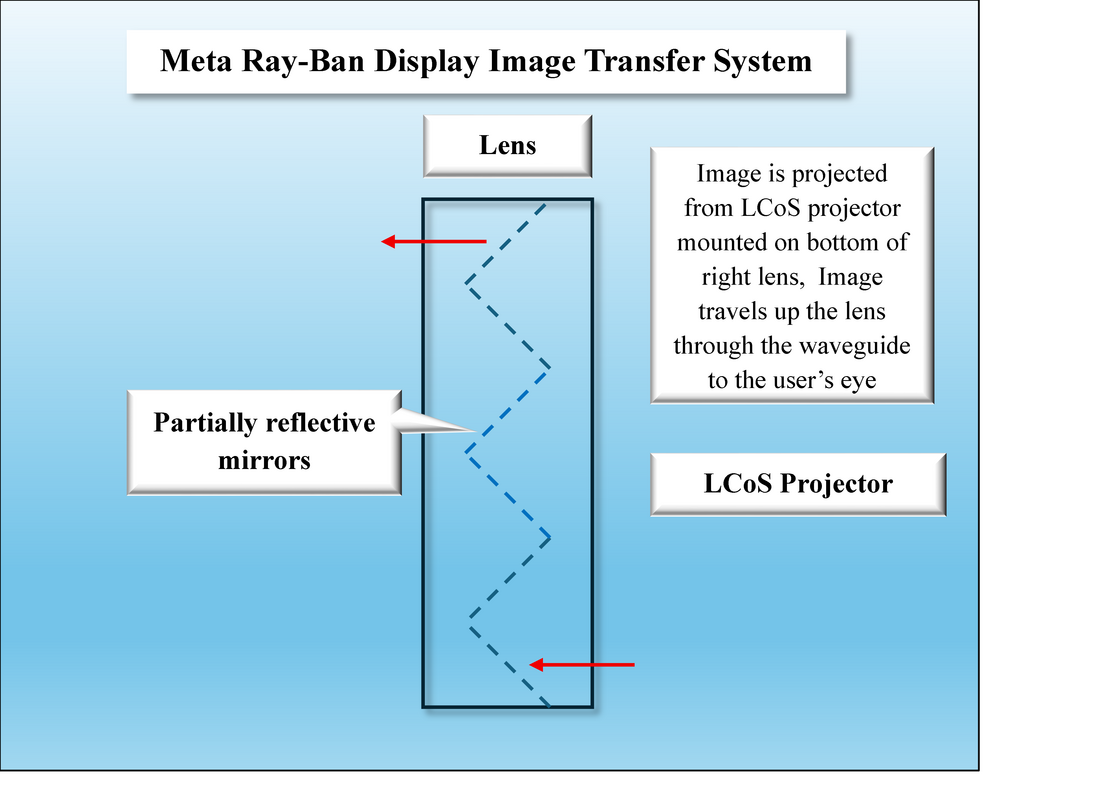

Smart glasses with a display offer the ability to view data and images without the need to access your smartphone. While VR blocks your view of the outside world, smart glasses allow the user to see the real world directly through the lenses. Those with displays actually project the digital images onto or into the lens, combining it with the actual image the user sees. The OST (Optical See-Through) sub-category has a typically higher price point, accounting for the cost of the display/projector, waveguides, and associated optics, and typically costs between 2x and 3x the price of the non-display category but provides a much more robust platform. Pricing ranges from ~$300 to $900, again depending on features and style, with 2026 models about to be announced at CES.

The primary advantage of the display-equipped category is the elimination of "digital guesswork." In non-display models, a user receiving a notification hears a chime but cannot discern its urgency without a voice readout or checking a phone. In contrast, display-equipped glasses provide instant notification, a discreet text overlay that allows the user to read an incoming message in their peripheral vision while maintaining eye contact in a social or professional setting. This "glanceable" interface reduces the cognitive load of switching focus between a physical task and a handheld screen.

Further, the display transforms several key functions from abstract audio into concrete utility:

- Visual Viewfinder: As noted previously, non-display glasses require "shooting blind." A display provides a real-time viewfinder, allowing the user to frame photos, adjust zoom, and confirm that the camera is capturing the intended subject, essential for high-quality content creation or documentation.

- Contextual Navigation: Instead of listening for "turn right in 200 feet," OST glasses can project 3D directional arrows directly onto the pavement or street in the user’s line of sight. This "heads-up" navigation is significantly safer and more intuitive for cyclists, pedestrians, and drivers.

- Visual Translation (Subtitling): While audio translation is useful, it can be intrusive or easily drowned out by ambient noise. Display smart glasses offer real-time subtitling, projecting translated text below the speaker’s face. This allow for a natural conversational flow, as the user can read the translation without breaking eye contact or relying on an earpiece.

- Teleprompter & Productivity: For professionals, the display acts as a hands-free teleprompter for presentations or a "secondary monitor" for checking technical schematics and checklists. This is particularly transformative in industrial and medical fields, where "eyes-on-task" is a safety requirement.

Lifestyle Integration

As we look toward the 2026 product landscape, the choice between display-equipped and display-less smart glasses is no longer just about a budget. It is about a philosophy of use. For the user seeking a “digital assistant in the ear” and a high-quality hands-free camera, the display-less category offers a frictionless, socially acceptable entry point that feels like regular eyewear. For those who require visual data, whether for navigation, real-time subtitles, or mobile productivity, the display category provides a more robust, albeit costlier, window into the future of computing. Regardless of the path chosen, the "Sword of Damocles" has finally been unsheathed. By prioritizing convenience over total immersion, the industry has successfully moved AR from a sci-fi curiosity to a cornerstone of the modern CE ecosystem.

RSS Feed

RSS Feed