Shock & Awe?

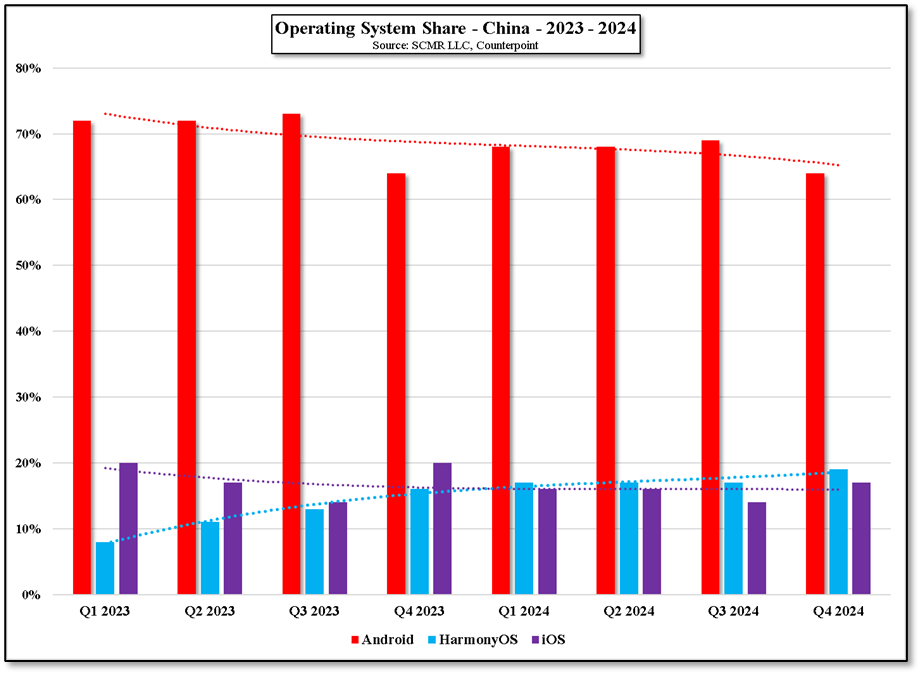

The Huawei Harmony OS that runs on Huawei devices passed iOS in terms of active users in China during the early part of last year, although still behind Android. (64% for Android, 19% for Harmony, and 17% for iOS), but it continues to grow as more Chinese users migrate away from external products and more toward products running on Chinese software and hardware. It seem that said progression could take another step as on Monday Huawei is expected to announce its first foldable PC, and it runs Harmony OS on Huawei’s in-house developed Kirin X90, thought to be a 10-core Arm SoC that Huawei developed to challenge Apple’s (AAPL) self-developed silicon.

About a year ago, when the US revoked Intel’s (INTC) and Qualcomm’s (QCOM) trade licenses with China, an executive director at Huawei indicated that they were down to their last batch of Windows™ laptops and that future models would be therefore running on Harmony OS. This led some to believe that future Huawei laptop efforts would be similar to their earlier attempts, using modified server chips that lacked the necessary hooks into Huawei’s laptop hardware. It seems that they were wrong as the soon-to-be-announced foldable Huawei device is running on Huawei’s X90 chipset, which was designed by Huawei’s HiSilicon (pvt) subsidiary and produced by China’s largest foundry, SMIC (981.HK), pointing to the same increasing development prowess that was shown with the Kirin 9000s and 9020 follow-ups.

All in, if the device and chipset are as good as expected, it puts a plus sign in the Huawei column and more frustration in the US government, who thought that even the early sanctions on Huawei would destroy the company. As of now, it seems to have spurred Huawei to push harder to prove it can not only survive under US sanctions but can work around them and produce comparable or close to comparable devices. If the US trade press catches the release next week, and the specs are acceptable, it could push the US to tighten sanctions further. This month the US Department of Commerce issued guidance surrounding Huawei’s 900 series chipset, indicating that the use of these chips would violate US export controls as they were likely developed on US tools, so Huawei remains in the crosshairs of the US government. However, the question is, with every new sanction do more Chinese citizens feel compelled to adopt in-house developed CE technology? So far that seems to be the case…

RSS Feed

RSS Feed