Non-Consumer Electronics

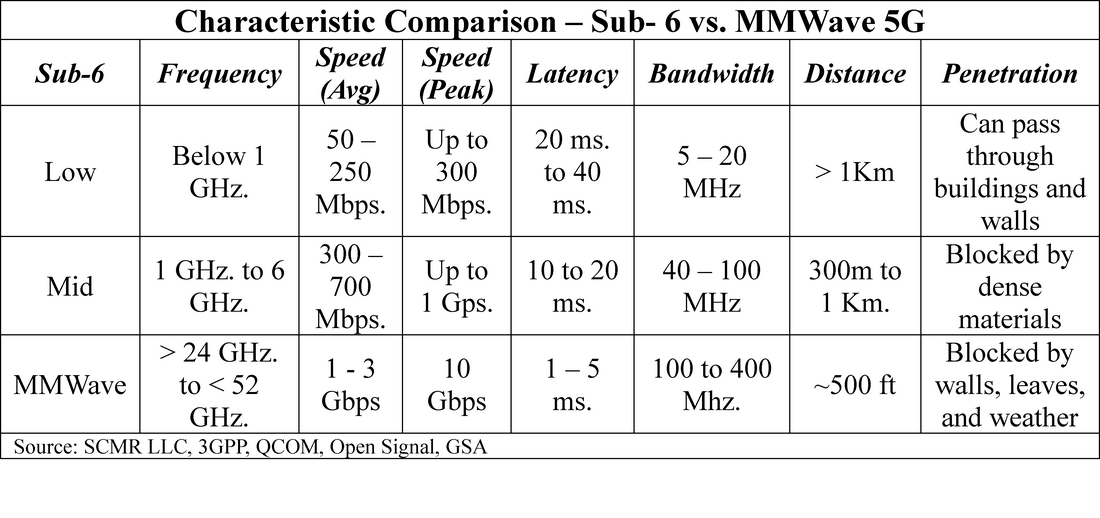

MMWave is ideal in circumstances where ultra-wide bandwidth is important. Think of a football stadium with thousands of folks watching an exciting game. The quarterback breaks away from the pack and heads down field. What does everyone do? They grab their phones and record the touchdown, and then they either post it on social media or send it to friends. College stadiums can hold up to 100,000 spectators, which means there are a lot of phones pulling down bandwidth after that run. A quick calculation for a 30 second ‘good quality’ 2K video would allow for between 1,000 and 2,400 videos to be sent before Sub-6 5G bandwidth is used up, leaving a lot of spectators watching the circle spin. MMWave would allow up to 10,000 such videos to be sent every 30 seconds, and while not satisfying everyone in the stadium, its almost 5 times the best Sub-6 metric.

This kind of relatively small space is ideal for MMWave, as the coverage distances are relatively small and repeaters can easily be placed near spectators. As it turns out all 30 NFL stadiums have a combination of Sub-6 (Mid) and MMWave coverage. A number of MLB stadiums have similar MMWave coverage including Citi Field (NY) and Progressive Field (Cleveland), along with a number of NBA venues, including MSG in NY and the United Center in Chicago and a number of college stadiums. Arenas and halls like the Javits Center in NY, the Las Vegas Convention Center, or McCormick Place in Chicago, are all MMWave equipped and able to handle high usage volumes.

But what other environments might benefit from MMWave’s high bandwidth, high speed and low latency? What about private networks? Here’s an example:

Bosch (BOSH.IN) in Stuttgart – Bosch decided to team with Nokia (NOK) to create a private network for its 10,000 m2 facility using eight small cells (both MMWave and Sub-6) to cover the entire campus. The network supports a fleet of autonomous ‘Active Shuttles” on the factory floor that are able to avoid obstacles and people while delivering parts. The low latency allows the system to control, in real time, robotic arms and similar automated machinery used in complex assembly, and the system allows for mobile devices to be connected to the network, removing the wired connections that would normally exist at many point on the line.

At the same time the network collects a constant stream of data from hundreds of machines and sensors which is fed into an edge computing system where an AI algorithm analyzes the data to generate predictive maintenance, process optimization, and quality control, all with the goal of improving production efficiency and reducing equipment failures. Because the network is private and separate from the public networks, all of the data remains in the system, giving Bosch heightened security control. None of this could be done with Wi-Fi or public cellular as the ultra-low latency and high bandwidth allows for large amounts of data to be moved with six 9’s reliability, and a wireless system, reconfiguring the factory floor no longer means removing cables and placing new ones to connect to tools, a major cost savings and flexibility improvement.

This is just one example, but the benefits of MMWave in these environments are obvious, without the issues that make MMWave less than ideal for consumer to consumer communications. Strangely, while North America (Primarily US and Canada) lead in operator investments in MMWave, Europe leads in launches and deployments, with NA only slightly ahead of Asia. If the US is serious about bringing manufacturing back to the US, MMWave 5G has to be a part of the infrastructure, and adding AI to the mix just increases the need for high speed data movement and massive bandwidth capabilities. MMWave makes the reality of highly efficient private networks attainable and gives us the ability to compete on a more level playing field with countries that are manpower based. The technology is here, and the equipment exists, but moving the focus away from consumer oriented 5G products toward MMWave for business is the challenge.

Note: SCMR LLC receives no compensation from any company mentioned in these notes and has no commitment to publicize or comment on any company or product.

RSS Feed

RSS Feed