October Display Panel Shipments Fall 15.8%: Market Shifts to Profit-First Strategy

Conclusion: Display Panel Market Shifts to Rational Supply Management Amid Demand Volatility

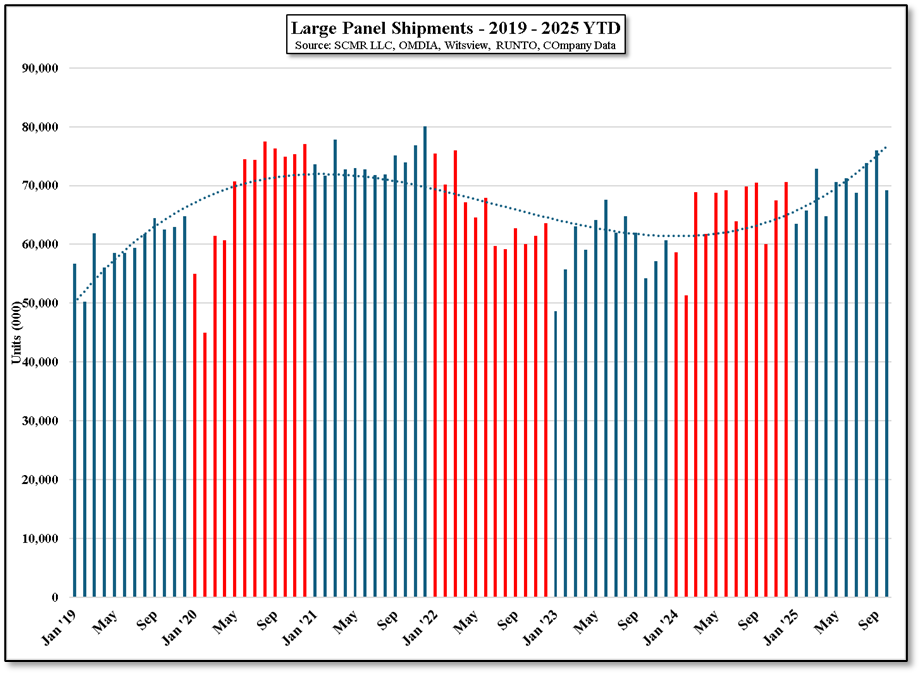

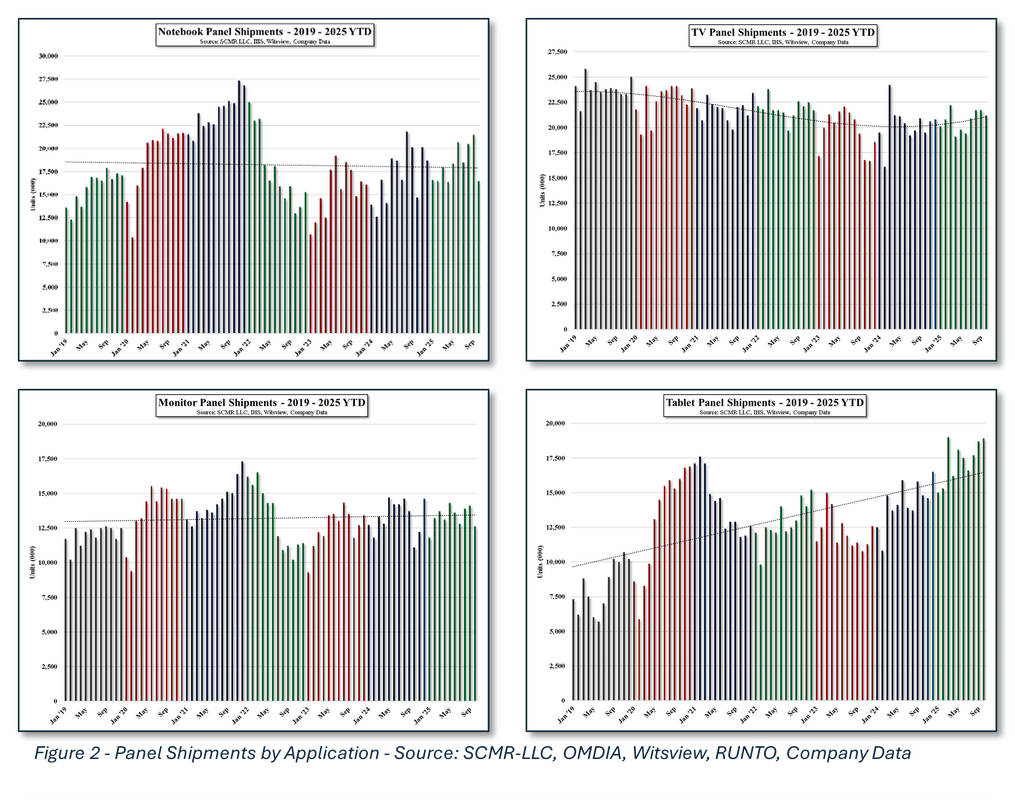

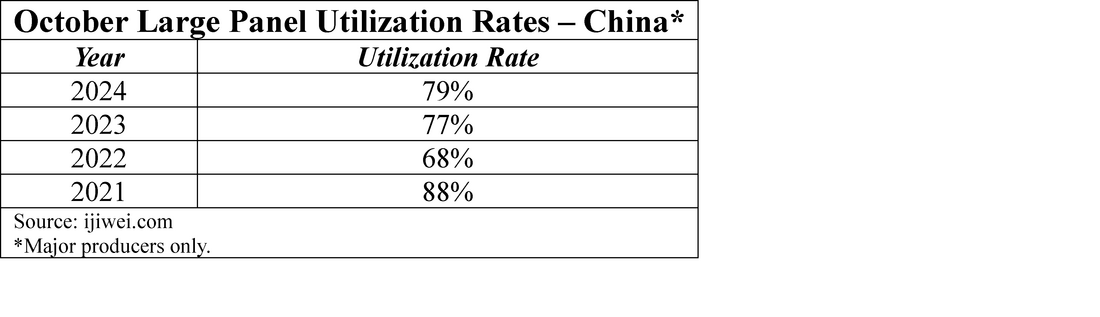

The October display panel shipment data reflects a swift correction in the consumer electronics (CE) market, shifting from two months of unusual strength to a sharp 15.8% month-over-month decline. This drawdown was driven by a combination of weakening consumer spending and an inventory correction by CE brands that had over-ordered in prior months.

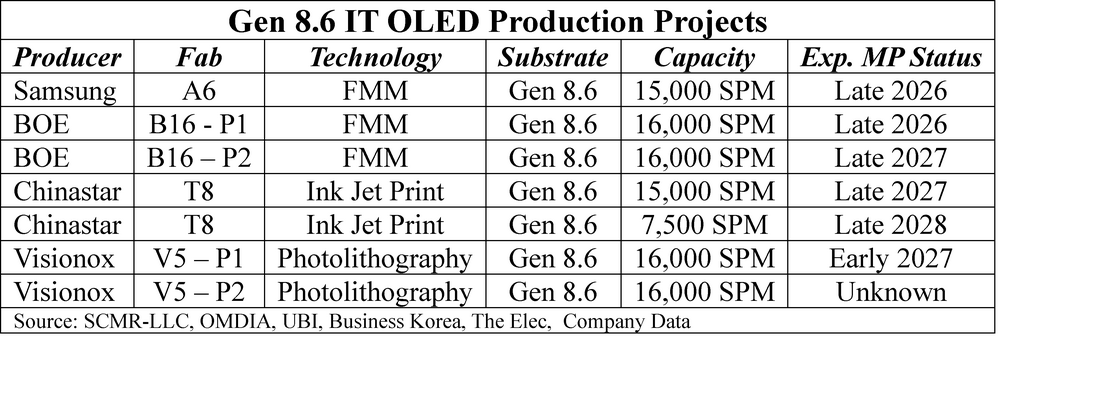

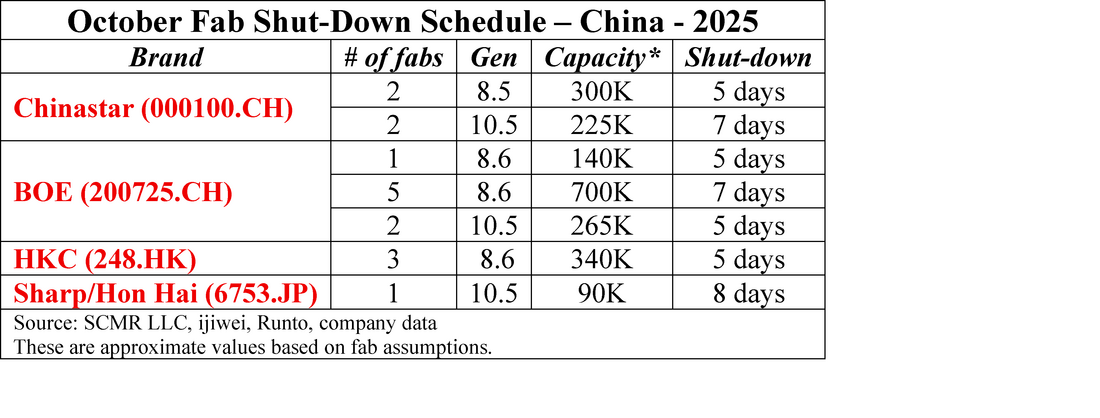

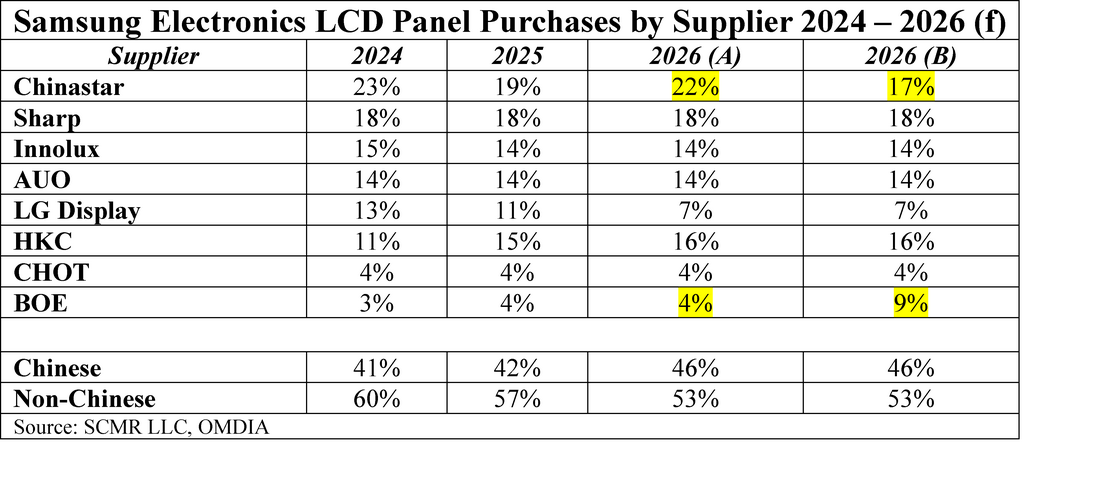

Crucially, the response from dominant panel producers, particularly in China, signals the continuation of a strategic pivot toward rational supply management. By reducing fab utilization instead of aggressively cutting prices to maintain market share, a past practice enabled by generous government subsidies, manufacturers are prioritizing stable profitability over volume at all costs. This is a fundamental change in market dynamics, suggesting a healthier, more mature industry outlook less susceptible to catastrophic price collapse or sharp upward movement.

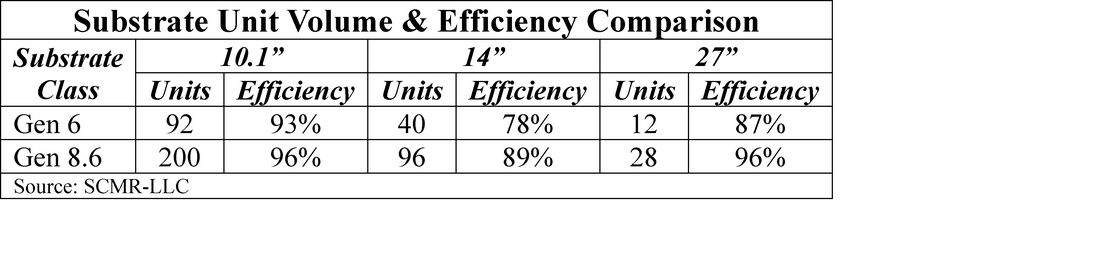

Looking ahead, the market faces a mixed-growth environment in the longer term. While unit shipments are forecast to see minimal to negative growth in 2026, the Area Shipment metric is expected to show positive growth (2.5% to 3.7%). This divergence confirms the continuing trend of larger-sized displays (e.g., 100" ultra-large TVs) driving the average yearly panel size higher, albeit with physical and cost limitations keeping some of that growth in check..

We focus on this trade-off: weak unit demand points to consumer conservatism, but the strategic reduction in supply and persistent area growth indicates a disciplined market structure that is better equipped to support panel maker financials despite the cyclical headwinds. While we expect these factors to support a more stable display space in 2026 real consumer demand will drive shipments with a somewhat negative outlook for the 1st quarter. Inventory levels coming out of the Christmas/New Year holidays will play into that equation, but we are still to early into the holiday season to estimate early 2026 inventory levels.

RSS Feed

RSS Feed