Speaking of Regulations…While not officially confirmed by the South Korean government, it has been said that the US has granted Samsung Electronics (005930.KS) and SK Hynix (000660.KS) a one-year extension to the US export rules on semiconductor equipment that were put into effect last October. The rule, which would have tacitly included fabs situated in China but owned and run by both South Korean companies, would have prevented both from expanding or upgrading existing facilities, making them non-competitive with Japanese, Taiwanese, and other Chinese fabs that might find local sources for certain equipment. We expect official announcements will be made once the current grace period ends at the end of September.

0 Comments

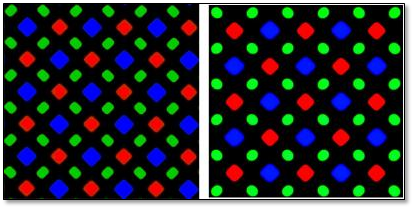

Singing the Blues |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed