China Smartphone Shipment Trends Q3 2025: September Chinese Smartphone Sales Surge - Domestic Brands Lead Amid Flat YoY Growth

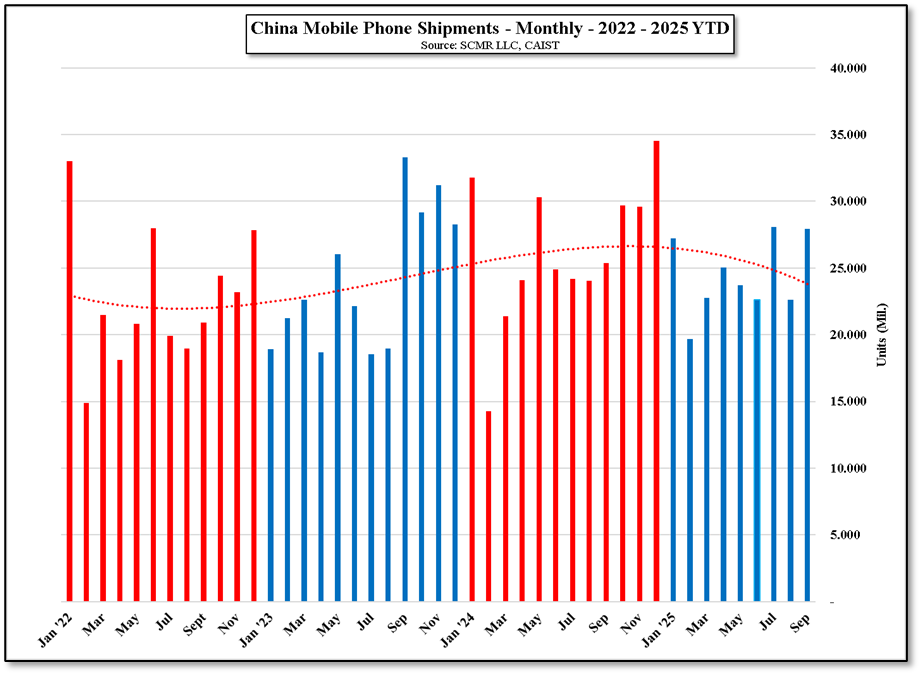

China’s official accounting for smartphone shipments has indicated that September saw shipments up 23.6% m/m and up 10.1% q/q, 12.4% above the 5 year average for the month, with shipments of domestic brands 84.7% of the total. The 3rd quarter saw shipments of 78.63 million units, up 10.2% q/q and up 0.7% on a cumulative y/y basis. 3Q was 12.0% above the 3rd quarter 5 year average.

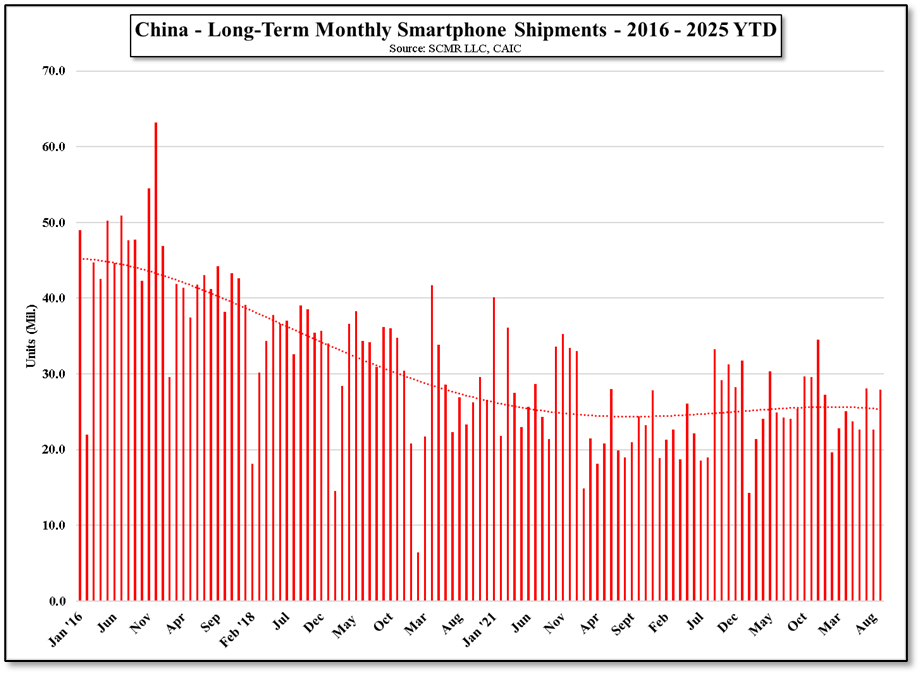

The data indicated that while the month was strong on a m/m basis, the quarter was inline with last year, maintaining the modest two-year recovery in Chinese smartphone shipments but with little or no y/y growth. We note that expectations for CE products in general for October and November are relatively low as the Chinese ‘New for Old’ consumer product summaries winds down for the year. Expectations for 2026 are also conservative at this point, given that it is unknown whether CE subsidies will return next year and if not, how much 2026 buying power has already been used up in taking advantage of the 2025 subsidies.

Conclusion

In summary, China’s smartphone shipment data for September and Q3 2025 reveals a solid month-on-month rebound, with volumes well above medium-term historical averages. However, on a year-over-year and cumulative quarterly basis, the market remains essentially flat, reflecting a stabilization phase after two years of modest recovery. With domestic brands comprising almost 85% of shipments, national preference and competitive pricing continue to shape the market landscape. Looking ahead, market sentiment for upcoming months is cautious due to the winding down of the “New for Old” program, and projections for 2026 hinge on potential government intervention and subsidy renewal.

RSS Feed

RSS Feed