Chinastar Expands Inkjet OLED Capacity Following JOLED Asset Acquisition

JOLED (Bankrupt) was formed in 2015 as the combination of the OLED R&D divisions of Sony (SNE) and Panasonic (6752.JP), with funding from Japan’s INCJ (Innovation Network Corporation of Japan), a quasi-government organization that funds technology projects that are considered vital to Japan. The company’s technology was based on ink-jet printing and produced its first IJP displays in 2018 using a pilot production line. In 2018 the company began construction of what was the first commercial ink-jet printing line in Ishikawa, Japan and raised an additional $400 million from DENSO (6902.JP), Toyota (7203.JP), Tsusho (8015.JP), and Sumitomo (4005.JP) to fund the project. While completing the line and beginning production JOLED was never able to scale to profitability and called on Chinastar (pvt) (China Star Optoelectronics Technology) and parent TCL (000100.CH) for an additional round of financing in 2020 (10% stake).

While JOLED continued to produce relatively small quantities of ink-jet based monitors, the COVID pandemic proved to difficult for the company to navigate and in March of 2023 JOLED declared bankruptcy as debts mounted to $257 million. The fab was closed and most of the employees were laid off. As a creditor Japan Display (6740.JP) acquired JOLED’s IP and the remaining OLED R&D team, while later in the year Chinastar/TCL acquired JOLED’s ink-jet production equipment, which was shipped to Chinastar’s T5 fab in Wuhan, China to facilitate CSOT’s production of IJP products, which began at the end of 2024.

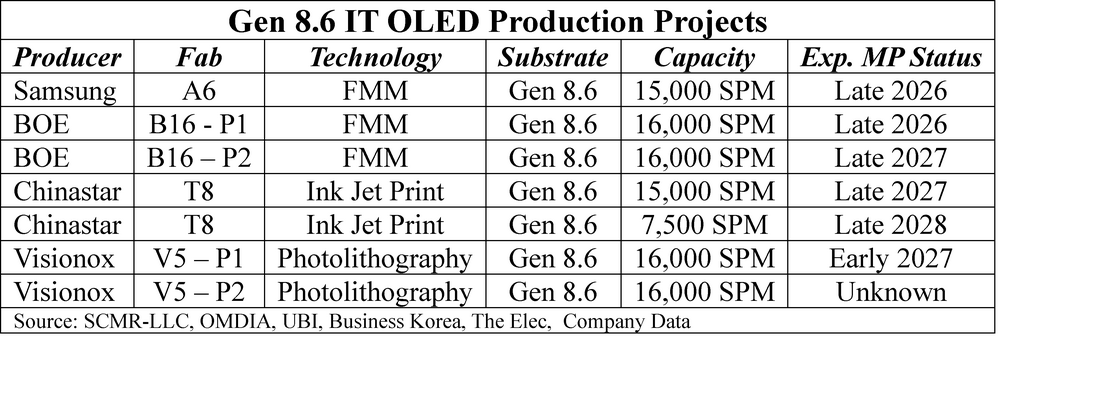

IT OLED Gen 8.6 Projects

Interestingly, Chinastar/TCL just announced that they will be spending an additional $211 million to triple the capacity of its Gen 5.5 ink-jet line, which is based on the equipment they received from JOLED. In 3Q that fab was running at ~9,000 sheets/month, a bit under half of the stated capacity of the equipment when it was part of JOLED. This fab is expected to begin mass production during the 1st half of next year, which leads us to believe by the end of June 2026 Chinastar will have the capacity to produce at least 10,000 sheets/month however we expect utilization and yield will reduce that number considerably.

That said, in late 2027 or early 2028 when both the Chinastar Gen 8.6 (Phase 1) project and the Gen 5.5 expansion projects are expected to come online, Chinastar could have the ability to produce up to 15,000 Gen 8.6 sheets/month and 30,000 Gen 5.5 sheets/month, ~2.4 million 14” units/month, or just under 29 million 14” units/year. Currently ~10m OLED panels are produced each year (all sizes, so Chinastar would be able to produce almost 3x today’s current demand. Considering demand growth, further OLED adoption in the IT space, and the capacity coming online from Samsung Electronics (005930.KS), BOE (200725.CH), and Visionox (002387.CH), we expect competition in this burgeoning space will be intense.

Market Outlook: Oversupply Risks and Technical Challenges

As we have noted in the past, capacity expectations must be tempered with realistic utilization rates, lower than expected yields, longer than expected customer qualification timelines, and process optimization issues. All of these factors play into production estimates that are lower than what the maximum capacity claims might be. Additionally, two of the four Gen 8.6 OLED fabs that are under construction are using non-traditional production processes that could cause production or yield issues that could delay adoption. Should either of the non-traditional technologies prove to be as cost efficient as expected, the industry’s competitive balance could change considerably. These factors, and the level of adoption by customers are an industry balancing act that is the crux of the current IT OLED industry, with the next 2-3 years the playing field on which this battle will take place.

Conclusion – Lots of Ifs

The aggressive expansion of Chinastar (CSOT) represents a pivotal moment in the display industry’s history. By successfully integrating JOLED’s legacy assets with a massive $4.15 billion investment in its own Gen 8.6 T8 fab, CSOT is attempting to do what no other manufacturer has achieved: commercializing Inkjet Printing (IJP) OLED at a mass-market scale.

If CSOT successfully navigates the technical hurdles of yield and process stability, they stand to disrupt the industry's cost structure, potentially offering OLED IT panels at significantly lower prices than the vacuum-evaporation methods used by Samsung and others. However, with capacity projected to exceed current demand by nearly 300% by 2028, the market is heading toward an uncertain balance between supply and demand. The winners in the 2026–2028 window will not necessarily be those with the highest theoretical capacity, but those who can achieve stable yields and secure customer qualification first. For CSOT, the transition from JOLED’s pilot-scale struggles to industrial-scale dominance is the ultimate test of the inkjet thesis.

RSS Feed

RSS Feed