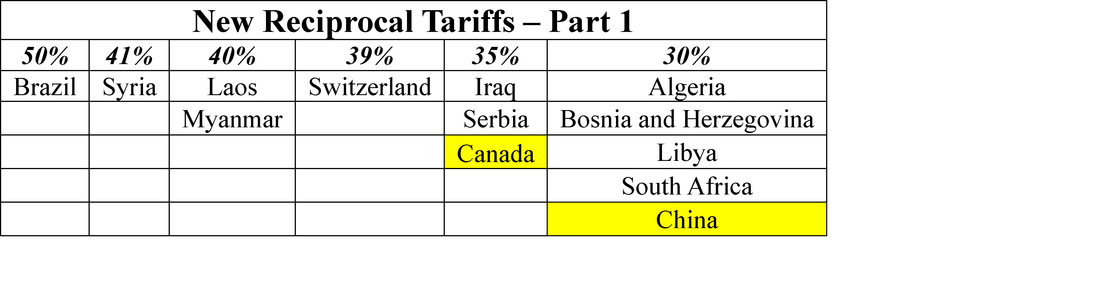

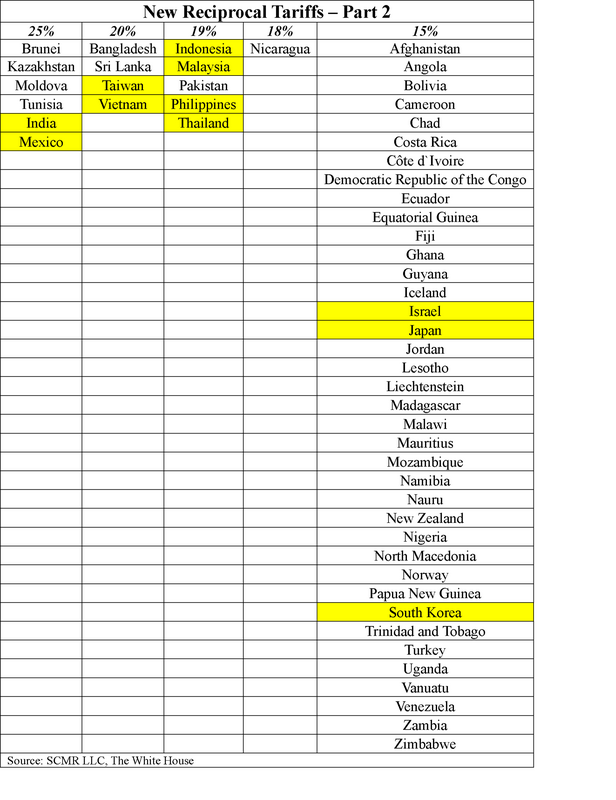

Like, Not LikeIts tariff announcement day, and it seems not every country was ready to kiss the ring or make the required genuflections, and negotiations continue. Without comment, here’s the list with key CE countries highlighted. The EU has a special category as it works on a product by product basis. If the product tariff is less than 15%, it is brought up to 15%. If the tariff is 15% or higher on particular goods, it stays at that level:

0 Comments

Cry Wolf |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed