The Logical Conclusion

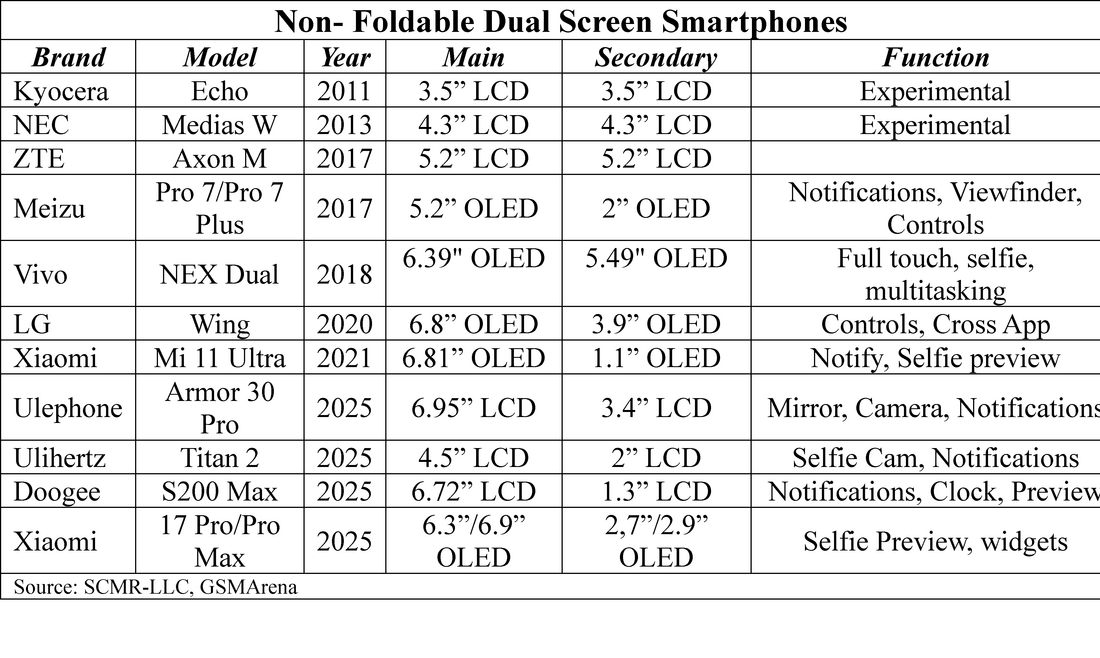

There is one feature that has been gaining attention. One that has actually been around since 2011 but was not in a position to be accepted by consumers at that time. That feature is a second smartphone display. Brands have been experimenting with these additional displays, typically on the back of the phone for years but until the advent of foldable phones they were considered novelties with little attraction for consumers. Now that smartphone buyers are more familiar with secondary screens and the controlling software has become more sophisticated, these additional displays have become more popular.

RSS Feed

RSS Feed