Strike While the Iron is Hot – Glass Substrates for Semiconductor Packaging

Critical Capacity-Adoption Challenge for Glass Substrates

While Absolics is small compared to major glass producers they have been particularly focused on glass substrates for semis and already have a 12,000 m2 production facility and has been planning its expansion to 72,000 m2 with a 60,000 m2 addition. At an expected cost of almost $350 million over the next two years, with ~$140 million in 2026 alone, the company and parent are a bit concerned that this might be a bit more capacity than the market can currently bear.

The Capacity-Adoption "Chicken and Egg" for Advanced Packaging

On the positive side, Absolics is expected to have passed qualification procedures for AMD (AMD), while some believe (unconfirmed) that Amazon (AMZN) Web Services has postponed glass substrate qualification until there is enough capacity to justify adoption. So we wind up in a chicken and egg situation where SKC and Absolics are concerned about expanding capacity before the market develops and potential customers are concerned about adopting the technology before there is enough capacity to support commercialization.. SKC has also been considering moving its copper foil business, another capital intensive project that is vying for SKC’s capex in 2026 and 2027 and as SKC recently found itself with a new CEO, the question as to where Absolics sits in the new regime remains open.

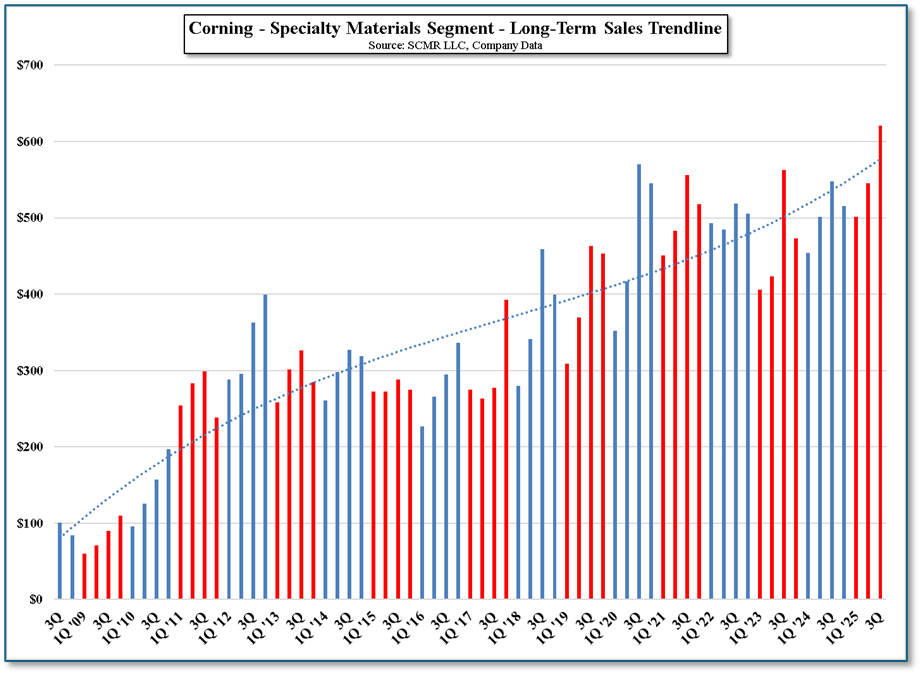

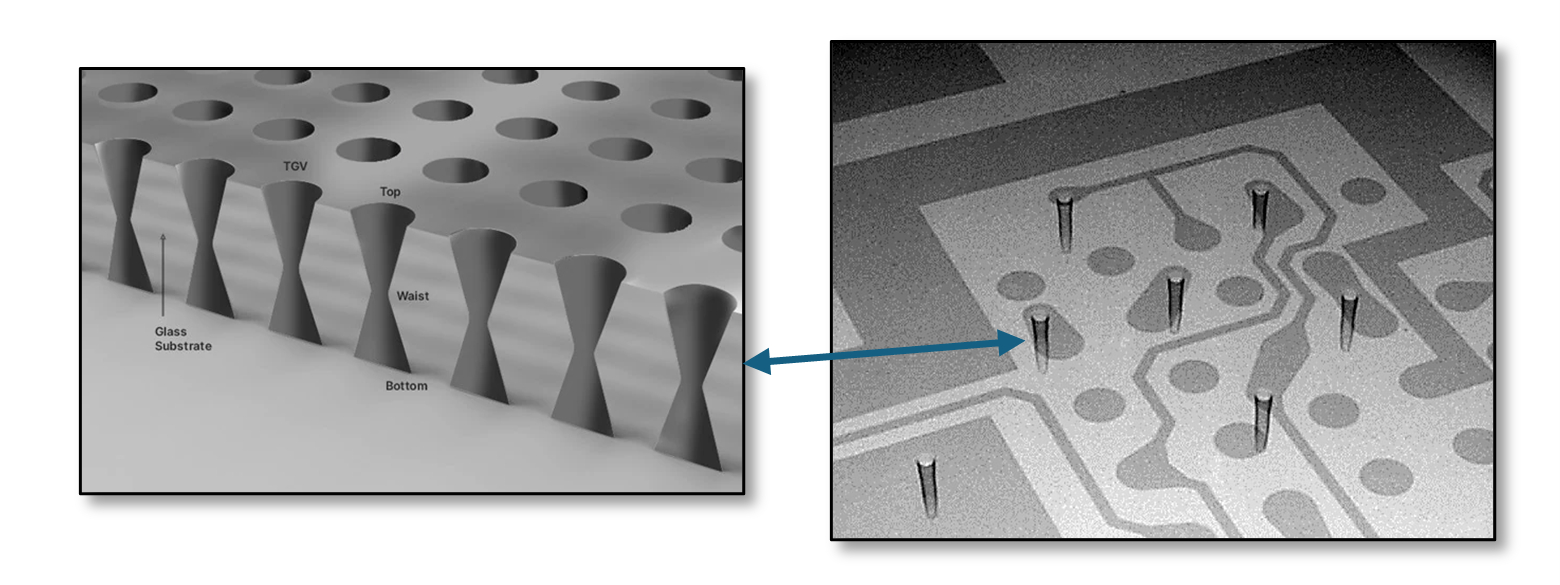

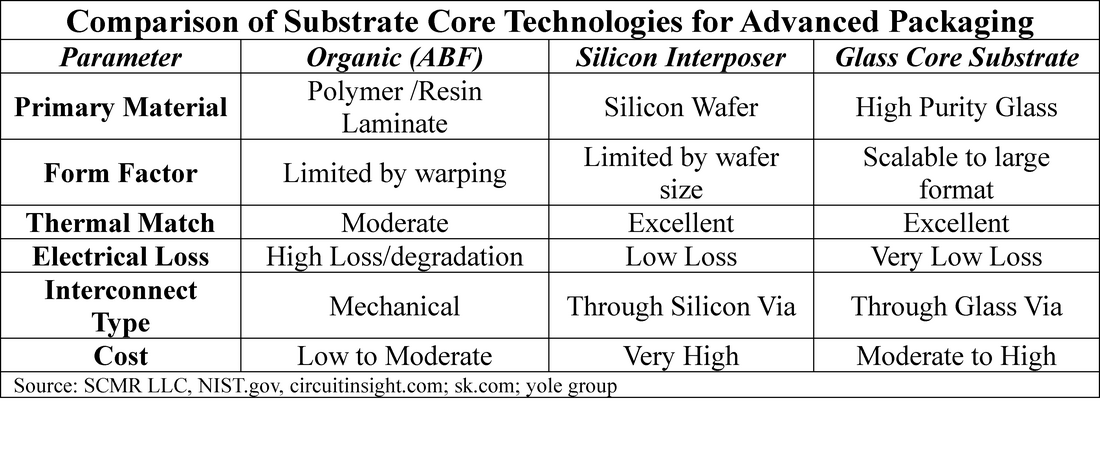

Competition in the Glass Substrate Market: Why SKC Must Act Now

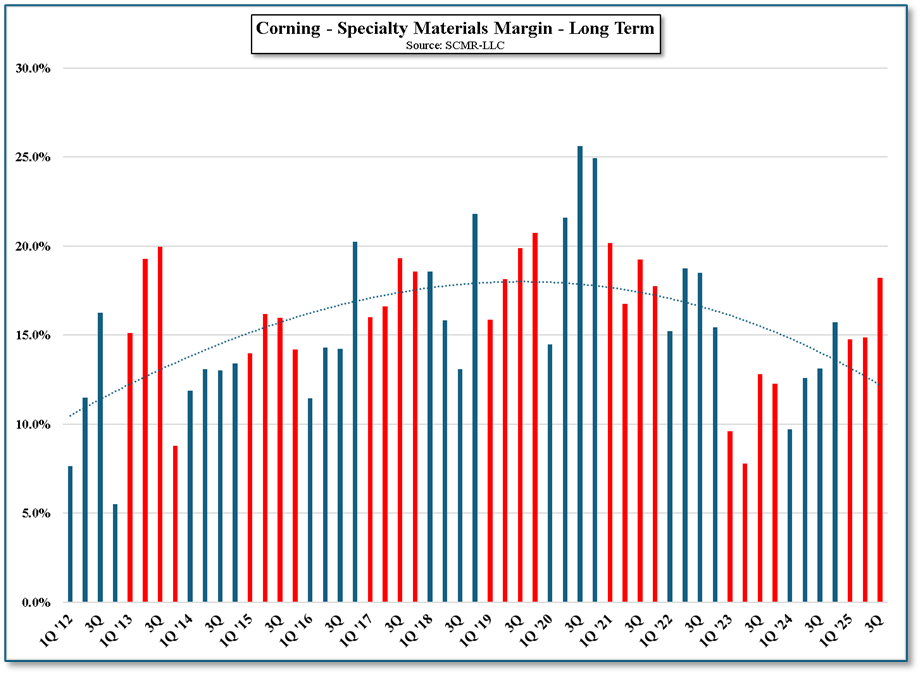

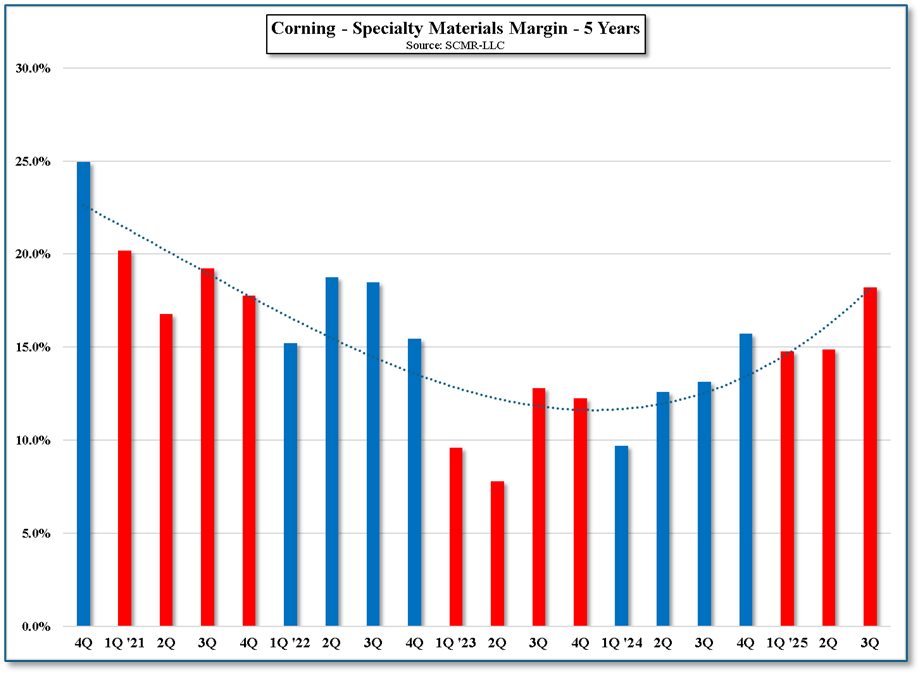

That said, even at 12,000 m2/year Absolics is the leader in the space and seems to be further along on qualification than others, including larger glass suppliers, most of whom we believe are working on small (1,000/2,000 m2/yr. lines). While SKC might be cautious about expanding capacity before the market takes off, we expect such a view would be considered short-sighted a few years down the road. Glass substrates for semiconductor packaging does face some challenges, but it is expected to be the impetus for another round of semiconductor growth at it allows for higher component density in packaging and can also be used to relieve density issues for high-end PCBs. As Absolics is being challenged by large glass producers like Corning (GLW), AGC (5201.JP), Schott (pvt), Hoya (7741.JP) and NEG (5214.JP), they need to strike while the iron is hot.

[1] Mandalorian Image Source: https://starwars.fandom.com/wiki/Cryo-furnace

RSS Feed

RSS Feed