Somebody Missed the Boat

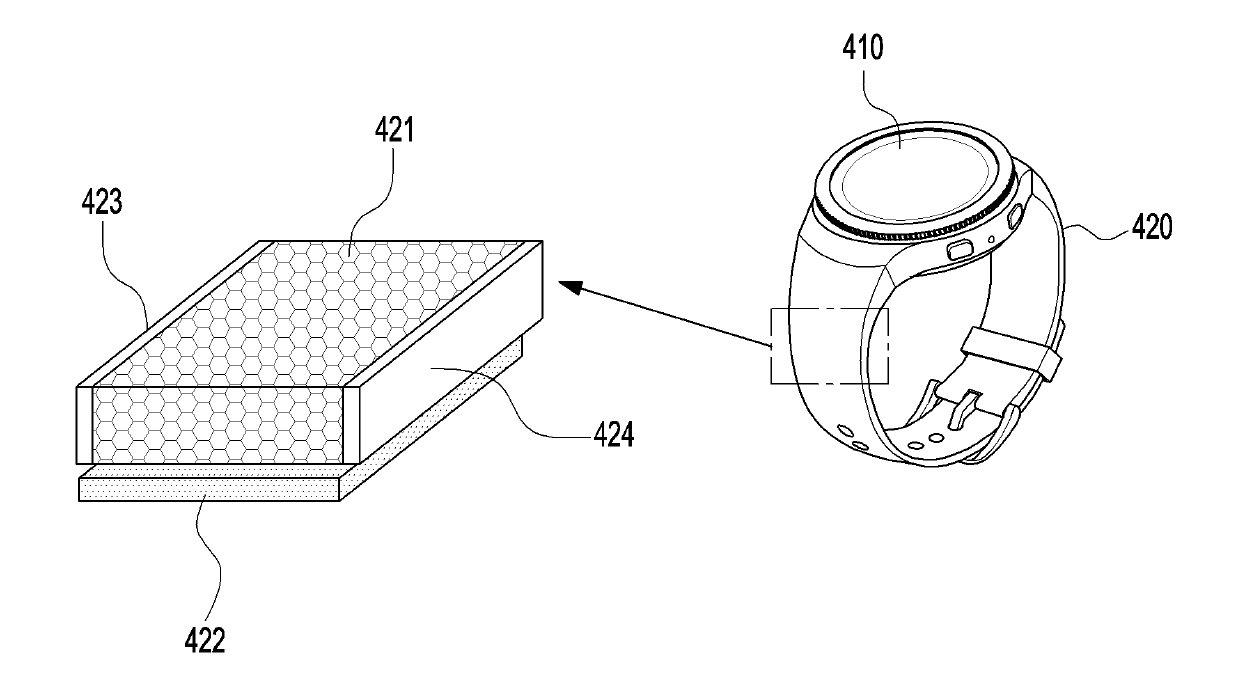

Japan Display eventually got on the OLED bandwagon and in 2019 the company won their first order from Apple for the Apple Watch. Unfortunately they were quite a bit behind other major OLED players, particularly LG Display, (LPL) who was Apple’s primary OLED watch display provider, and never regained a major supplier position. More recently after a number of fab consolidations and years of financial missteps, Japan Display pulled the plug on all OLED production, and it seems the beneficiary will be none other than LG Display, who will become the sole supplier of OLED displays for the Apple Watch, despite Apple’s internal rule about single source suppliers.

One might think that producing 30 to 35m watch displays was not a real business when compared to selling a few million TV OLED panels and a slew of iPhone OLED displays, but when it comes to margins, smaller is better. Producing large panels generates higher sales dollars but is an extremely competitive business, while designing and producing watch-size displays requires more R&D and design work, allowing for higher margins. OLED would allow for a premium on top of that, so it seems Japan Display not only missed the OLED boat but also lost what is lucrative watch display business.

But there is another loser and it’s not Samsung Display (pvt) who is Apple’s primary OLED display provider in general. BOE (200725.CH) seems to have missed the opportunity to use its vast OLED resources to capture some of the Apple Watch volume that Japan Display was still producing, but no word from BOE as to why they did not seem to be in the running as a potential OLED watch display provider. Perhaps they are not confident that they can meet Apple’s rigorous specifications, although they do supply OLED displays for the iPhone, or perhaps they lack the expertise needed to squeeze a high pixel count into such a small display, but whatever the reason, they did not seem to be in the running.

What makes this an even more lucrative deal for LG Display is the fact that Apple is expected to increase its order rate for the Apple Watch in 2026 by ~20%, so not only does LGD pickup the Japan Display slack next year but will see an increase of units in addition. We estimate that Japan Display’s share was a bit under 4.8m units this year, so with the slack and increased volume, LG Display is likely to see a ~35% volume increase in a high margin product that does not require a vast amount of capacity or incremental R&D.

LG Display has a number of other major business lines that have their own margin characteristics, but the mobile display business (Watch and phone) represented 34% and 28% of revenue for LGD in 1Q and 2Q ‘25 respectively, so we expect the dual volume increments will be noticeable, likely more so to margins than overall sales. By itself it’s not going to offset other potential problems LG Display might have next year, but its nice to have something on the plus side as an offset.

RSS Feed

RSS Feed