Price Check 2025: Is Black Friday the Best Time to Buy a Samsung Premium TV?

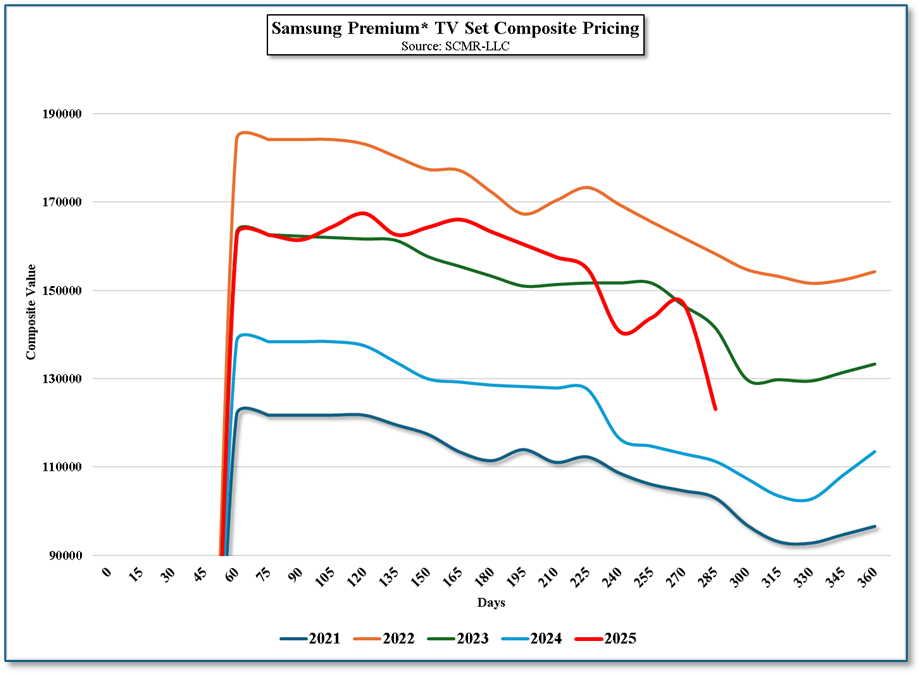

It’s time to measure whether you are getting a good deal if you are buying a TV set. Typically the year’s lowest price are found around Thanksgiving and Black Friday (Between day 311 and day 330), with prices rising through the Christmas holiday and the end of the year. Figure 1 shows a comparison of Samsung (005930.KS) Premium* TV set prices over the period of one year (1st available year). The composite value (the sum of the price of all category models) is relevant but less so than the price trend relative to other years, as the make-up of each year’s model roster is different.

Our data indicates that Samsung’s 2025 Premium TV (Mini-LED/QD) models saw a large price drop (down 16.2% over the last month), pushing the group to a yearly low (down 24.2% YTD) with almost all models hitting yearly lows. At this point in the year most brands are heavily focused on current year models, with Samsung’s Premium 2024 models down only 7% for the month, although they are down 22.5% over the 2024/2025 period. Interestingly, the 2025 models are already down 25% YTD, a bit more than the 2024 models, with the 2025 models looking like they are still declining in price.

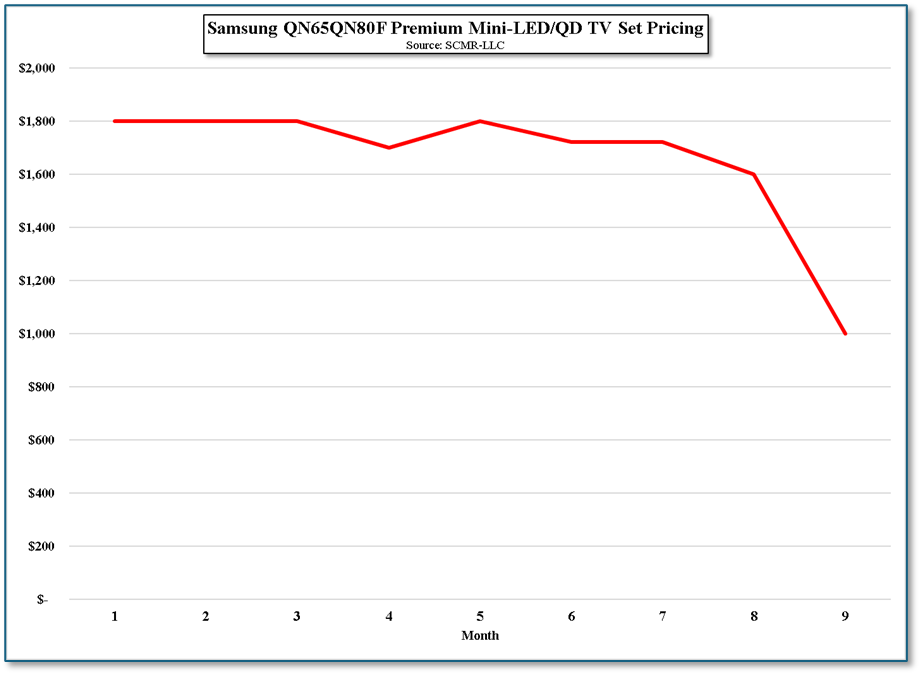

November is a time when some of the more extreme pricing that Samsung does with its ultra-large TV sets loosens up. The example would be Samsung’s 8K 98” Mini-LED/QD TV, which carried a $40,000 price tag for much of the year until a $5,000 price drop in August. However, this month the price has been reduced again by 14.3% to $30,000, offering this behemoth at a 25% discount to its original price. More apropos to the average consumer, we look at the Samsung’s mid-tier (QN65QN80F) 65” model. This premium set is not too small and not too large for the average living room. It is a Mini-LED/QD 4K set with all the bells and whistles typically allocated to Samsung’s mid-tier price range. When the set became available at the end of March, it was priced at $1,800. This week (11/11) it is priced at $1,000, down 44% for the year.

Relative to 2024, while the basic trend remains the same,, there has been more price volatility this year. This is likely a function of the trade tariff situation between the US and its allied trading partners, including South Korea. We expect, on a short-term basis, that Samsung was working toward maintaining inventory levels that would give it some leeway (both directions) as the tariff situation changed.. Currently, if we align the starting value points for each year, 2025 discounting has been a bit ahead of 2024, which we expect will be maintained through Black Friday, but we expect that new models in 2026 to see price increases at the onset..

Samsung typically uses the Consumer Electronics Show in January to ‘reveal’ the company’s new TV models, but holds back pricing information until the pre-order period, between two weeks and a month before the official release date. This leaves us blind to 2026 Premium TV set pricing until late February, but we expect to see higher initial prices to absorb higher component prices and tariffs. That said, we also expect that Samsung might reduce the size of the Mini-LED/QD lineup, as it did this year by eliminating quantum dot only sets from the premium category. Given that there are six price tiers for Mini-LED/QD TVs, we believe Samsung could eliminate one tier without stunting the premium Mini-LED line. While Samsung has been a major proponent of 8K TVs, power consumption restrictions in Europe made 8K sales more difficult this year and while we would not expect Samsung to give up on 8K completely, we could see a single price tier, rather than the current two.

Price Signals and the Purchase Decision

Based on the price trend analysis of Samsung's 2025 Premium Mini-LED/QD TV sets the data presents a clear signal for consumers.

The current deep discounts—such as the 24.2% Year-to-Date drop across the premium line and the 44% discount on the mid-tier QN65QN80F ($1,800 to $1,000)—confirm that the period around Day 311 to Day 330 (Thanksgiving and Black Friday 2025) is living up to its reputation as the lowest price point of the year. The aggressive discounting on the ultra-large 8K models, such as the $10,000 reduction on the 98” set, further illustrates a full-scale inventory clearance push.

Crucially, this year’s price drop comes with an added variable: future pricing risk. While new models will debut at CES in January, our expected higher initial MSRPs for the 2026 lineup—driven by component cost increases and trade tariff uncertainty between the US and its trading partners—suggest that the price floor for comparable feature sets is likely to be meaningfully elevated next year.

Conclusion:

This is not just a historical discount; it is a convergence of end-of-year clearance and a hedge against future market uncertainty. For the majority of consumers, the current pricing offers the best possible value on a premium Samsung Mini-LED/QD TV. If you are in the market for a high-end 4K or 8K set, our data strongly suggests that the decision to purchase should be made now, before prices rebound through the Christmas season and before the inevitable, tariff-driven inflation of the 2026 TV model launch.

RSS Feed

RSS Feed