Inka-Dinka-Doo

Most investors would recognize E-inks technology from the early e-reader market, with Sony (SNE) the earliest adopter in 2004 but made famous by Amazon’s (AMZN) Kindle reader, which is still popular today. Over the years the e-ink market (we use it as a generic term here), has divided into two broad product categories, e-readers, and ESL’s (Electronic Shelf Labels) that are placed with retail items and contain pricing and other information about the specific product. Typical brick-and-mortar grocery stores carry ~32,000 items, the price of which can change as often as weekly and sometimes daily. The traditional method for changing prices at the shelf level is to send the label information to a printer who prints out labels which are sent back to the store. A team of associates must then find the item in the store, remove the old label and place a new one on the item’s shelf. This is a tedious and expensive process that takes a team hours to accomplish and can entail thousands of changes each week for sales and promotions. ESLs are battery operated and wireless, but what makes them most beneficial is that not only can each item label be controlled individually, but the labels only draw power at the moment when the label is changing, as opposed to a constant power draw required by other electronic displays. This means that a single person can change hundreds of labels in a few seconds from a computer or tablet, and that ESL’s themselves last up to 5+ years on its initial battery. In fact, they draw so little power that E-Ink has said that when the battery does finally die, most customers replace the ESL with a new model rather than have the battery replaced, given the advances in the technology over the l5 year+ lifetime The initial cost is high, given the number of tags, but the typical payback period runs from 1.5 to 2 years in Europe to 2 to 2.5 years in the US, so the cost is relatively quickly covered.

The Market

While more mature CE product market estimates vary, estimates for relatively new markets like electrophoretic (e-paper) displays vary far more and are therefore far less reliable, especially as large CAGRs drive higher readership or more report sales, so we show the market values we have collected tentatively and without source names. Our base year is 2024 for sales value but the CAGR periods differ.

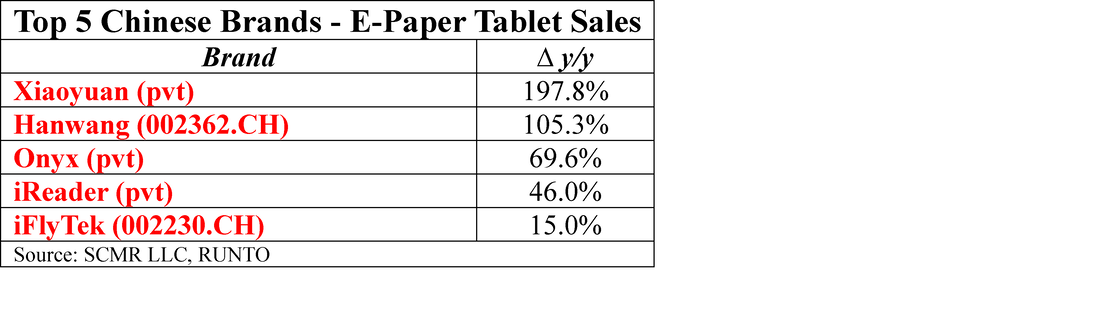

The e-paper market is a three product category market, with consumer products, such as e-readers being the largest, followed by ESLs, and signage the smallest. Yet we expect the proportions to change over the next few years as capacity for color e-paper expands, making larger size signage displays available. On a regional basis, North America, with its higher levels of disposable income has been the largest markets but China is thought to have the greatest penetration share potential in the long-run based on population size. In terms of leadership, we believe E-Ink holds a very dominant share of ~70% as the primary producer of e-ink display films and inks, while others like Samsung Electronics (005930.KS)) and others license the technology or package the raw displays into products. In June of this year Samsung, who holds the leadership position in the digital signage market (since 2009) and has a 34.6% volume share of the digital signage market (2024) introduced its first e-paper product, a 32” (2,560x1,440) color E-Paper digital signage display system, using E-Ink technology and Samsung’s proprietary waveform algorithm. The device can be managed with an app on Android or iOS and interfaces with Samsung’s VXT control and content creation platform, which has now been optimized for color content and control.

E-Ink

While the company’s original concept and product is unlike almost any other consumer display technology, E-Ink’s more recent technology leap, to produce color e-paper displays, moves the technology into a much broader product range and moves the technology from a poor cousin of more typical consumer display technology to a full family member that solves problems that other display modalities cannot. E-Ink has multiple production lines, all of which a currently fully utilized. H5, the most recent is in the customer certification stage, with sample product produced, but will likely not be in full production until 1H 2026, while H6 is expected to initiate construction in 2026 with production in 2027, extending the company’s production reach.

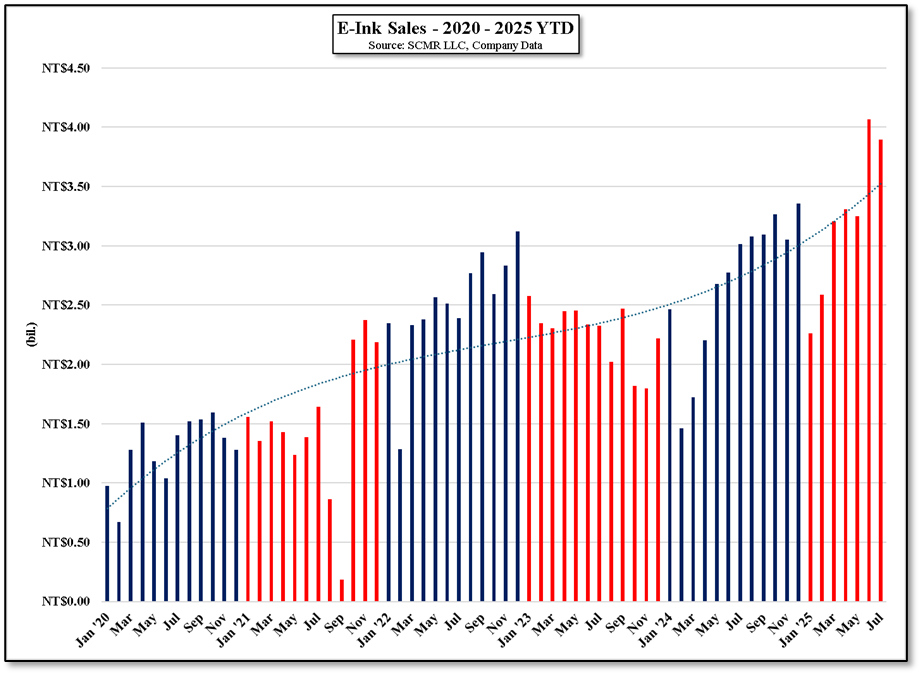

We note that as E-ink’s black & white and color technologies are quite different from each other, not all lines can produce all technologies and as e-ink is primarily a seller of e-ink films, inks, and modules, they have been capacity constrained at times and will likely remain so as color e-paper demand increases in the near-term. The company’s 2Q results, which were up 31.8% q/q and 38.8% y/y did include some pull-in due to tariff concerns, so 3Q is expected to be down slightly q/q and the company remains conservative about 4Q, again because of tariff questions, but has not changed its full year outlook. We do note that currency (NT$) had an effect on operating profits, even with hedges in place, as the NT$ swing was considerably larger than expected (1% currency move = 0.3-0.5% of op profit)) but almost 100% od sales and COGs in in US dollars. On a longer-term basis the company remains quite optimistic within normal macroeconomic constraints.

There are a number of companies that hold key IP for consumer oriented technologies, most of whom garner considerable income from licensing. While E-ink is also in this enviable position, the company generates less than 2% of sales from royalty income[1]. E-ink management has a somewhat unique approach to this issue, saying that they are far more interested in making their technology available as a producer than as a licensor, and will continue on this track to promote the technology and expand its market. While we know other companies give concessions to certain customers, E-Ink is a bit more open about how they look at customers, again with the idea that happy customers expand orders. The example would be with gross margins. The company targets gross margins in the 50% to 55% range, but at times, because of its high utilization rates, has exceeded those rates (over 60% in 2Q). The company has indicated that they will ‘share’ gross margin over the 50% - 55% level with customers, a very progressive concept.

Technology

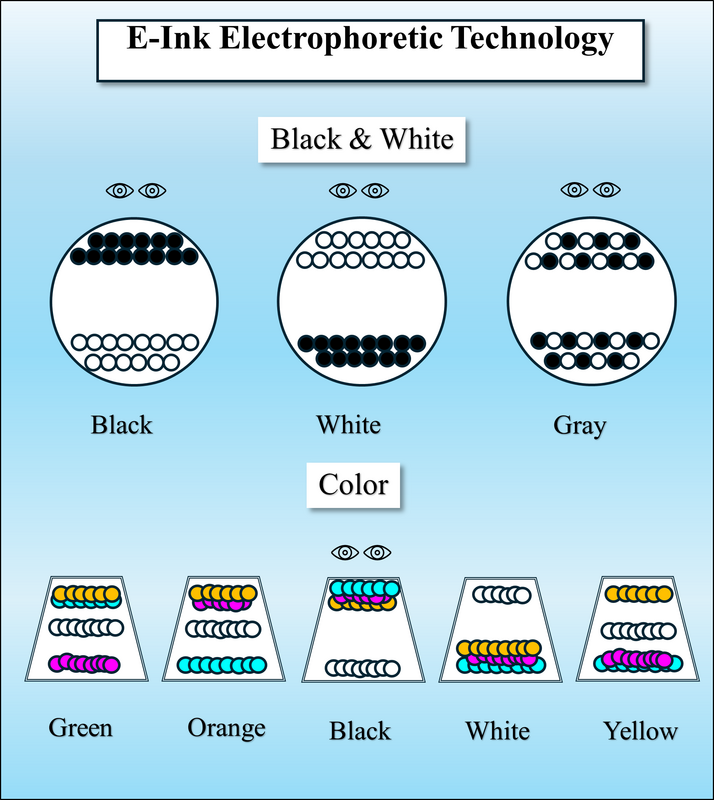

In order to understand E-paper, it is important to understand both why it is different from other display types and how it works. E-paper uses inks not organic materials or phosphors, and they do not generate light like LCDs (backlight) or OLEDs (self-emissive). They are reflective displays that reflect external light off these inks to produce images. That means they work best in bright light and worst in dark areas, typically the opposite of other display modalities. This makes them ideal for outdoor signage or any location that is lit 24/7. The biggest draw for e-paper however is the fact that the only time the display draws power is when the image is changing. If the image is static, such as with an ESL, no power is used. This means that battery life is extremely extended and other than an initial charge, no connection to an external power source is needed, making e-paper ideal for remote locations where power sources are not readily available or locations where power source changes (battery) are difficult (remote sensors, etc.). Here’s how it works:

E-ink’s original system was a film with microcapsules (Think pixels). The capsules were filled with an oily liquid in which black (Carbon black) and white (Titanium Dioxide) ink particles were suspended. The white ink particles were positively charged, and the black ink particles were negatively charged. An electrode under each microcapsule produced either a positive or negative charge, with a positive charge repelling the white particles, pushing them to the top of the capsule and attracting the negatively charged black particles, pulling them to the bottom. As the top of each microcapsule was on the surface of the film, that capsule would produce a white dot, conversely a negative charge on the electrode would produce a black dot. As the inks are suspended in the capsule fluid, once they are moved to a location they stay in place, which is the key behind the fact that power is only used when changing an image. The example would be an ESL, which would use power only for the few seconds when a new price or information is being added, and would use no power until the next time it is changed, which could be days or weeks.

E-Ink used this technology for black & white e-readers and a number of other products to seed the electrophoretic market in the early 2000’s, but found it was always being negatively compared to other display types which were able to display thousands, if not millions, of colors, so E-ink took the path of placing a RGB color filter over the film, allowing the white dots to become color. This is the same tact that LG Display (LPL) uses for its WOLED displays, where the OLED materials produce a white light that is passed through a color filter to create colors. However, color filters do just what they say, they filter out a large portion of the light, reducing its brightness. As OLED materials produce their own light, the result for WOLED is still viable, but e-paper is reflective and in low light situations the color filter reduced the brightness so much as to wash out the colors.

E-ink took on the challenge and figured out a way to produce colored e-paper without using a color filter, and we have to say, it is an unusual and interesting system. Here’s how it works:

The microcapsules ae shaped a bit differently, but they are still filled with an oily liquid, and now they include white ink as in previous versions, but also include cyan (lt. blue), magenta (purple), and yellow inks, the same basic inks used in magazine printing. Combining these colors produces roughly 60,000 color combinations, a far cry from the many millions produced on RGB displays, but enough to satisfy the printing market for many years and most signage. The problem is, with this many inks how is the system going to push them up to the top individually? Before (B&W) there was a positively charged and a negatively charged ink to correspond with a positive or negative charge at the anode, but now there are four inks.

E-ink’s solution depends on its proprietary inks, each color with a different charge and a different size. The voltage at the anode, which was positive or negative for black & white e-ink films, now has a complex waveform which varies between polarity (charge) amplitude (signal strength), and duration (frequency). The easiest to understand is polarity as each of the inks has a charge between positive and negative. By varying the polarity of the waveform for each microcapsule the waveform will push a particular color ink to the top. The waveform amplitude determines the ‘position’ of the ink in the suspension (high to low), which is key for color mixing (Blue on top, yellow in the middle makes green, blue and yellow on top makes light green). A big push gets the color to the top while a little push might only move it to the middle. As each ink is a different size (Bigger moves slower), the duration of the waveform also affects positioning.

This makes the waveform extremely complex and obviously different for each microcapsule (pixel) for each frame of the image, so E-ink created an algorithm that takes the RGB image data that is being fed into the system and computes what combination of inks will give the closest color match. It them looks ate the micro-capsule to take a ‘snapshot’ of where each ink color is and figures out what the waveform should be to move the inks in that capsule from where they are to where they should be. However, if it finds that a particular microcapsule (pixel) does not change between the old image and the new one, it tells the waveform generator to skip that capsule, saving even more power. Once it completes all the changes (price update, etc.) it stops. Remember that the ink particles remain suspended in position once they are moved and therefore require no power or refresh until the next time they need to be changed. This could be days, weeks, months or years, while other display types need each pixel to be refreshed a minimum of 60 times each second.

Those who work closely with E-ink understand the mechanics behind how the system works and are able to modify the waveform algorithm to their own specifications, as did Samsung in its 32” color offering, but the technology is all E-ink’s. With the production of the microcapsule film done at E-ink, OEMs can make waveform and algorithm modifications as they wish but must pay a royalty (see above) and purchase materials from E-ink. E-ink believes that this color system will allow a broader set of applications, particularly for outdoor signage, that will expand the market and keep utilization high on the company’s new lines. So far, even given the capacity constraints and macro issues that surround color e-paper, they seem to be on the right track.

[1] E-ink shows Royalty Income in Non-Operating Income, we include it in sales to estimate the percentage

RSS Feed

RSS Feed