BOE Wins Primary Display Role for iPhone 'e' Series, Faces Hurdles with Flagship LTPO OLED Production

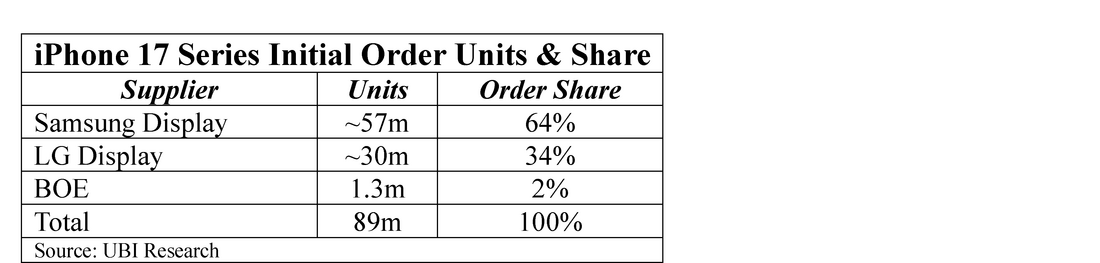

Apple is expected to order ~8 million 17e units in the 1st half of 2026, a relatively small amount considering the three iPhone 17 series models are forecasted to ship ~89 million units this year (see “Down But Not Out” for details), but understanding the difference between the iPhone 17 series and the iPhone 17e gives a better understanding of BOE’s real position in the Apple supply chain.

Defining the 'e' Series: Apple's Strategy for Mid-Tier Competition

In order to compete with other brands for mid-price tier smartphone customers (particularly Chinese smartphone brands) Apple created the ‘SE’ model designation, which has now become the ‘e’ model series. The SE/e series is an entry level smartphone that was and is considered ‘budget friendly’ or ‘more affordable’ by the industry. Rather than make this lower priced model an official part of the iPhone flagship series lineup, Apple separates the ‘e’ series with a number of feature changes to preserve the premium status of the main iPhone line.

Component-Level Differences (The Feature Gap):

- Early release date – Typically announced in 1Q relative to the standard early 4Q release for the three main iPhone models. This keeps the ‘e’ series from competing directly with the flagship iPhone 17.

- Lower Price - Typically ~25% lower than the base model iPhone 17, putting it in a better position to compete with the slew of mid-tier smartphones that are typically released or announced at the end of 1Q

- Lower Component Cost - The ‘e’ series is thought to incorporate refurbished parts (unconfirmed) and has a single main camera and a relatively small selfie camera, while the iPhone main series has a number of cameras and lens configurations. There are also some design changes that relative to the flagship series that help to reduce costs.

- GPU (Graphics Processing Unit) Step Down - The ‘e’ series has the same Apple processor (A18) but with fewer graphics processing cores in the ‘e’.

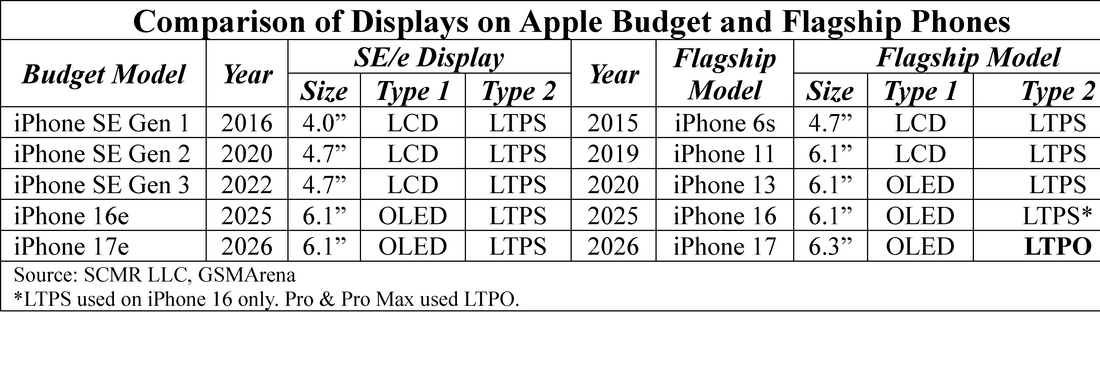

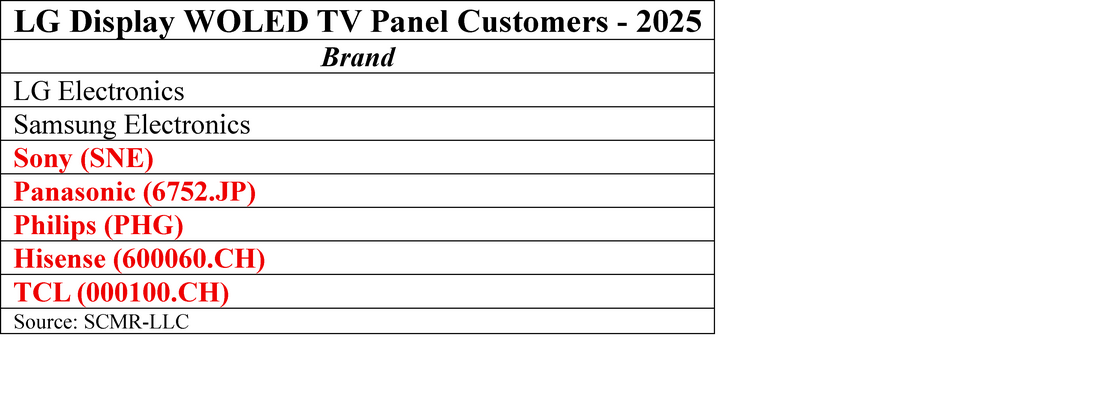

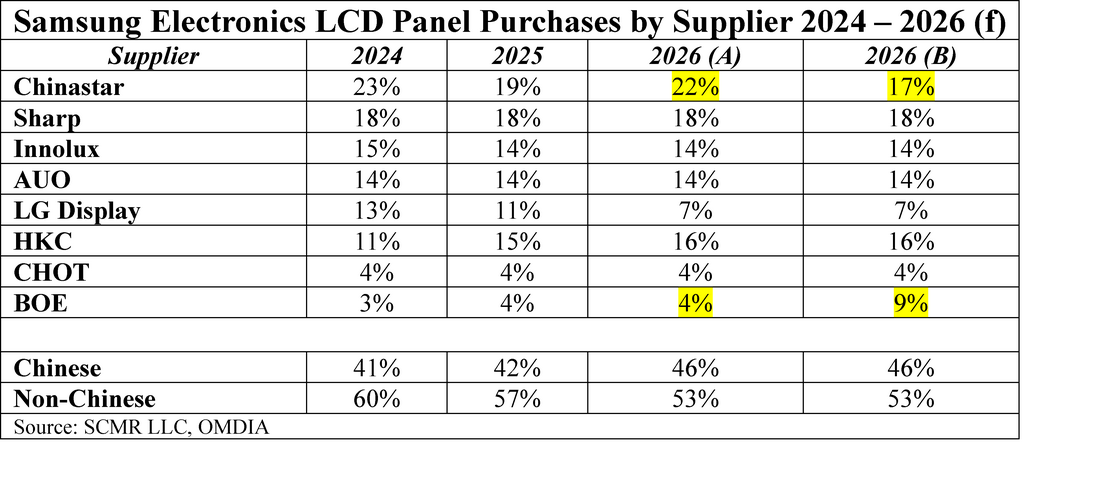

- Display – Based on the chart below it can be seen that the display on the SE/e series tends to be smaller than the flagship model, and therefore less expensive, with the tendency for Apple to use displays from older flagship models for the SE/e series. We note also that the backplane (Thin-film transistors that drive the display) are typically configured using LTPS (Low Temperature Poly-Silicon), a lower cost but less flexible technology backplane technology While the table shows LTPS for the iPhone 16, LTPO (Low Temperature Poly-Oxide), a more versatile technology was used for the higher priced iPhone 16 models. In 2025 all flagship iPhones used that technology while the iPhone 16e did not. We expect the same in 2026. This is a key factor in why BOE is not a major supplier for the flagship line as they have been unable to produce LTPO OLED displays to Apple’s specifications.

While BOE has yet to become qualified at Apple to produce flagship LTPO OLED displays, there are a number of reasons why BOE was chosen as the primary supplier for the 17e variant.

- Broaden Supply Chain - Apple has a strong focus on broadening its small panel display supply chain. Apple’s display specifications are rigorous, along with strict rules concerning display production performance. This leaves few panel producers able to meet Apple’s high volume needs and an unusual dependence on both Samsung Display (pvt) and LG Display (LPL) as display suppliers for the flagship iPhone line.

- Largest OLED Producer in China - BOE is the largest small panel OLED producer globally and the largest producer of OLED displays in China. When it comes to small panel OLED volume on a more generic basis, BOE is the global volume leader, allowing Apple to use their lower-cost model to put pressure on display pricing with its other suppliers and maintain a lower cost structure for entry-level devices.

- OLED Expertise - BOE has considerable expertise in producing LTPS (Low Temperature Poly-Silicon) OLED displays, which are lower cost alternatives to the LTPO displays in the iPhone 17, Pro, and Pro Max. BOE supplied ~40 million iPhone displays in 2024, primarily for older models and replacement displays for refurbished phones, with few for then current flagship models.

BOE has had difficulties producing LTPO (Low Temperature Poly Oxide) on a consistent basis. As the three main iPhone 17 series models are expected to use LTPO OLED displays in 2026, BOE has essentially been left out of display production for these models until it is able to prove its ability to maintain consistency in LTPO production, leaving Samsung Display (pvt) and LG Display (LPL) as the primaries.

Conclusion/Summary

China's largest panel producer, BOE, has been selected as the primary display supplier for the upcoming iPhone 17e, a role it maintains from the iPhone 16e. The 'e' series is Apple's entry-level, budget-friendly smartphone, typically released early in the year with a lower price point and featuring older/lower-cost components, such as LTPS (Low-Temperature Poly-Silicon) OLED displays.

BOE's prominent position in the 'e' series supply chain is attributed to its global volume leadership and expertise in producing these LTPS OLED panels, which allows Apple to broaden its supply chain and exert pricing pressure on other vendors.

However, BOE's participation in the higher-volume flagship iPhone line (iPhone 17, 17 Pro, and 17 Pro Max) is limited because these models utilize the more advanced, power-efficient LTPO (Low-Temperature Polycrystalline Oxide) OLED technology. BOE has faced production stability issues and has been unable to consistently produce LTPO displays to meet Apple's rigorous specifications, leaving the supply for the flagship models primarily to Samsung Display and LG Display.

RSS Feed

RSS Feed