NAND Flash Market Outlook 2026: Price Forecasts, Supply Shortages, and Top Producers

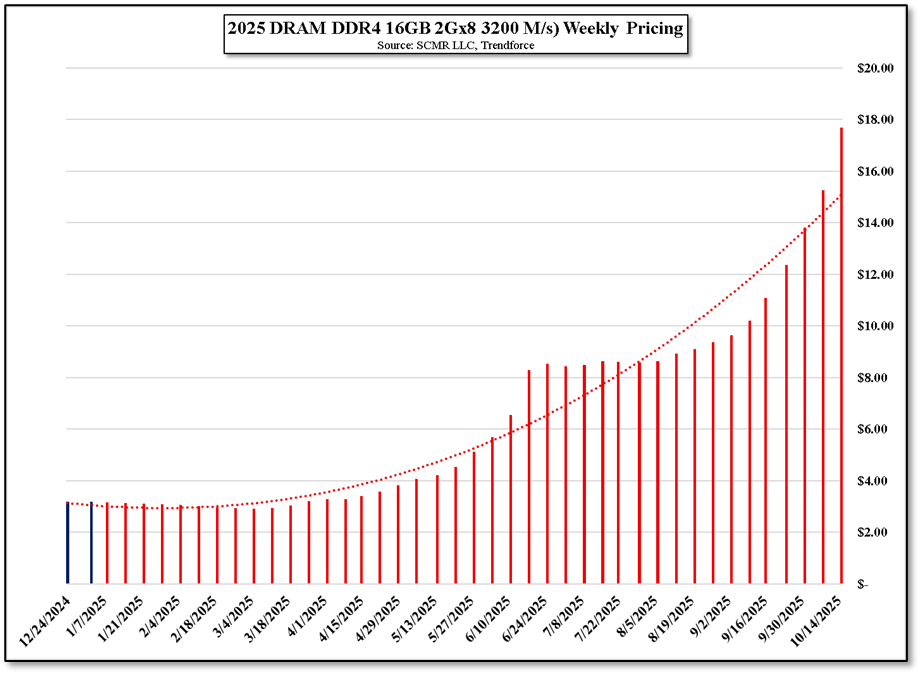

NAND vs. DRAM: The AI Price Gap

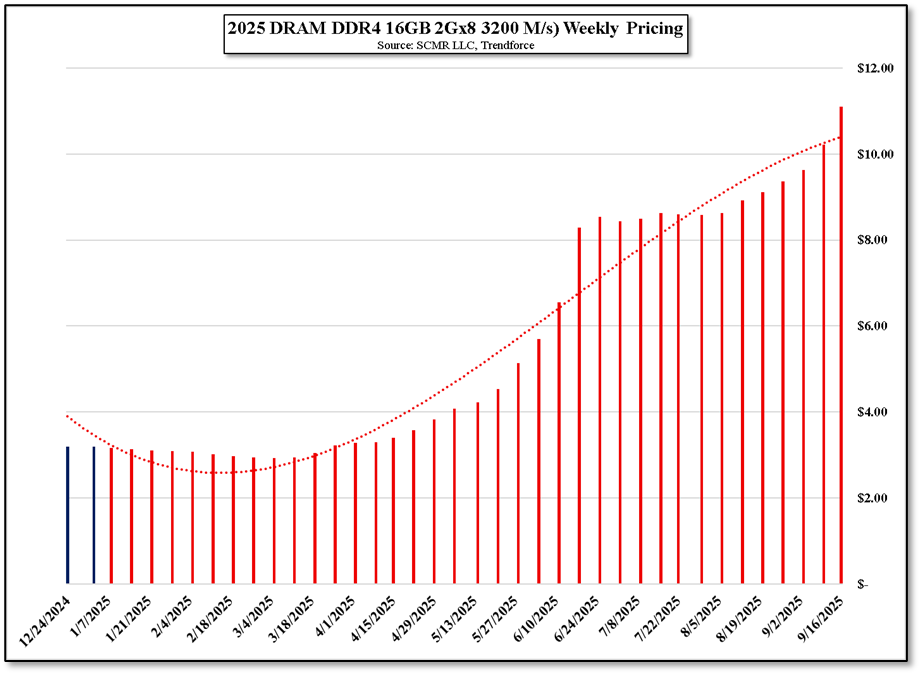

Much of focus on memory prices has been on DRAM as the obvious beneficiary of the AI boom.

- DRAM Price Increase: +561.1% (Average)

- NAND Price Increase: +63.6% (Average)

2026 NAND Price Forecast: The Supply Shortage

We have seen predictions that NAND prices will rise again in 1Q by more than 10% (Current Forecast) and 20% to 30% for the full 2026 year, based on demand growth of 20% to 22% against capacity growth of 15% to 17%, with rumors that supplier SK Hynix has already sold out its 2026 production an indication that negotiations for those in need of volume in 2026 have already taken place.

- Q1 2026 Forecast: Prices expected to rise >10%

- Full Year 2026 Forecast: Prices projected to increase 20% to 30%.

- Supply vs. Demand: Demand growth (20–22%) is projected to exceed capacity growth (15–17%).

Enterprise SSDs and data center storage continue to drive that NAND demand while producers are being very cautious about adding capacity. We believe there are three reasons for that caution:

- The 2022 Price Collapse – In 2022 the price of 512Gb wafer prices fell from ~$4.00 to ~$1.40. Inflation, the end of COVID demand, and considerable overproduction were responsible, and left producers selling product below cost.

- The Capital Allocation Choice – DRAM or NAND – Which of the two potential products would be more attractive to producers? The obvious choice, at least currently, is DRAM as HBM is the crux of demand in the AI server space. While NAND is getting more attractive as prices rise, if you have to choose, NAND comes in second.

- The Potential AI Bubble – Perhaps a bit more speculative, capacity expansion caution based on the possibility of an AI implosion always looms a potential factor when spending billions on new capacity.

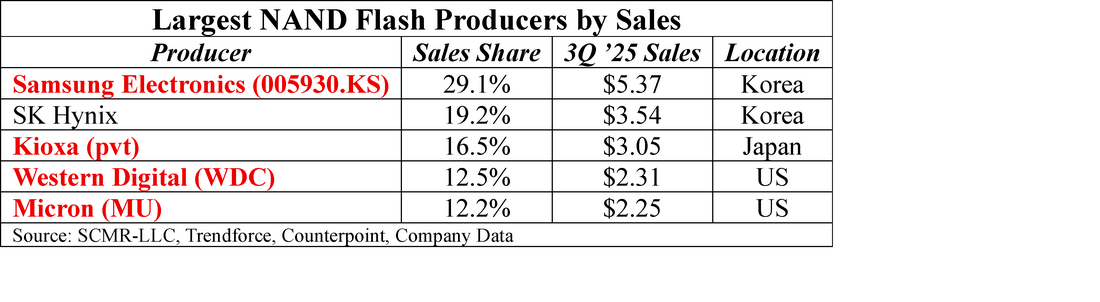

Top NAND Flash Producers by Sales (Q3 2025)

While the semiconductor spotlight remains fixed on DRAM and the astronomical rise of HBM, NAND Flash is quietly entering a period of structural shortage that seems to guarantee upward price pressure through 2026. The market dynamics suggest that the current 63.6% price recovery is not a ceiling, but rather a baseline for the next fiscal year.

The governing force for 2026 will be producer discipline born from trauma and opportunity cost. The memory giants (Samsung, SK Hynix, Micron) are effectively "shorting" their own NAND supply. By prioritizing high-margin HBM production and refusing to expand NAND capacity due to the scars of the 2022 collapse and fears of an AI bubble, they have engineered a seller’s market.

With demand growth (20–22%) structurally outpacing capacity growth (15–17%), and major players like SK Hynix already reportedly sold out for the year, the leverage has shifted entirely to the manufacturers. For investors and enterprise buyers, the narrative is clear: NAND may not be the volatility "sprinter" that DRAM is in the AI era, but it has become the steady, high-yield climber. As data centers fill with AI processors, the critical need for high-performance storage (Enterprise SSDs) ensures that NAND producers will enjoy sustained pricing power and revenue growth well into 2026, free from the threat of imminent oversupply.

RSS Feed

RSS Feed