Korea Asks for a Delay

This week however, the PPS granted an extension requested by the Government Procurement Computer Association, a group that represents PC and similar CE product suppliers that bid on government CE contracts. The extension had to do with past and potential delivery dates for PC related products that the GPCA felt could not be delivered on time, due to semiconductor and other component shortages. The PPS granted and extension of 15 days to delivery dates in order to avoid penalties or future bidding restrictions based on current conditions in Korea.

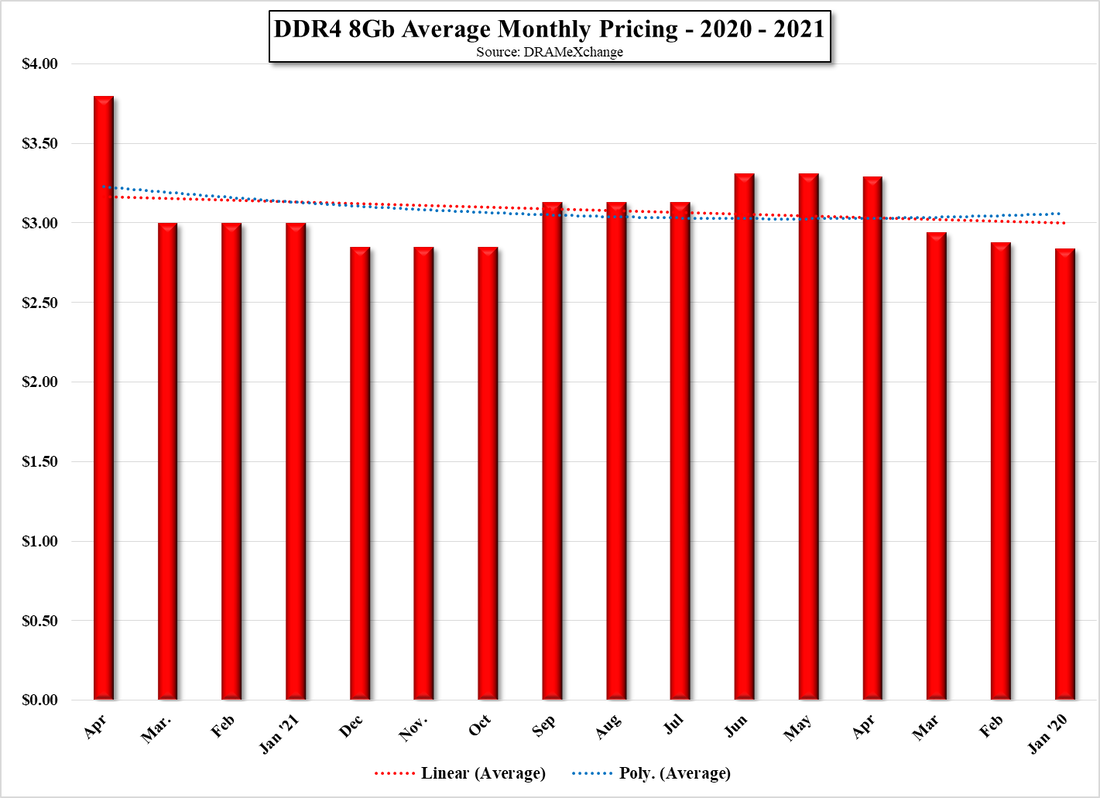

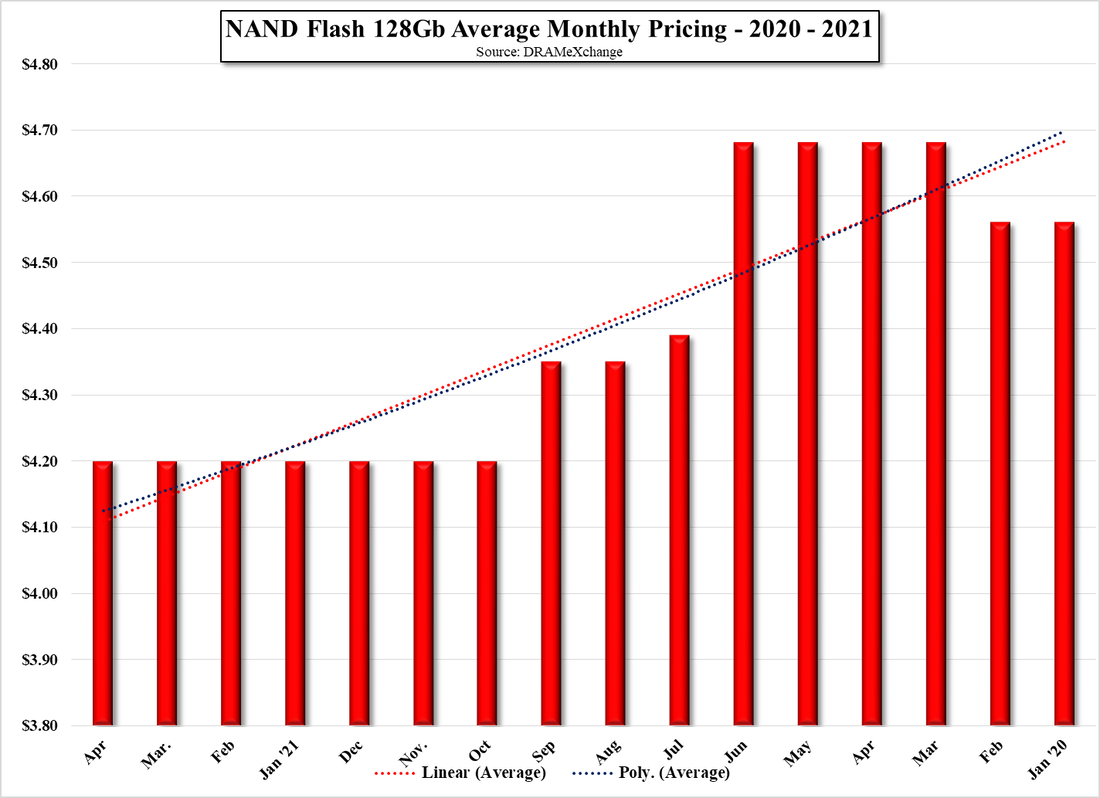

While the chairman of the GPCA stated that “In the procurement market, compliance with the delivery date is a strict regulation that is comparable to quality compliance,” the domestic procurement industry is also concerned that while the near-term effects of the component shortage have been dealt with, prices for basic, intermediate, and final CE products continue to rise. Graphics cards were cited as one of the most affected (see our note – 3/18/21), with prices rising from 200,000 won (~$178 US) to between 500,000 and 600,000 won (~$445 - $535 US), but public procurement contract prices are set under budgets from the previous year, and changes in finished product prices are not easy to come by, which leaves the supplier to eat the cost of the BOM increases, which, according to the PPS, is causing some end-user products to face limited public availability. While what is noted here is specific to South Korea, we expect similar situations to become more apparent if the semiconductor shortages persist through the remainder of this year.

RSS Feed

RSS Feed