Fun with Data – TV Screen Size

TV screen size is an important topic in the CE space as it is the offset to unit volume. The supply side of the display industry and its vast supply chain are dependent on increasing or at least stable unit volume and an increasing average panel size to counterbalance capacity expansion. With TV panel sizes being so much larger than IT or mobile device panels, the TV size metric is all that more important to that balance, but again variations in the data from multiple sources makes much of the data inherently unreliable.

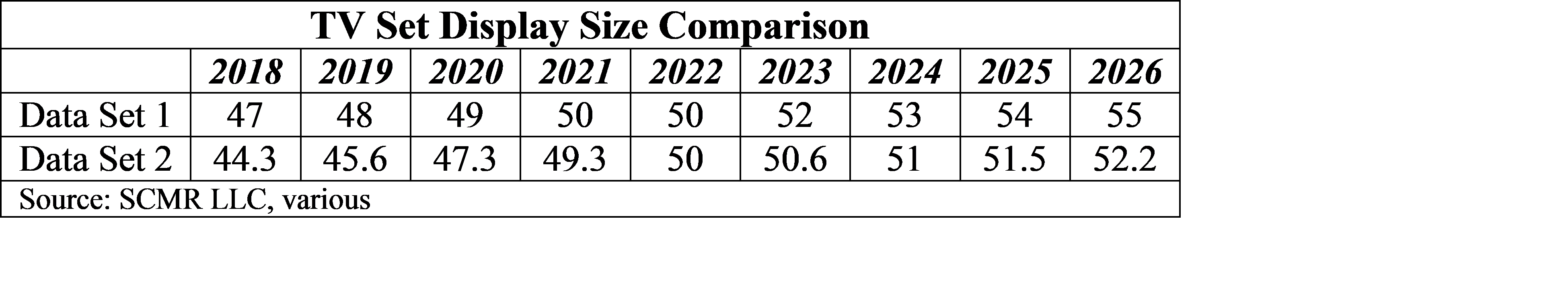

To get an idea of how that data can vary, we show two data sets indicating the progressive size of TV sets from 2018 to 2026. We note that while we would expect different forecasts for 2021 through 2026, we would expect 2018 – 2020 to be consistent. They are not, as the difference between data set actuals (2018 – 2020) ranges from 3.6% to 6.1%, while the differences between the two during the forecasted period ranges from 0% to 5.4%.

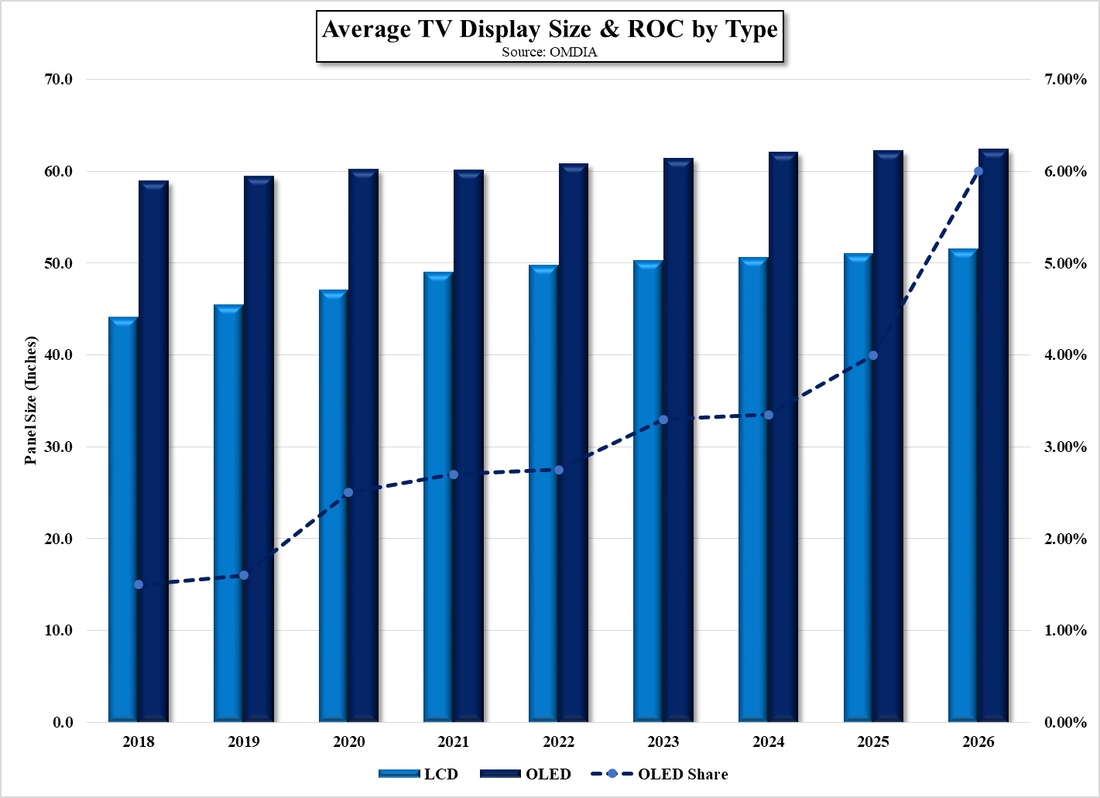

Since that data was not supplied, we calculated the OLED share and show both LCD TV and OLED TV size data in Fig. 2, along with the calculation showing what contribution OLED TV set size had on the average. The data shows that LCD TV set sizes are growing faster than OLED TV set sizes, and the larger inherent size of OLED TVs and the increasing amount of OLED in the mix helps to support an overall larger average TV set size in the forecasts. By separating the data we are better able to see whether we agree with the share attributed to the large OLED sets in the mix and better understand if we agree with the data.

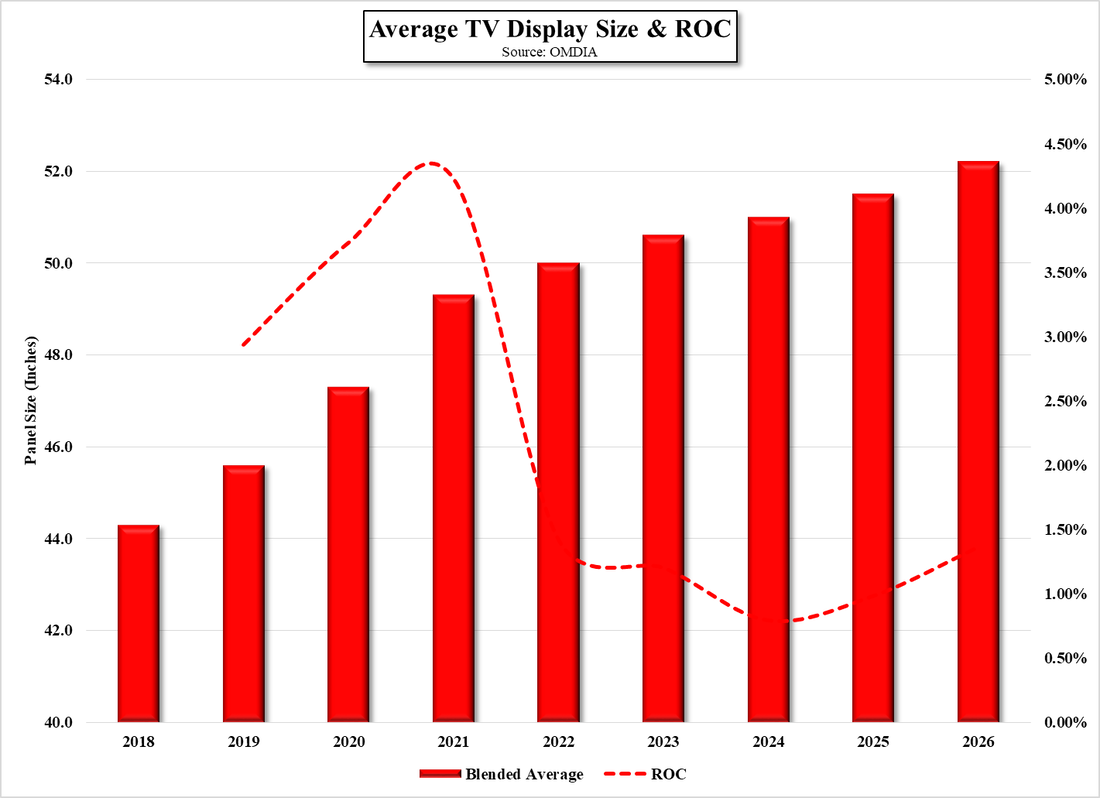

All in, using just this data set we are a bit suspect as to why there would be such a big jump in average TV set size this year and such a fall off over the next few years, especially with the price of TV sets rising substantially over the last year. Typically this would slow sales or push consumers to make a step down in TV size to compensate for the higher price, so our skepticism is more about our expectations for TV set prices in 2H. While TV panel prices have taken a step down in August and are expected to do the same in September, even with the declines in both months, at the end of September TV panel prices would still be up 9.4% for the year and up 66.6% from June 2020 when the increases began. While the 2 month decrease in panel prices might help TV set sales a bit, it will take some time for the industry to see that lower priced inventory work through retail, so we expect that the expected big jump in TV set size this year might be a bit less than predicted, and if the trend toward declining TV panel prices continues into 2022 and beyond, we expect average TV set size increases to be a bit larger than the data predicts for the out years. JOHO.

RSS Feed

RSS Feed