MLCC Status

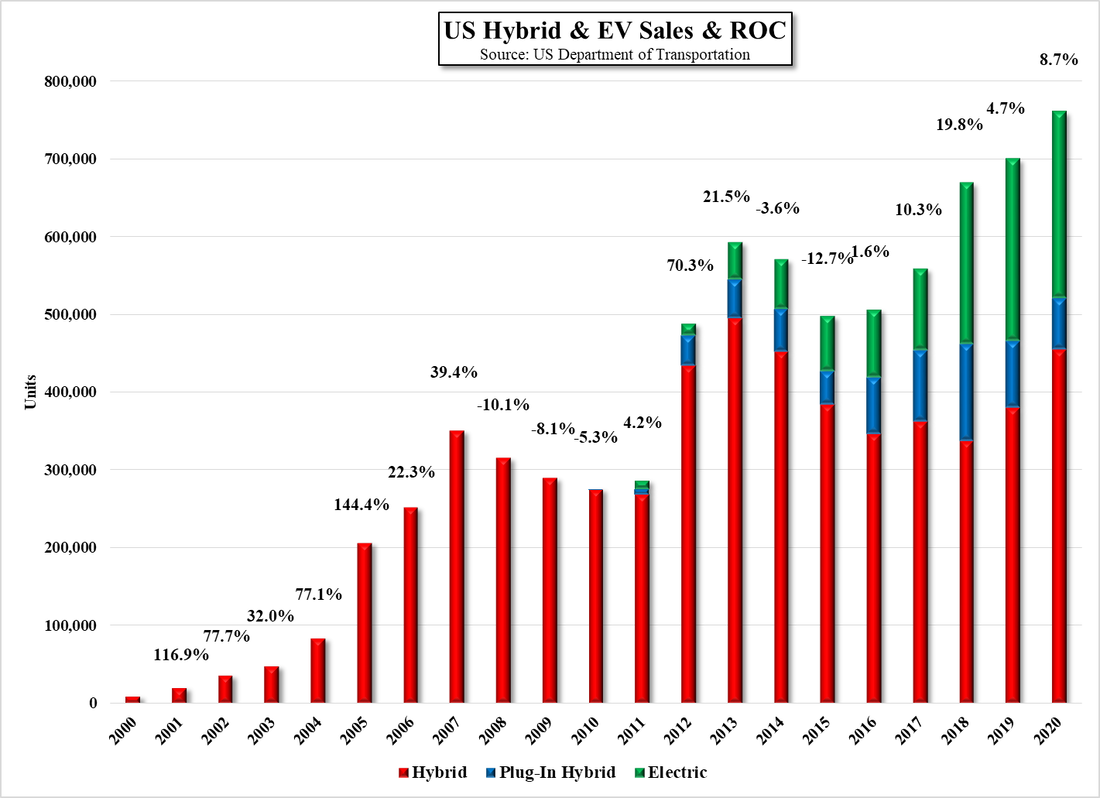

However MLCCs, which as small and hard to produce capacitors that appear in many CE, automotive, industrial, and defense products, continue to see strong demand despite supply chain issues that have slowed orders for some CE products. While the automotive industry has had its issues during the COVID-19 pandemic, demand for MLCCs continues to grow and has offset the slower demand from CE. As hybrid and fully electric cars become more entrenched, MLCC content in that space will continue to grow and we expect the industry to remain tight on a long-term basis, especially as entry into the production side of MLCCs is quite difficult for those that do not have the considerable expertise to make these small components.

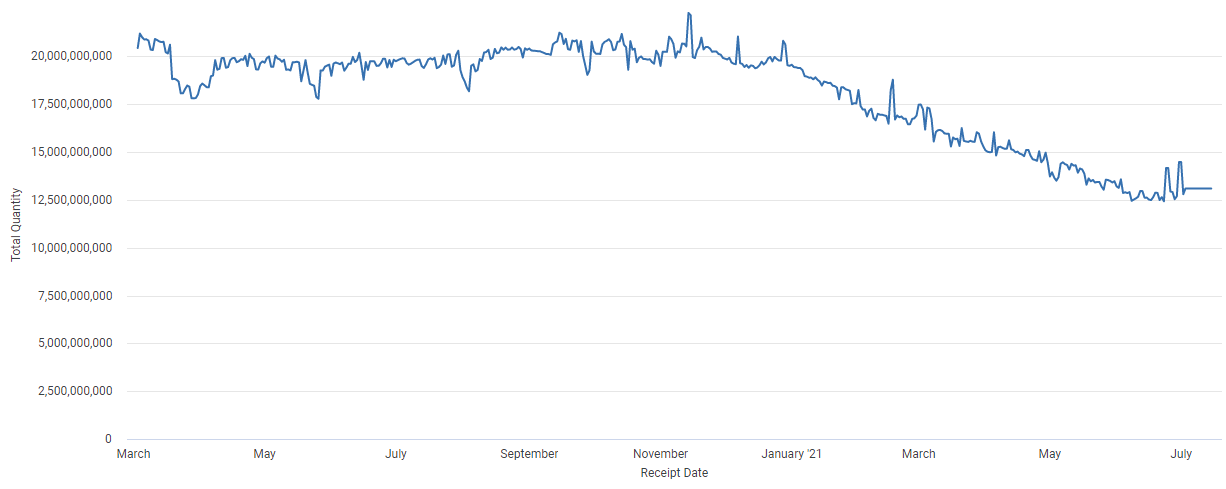

Inventory levels for MLCCs have been declining this year, and while this would not be considered a ‘shortage’ situation, lead times have been extended as automotive and 5G demand has picked up, despite the silicon supply chain issues that have limited broader CE demand late this year. We are less concerned with what are relatively short-term movements in MLCC lead times, inventory levels, and pricing, as we are in longer-term demand, and industry leader Murata has provided internal research that gives a picture of current MLCC usage in a number of products, giving some indication of the volumes needed for this component.

5G is a driver for increasing MLCC content in smartphones and the growth in Hybrid and EV is the driver for the automotive segments. While we believe some of the growth estimates for MLCC demand in 2022 are quite aggressive (25% is the highest we’ve seen), EV unit growth alone in just the first half of the year, has been averaging over 170% y/y for light vehicles on a global basis, and Fig. 2 shows the historic sales growth of Hybrid and EV vehicles in the US, the 3rd largest market for plug-ins behind China and Germany last year.

RSS Feed

RSS Feed