Samsung EM Makes Big Bet on Substrates

As almost all semiconductor substrate products have been in short supply for almost a year, made worse by a series of fires at Unimicron (3037.TT) in October of last year and again in February of this year, and the potential closing of SEMCO’s RF PCB business later this year, delays in deliveries of PCB based components have been high enough to cause product roll out pushbacks and rising prices. There are a limited number of substrate suppliers, and while the global market is large (Estimates range from $53b to $64b last year), many of the suppliers have a particular product niche.

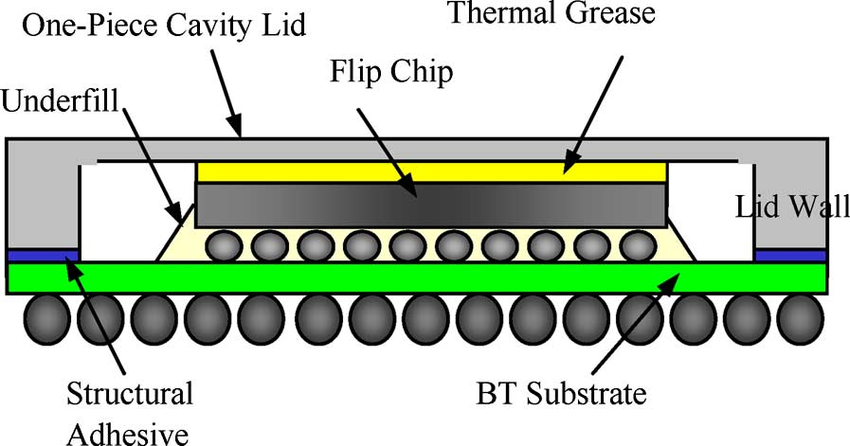

In that regard, Samsung EM is expected to spend much of the capital on Flip-Chip BGA substrates where there are few suppliers, and is expected to be dedicating some or all of these lines to a “US Chip Company”, likely Intel (INTC), who will also be making an investment in the lines. FC-BGA is most commonly used for CPUs, GPUs for servers and mobile devices (smartphone application processors). Samsung EM currently generates ~$423m from FC-BGA, which is expected to grow to over $1b when the expansion is complete. No timetable for the expansion has been set, although we expect more detail once the board gives final approval.

RSS Feed

RSS Feed