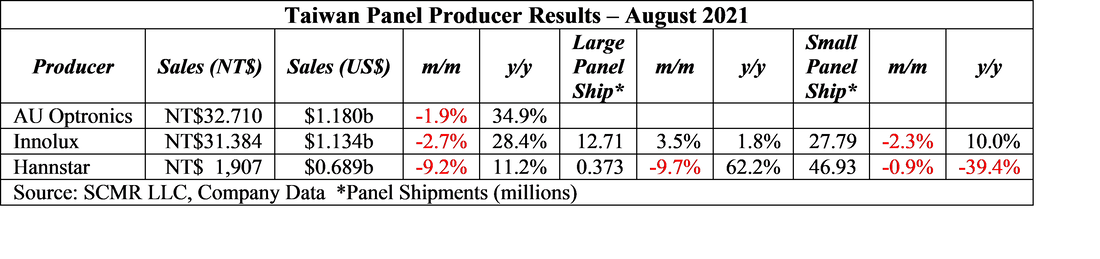

Taiwan August Panel Producer ResultsAugust was a bit of a difficult month for Taiwan based panels producers, and while particularly regional, is likely to be the tone for other panel producers that do not report monthly data. While AU Optronics (AUOTY) no longer reports large and small panel shipment data, sales declined 1.9% m/m in August, a month that is typically up 7.6% sequentially. Based on Fig. 1, it seems that sales this year peaked in June and have been declining, albeit at a modest pace. The decrease in sales (m/m) comes despite a 3.33% increase in total panel area shipped. Innolux (3481.TT) (Fig. 2) looks similar, with its peak in July and a slightly larger m/m decline in August, while Hannstar (6116.TT) saw its peak (Fig. 3) in March and has also been trending downward. We note that while Hannstar is growing their large panel display business, the bulk of Hannstar’s sales is based on small panel product, which sets them apart from AUO and Innolux. As we have previously noted, large panel prices have begun to decline, putting some pressure on overall sales, and component shortages have limited some IT panel production, however if large panel prices (TV mostly) continue to decline, even with the shift toward IT products many panel producers have made over the last few months, the effects will become a bit more visible, especially if IT panel pricing increases moderate. AUO generated 26% of sales from TV panels in 2Q and Innolux 38%, so there is still quite a bit of leverage toward large panel pricing which could prove detrimental this month and into 4Q.

0 Comments

Leave a Reply. |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed