China Smartphone Shipments – November

5G smartphone shipments increased substantially to 29m units, above our 26.8m unit expectations, up 9.0% m/m and up44.0% y/y. November would be the largest shipment month for 5G smartphones in China since the country began keeping records, so it follows the overall trend, and since the iPhone flagship family are all 5G phones, the growth of 5G smartphone units is likely being helped by iPhone sales. 5G share of overall mobile phone sales in China also set a record at 82.2%, well above our 76.1% share expectations.

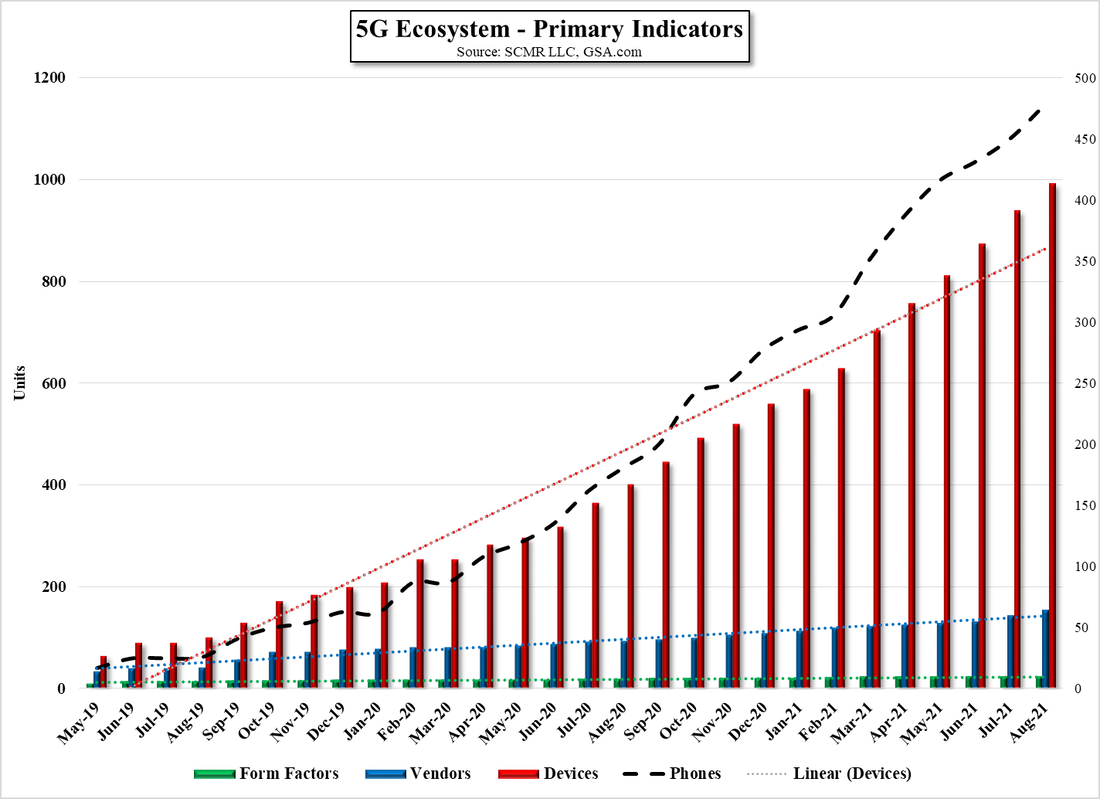

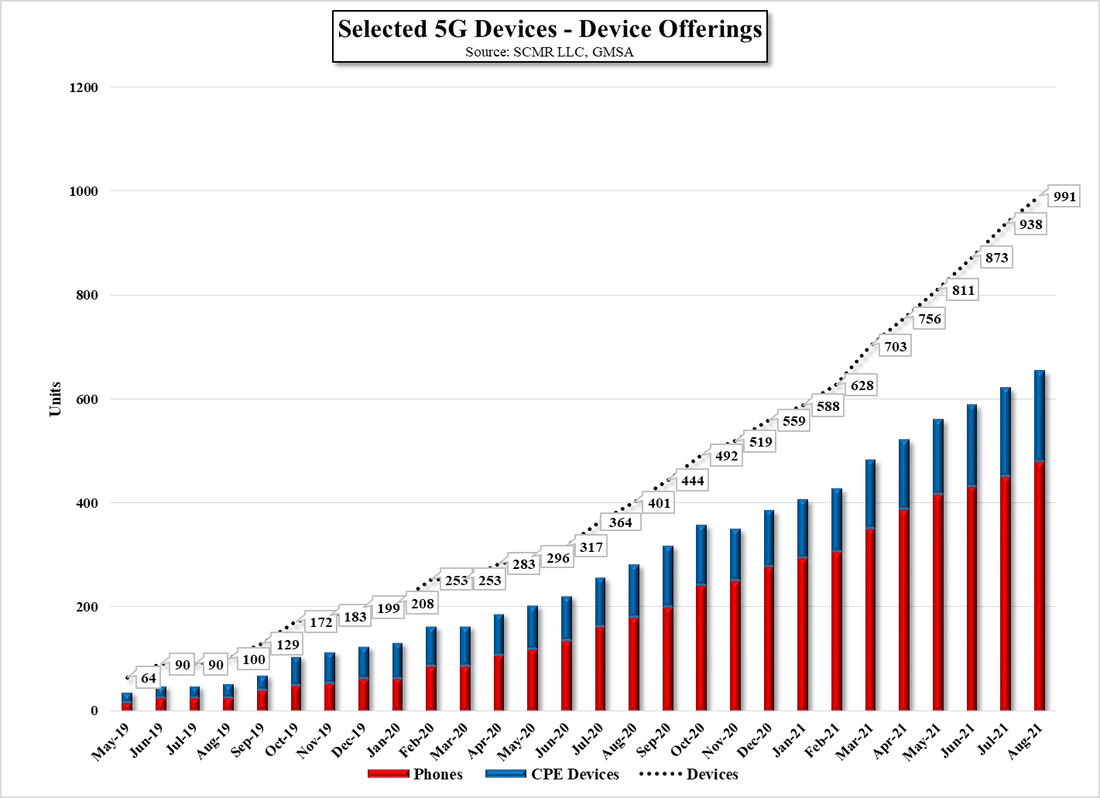

Based on our December estimate of 32.72m units (-7.3% m/m), total mobile phone unit volume for the full year would be 350.15m units, which would be up 13.7% y/y, and the first y/y gain since 2016, certainly a watershed event for the Chinese smartphone market. With 5G representing (exp.) 75.4% of smartphone shipments and 45.5% of all new domestic models released in 2021, 5G is the obvious growth factor that has helped to pull China’s smartphone market out of its extended slump. As of September the Chinese government has stated that just under 1m 5G base stations have been deployed across the country and local carrier 5G coverage extends to all prefecture-level cities, more than 95% of counties and 35% of towns, with over 392m Chinese households on the country’s 5G networks, which has been driving 5G smartphone growth through the replacement of 3G and 4G phones, and while we take most 5G data (both US and China) with the understanding that politics can shape the information, even a close approximation to those figures gives Chinese subscribers the incentive to convert to 5G.

We do note that a recent study by Ookla (ZD). Indicated that in 3Q the US was the country that provided the most 5G availability based on the percentage of 5G enabled users who spent the majority of their time on 5G networks, while on a performance basis ranked by 5G network speed in capital cities, Washington DC was 31st, at 160.41 Mbps. We note also that the blended spectrum being used by a country’s carriers will be a large part of the average speed across that country, particularly in smaller countries where the density needed for higher 5G spectrum is less of an issue. That said there are still many countries that still rely on 2G and 3G networks and are upgrading to 4G rather than 5G. Some are more obvious than others, with 89.9% of Central African Republic subscribers still on 2G/3G networks, while Palestine is still 84.7% 2G/3G and Israel has only 3.8% 5G availability, leaving many countries and regions open to 5G development.

RSS Feed

RSS Feed