Fun With Data – Chinese Smartphones

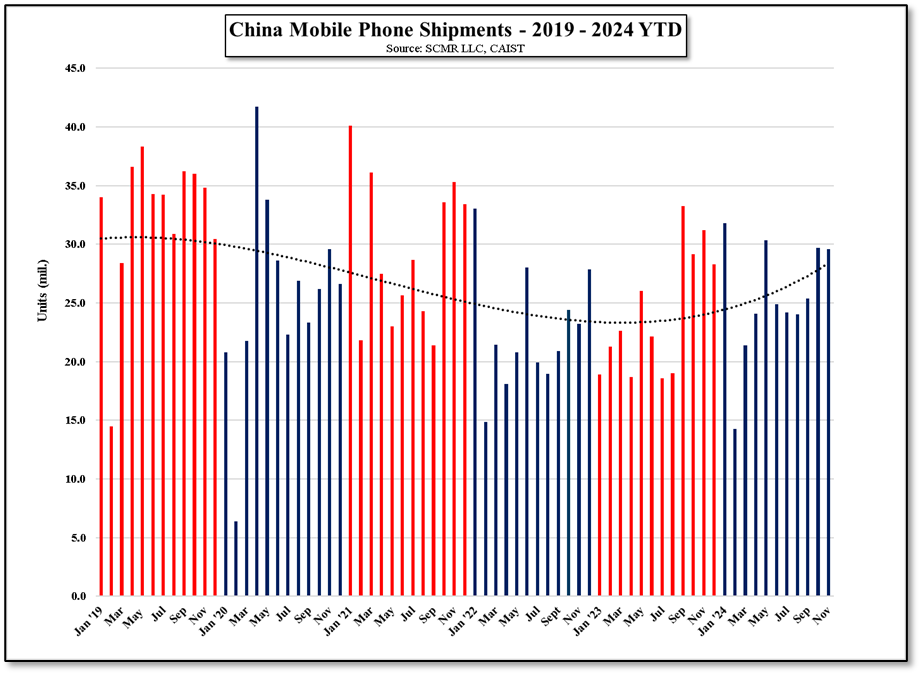

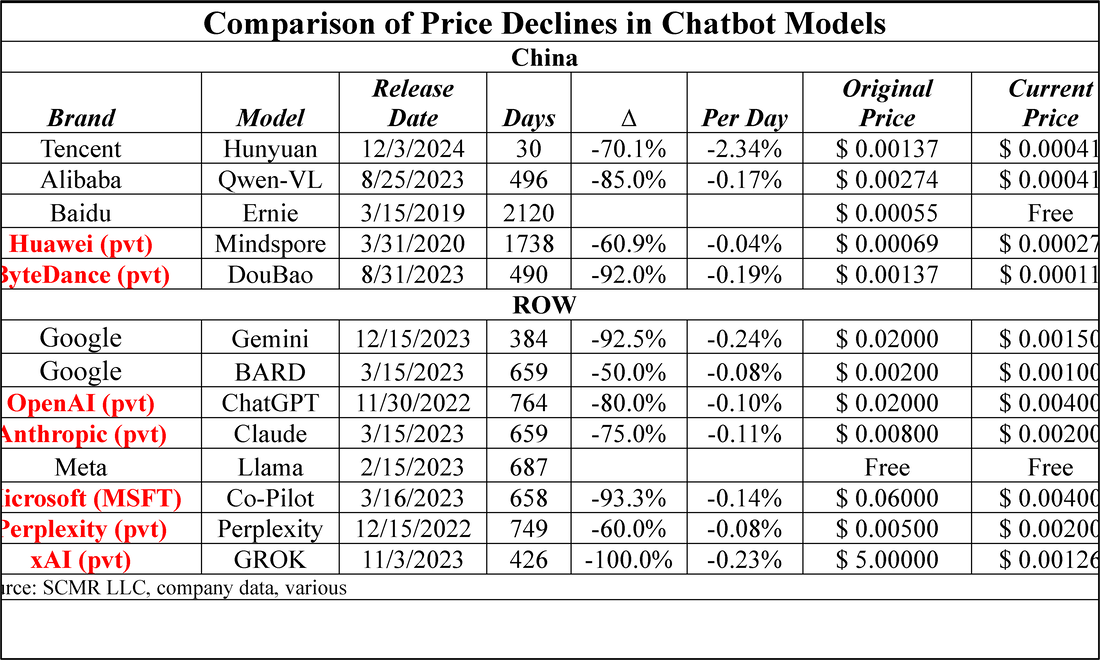

First, AI. The Chinese market has had a number of AI enabled models available to consumers, with the Vivo (pvt) X100, released in November of 2023, the first we can find that had advanced generative AI features, and also the first to use the Mediatek (2454.TT) Dimensity 9300 Ai chipset. By 3rd quarter of 2024 ~22% of all Chinese smartphone shipments were AI capable and Chinese brands held a roughly 92% share of the 28m Ai capable smartphones that were shipped in that quarter in China (Samsung (005930.KS)) had a 4% share along with ‘others’, also at 4%). This data points to Chinese smartphone brands looking to use AI in 2025 as a way to push the upgrade cycle on the mainland, in what has been a relatively weak retail environment.

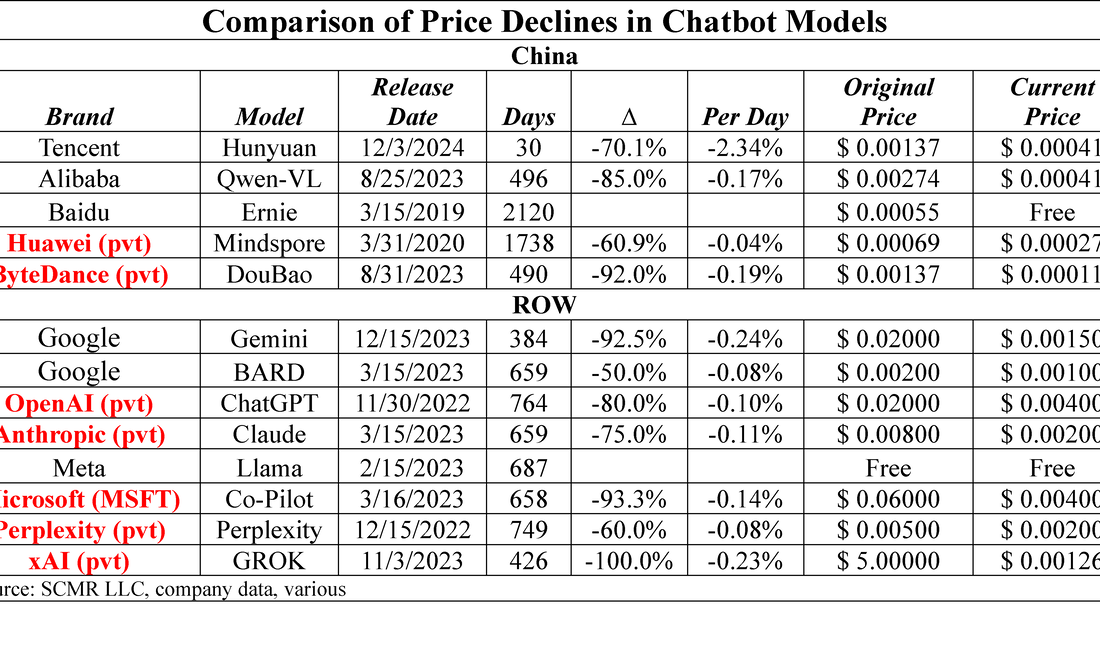

While the success of this strategy is far from certain, Chinese consumer seem to be more enthusiastic about AI, we believe, in part, because China itself has been quite aggressive in AI development, and started from a point similar to others, rather than having to play catch-up. While trade restrictions on semiconductor development could slow that growth a bit, we expect a continued push from Chinese smartphone brands to offer AI features as a selling point this year.

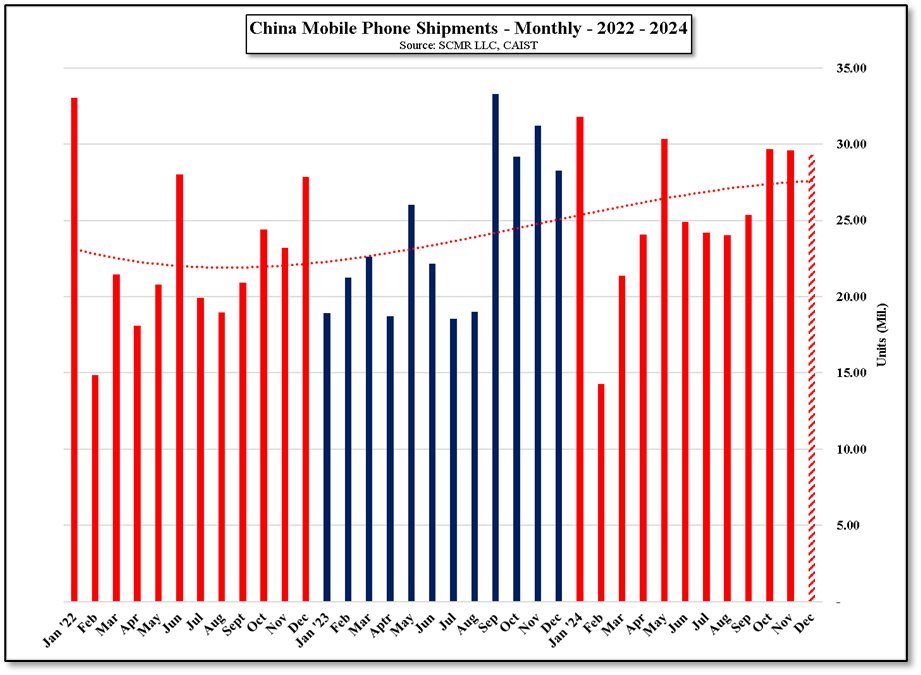

Second, the Chinese government has recently included smartphones in its ‘New for Old’ consumer subsidy program, which helped to spur sales for a number of CE products in 4Q ’24. Details of the smartphone subsidies are not yet available, but other products covered under the program typically garner a subsidy between 10% and 20% of the retail price, which we believe is substantial enough to move the needle, at least at the onset.

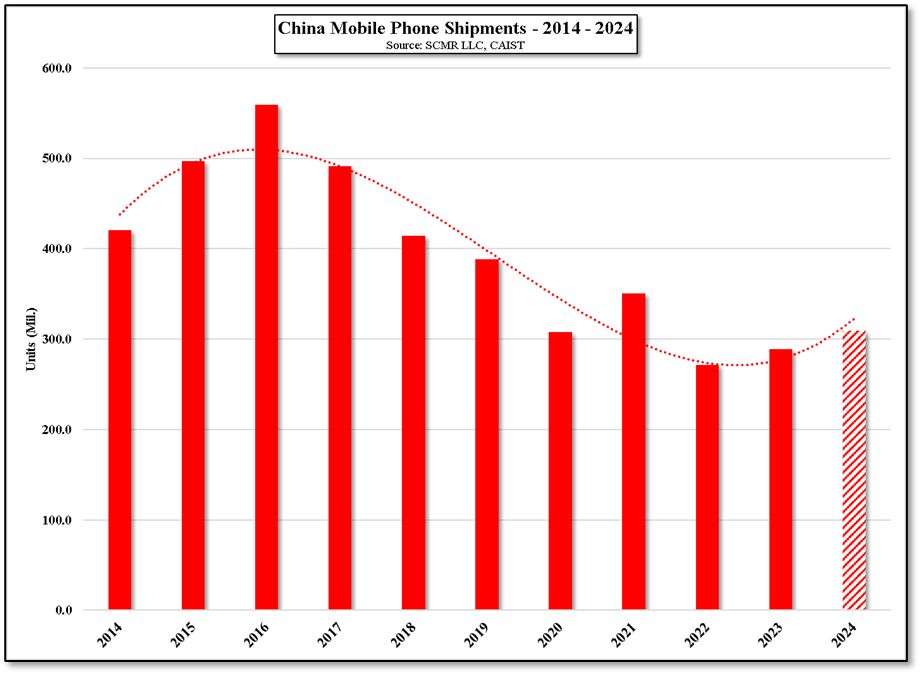

With these two potential factors as influencers early in the year, and an early Chinese New Year (1/29), we expect 1Q ’25 could see continued y/y growth, but we expect that it will lessen as the year progresses, as comparisons get more difficult and the enthusiasm behind the subsidies wears thin. All in we expect Chinese smartphone shipments to stay in the low 300-million-unit range for the year, with much of the y/y growth in the 1st half, and, barring any unforeseen trade issues, we see similar results for 2026 at this time.

As Chinese smartphone brands have a small share of the US market, potentially onerous trade restrictions on Chinese phones would have little effect on US consumers, with Xiaomi (1810.HK) having the largest share, albeit a small one (~1.2%). However the implications for non-Chinese brands, particularly US smartphone brands in China could face a bit of additional nationalistic pride from Chinese consumers, who tend to opt for Chinese brands during periods of trade tension with the US. 2025 presents a fair number of variables that can have an influence on the Chinese mobile phone market, but we believe the longer-term picture is one where it become similar to other more mature markets, finding a shipment level that remains fairly constant over the years.

RSS Feed

RSS Feed