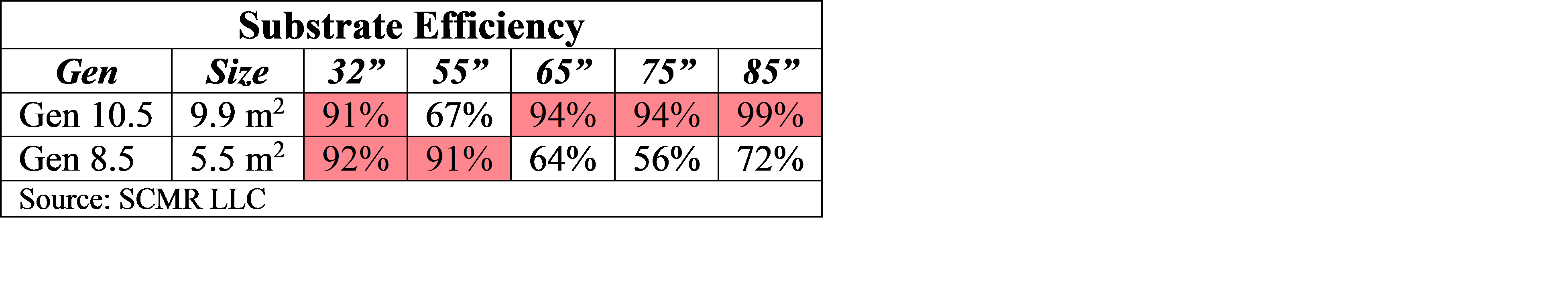

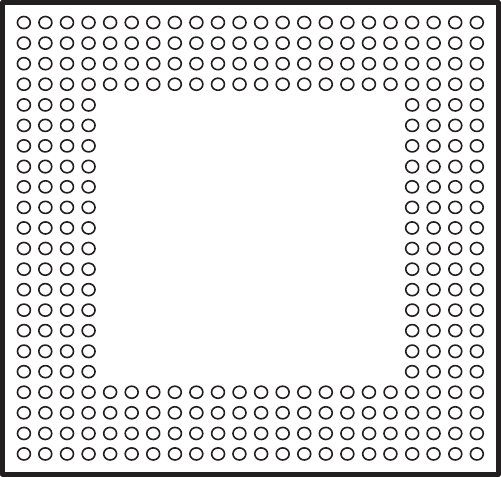

Corning makes it OfficialCorning (GLW) officially opened its 2nd Gen 10.5 glass substrate facility in China, and its 6th class facility in the country. The plant, which is located in Wuhan, is co-located with BOE’s (200725.CH) Gen 10.5 fab to allow for direct carriage of the substrates to the production facility without intermediate transport. The sheets that are produced at Corning and processed at BOE are 2,940mm x 3,370mm, which is 9.9078m2 or 106.65 ft2, which makes them extremely efficient when producing large size LCD TV panels as shown in the table below. Corning has been supplying Gen 10.5 substrate samples to the BOE Wuhan fab since January and completed its finishing operations last July. Corning’s other Gen 10.5 substrate plant in Hefei has been supplying BOE’s other Gen 10.5 fab since its opening in 2Q ’18. The BOE fab, which is known as B13/17 was officially opened in September of 2019 but has been slow to develop mass production scale due to the COVID-19 outbreak, which closed the plant in February ‘20 for about a month. While the plant was able to reopen relatively quickly, many workers were either unable to or unwilling to return to what was the hotbed of the pandemic, which further slowed the production ramp. The fab, which has a fully built-out stated capacity of 120,000 sheets/month is capable of producing 2.88m 65” TVs per quarter (in theory, at 100% utilization and yield), although such a rate would entail the buildout of an additional phase 2 line, which we expect to be put into operation in 2Q next year.

0 Comments

Prices Up… |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed