Blue Period

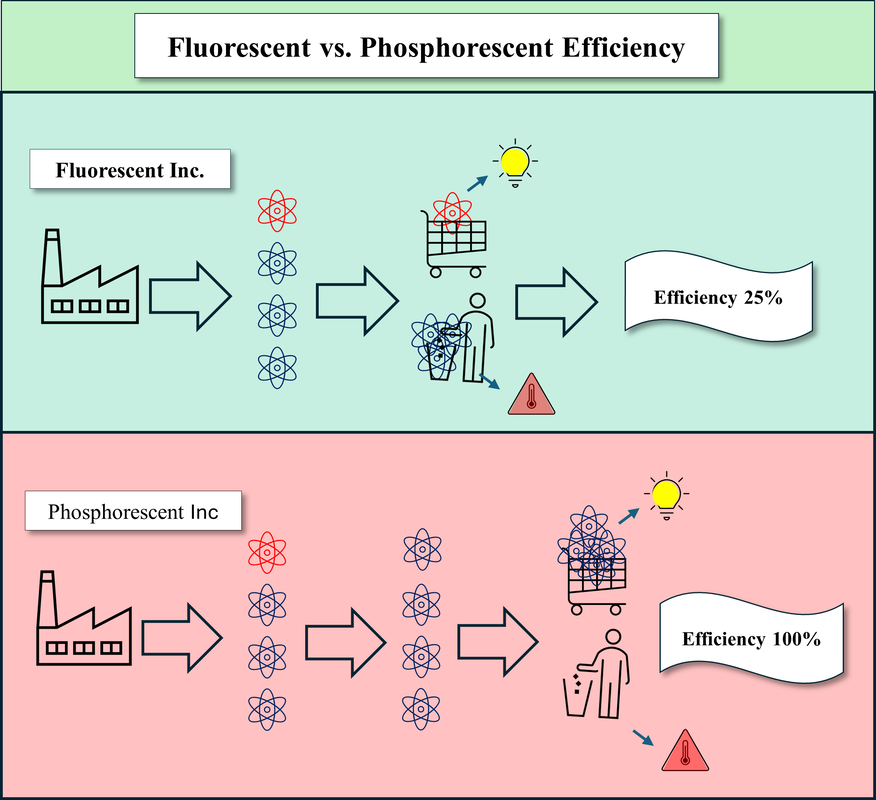

So, we know the development of a blue phosphorescent emitter has been difficult to say the least, as some potential blue emitter materials have high efficiency and a deep blue color point but only last for a few minutes, while others have a longer lifetime, and proper color, but are too inefficient to be used commercially, and some have excellent efficiency and a long lifetime but can’t quite produce the deep blue that is needed. While Universal Display has completed ‘commercial verification’ with LG Display, UDC continued to record blue emitter/host revenue in 1Q as ‘developmental’, which is required until the product using the material is commercially available. As the timeline for LGD’s panel production is still unknown, the key to understanding whether the LGD panels are being used in a commercial device will be when UDC begins recording the blue material as ‘commercial’.

What about Samsung?

Obviously, there are other OLED panel manufacturers working to bring a full phosphorescent blue emitter to market, particularly Samsung Display (pvt), who is also working with UDC along with their own development team. As the leader in small panel OLED displays, they have a very big stake in this process but tend to be a bit more ‘purist’ when it comes to OLED processes. SDC did not believe that LG Display’s TV panel, which uses a single color OLED and a color filter to create red, green, and blue, was the right way to produce large panel (TV) OLED in 2013 and concentrated on smaller RGB OLED displays, eventually settling on a blue OLED with quantum dot s to create colors for their QD/OLED TVs.

As the LG Display panel uses both fluorescent and phosphorescent blue emitters, we suspect that the current blue phosphorescent host/emitter that LGD is using as part of its stack might not meet Samsung Display’s requirements yet. Samsung would likely be most interested in using blue phosphorescent material in mobile devices (smartphones and tablets) where the higher efficiency of a phosphorescent blue emitter will be key to either a power consumption reduction or an improvement in brightness, but as mobile devices have individual sub-pixels for each color, we expect their requirements might be a bit more stringent. That said, we do expect SDC will find a way to incorporate a blue phosphorescent system in some product this year. It could be a similar fluorescent/phosphorescent blue emitter base for their QD/OLED TV/Monitor panels, or it could be a higher specification deep blue phosphorescent emitter for an RGB architecture for mobile devices, but we find it difficult to imagine that SDC will cede the first ‘blue year’ to LGD.

All of that said, changing from a blue fluorescent emitter to a phosphorescent emitter is much more complicated than just switching materials. In a large panel (TV), the OLED materials are deposited across the entire panel and the driving circuitry is the same for every sub-pixel point, as each sub-pixel is the same (white) color until it reaches the color filter or quantum dot. In current RGB (small panel) displays, the driver for the red and green sub-pixel can be the same but as the driving characteristics for the fluorescent sub-pixel (blue) as different, the circuitry for the blue driver is different, adding to complexity. In an all phosphorescent RGB display, all three sub-pixel circuits can be the same (in theory), which means not only does the material stack change, but the driver circuitry also changes, adding another level of complexity to designing an all phosphorescent display.

Timeline?

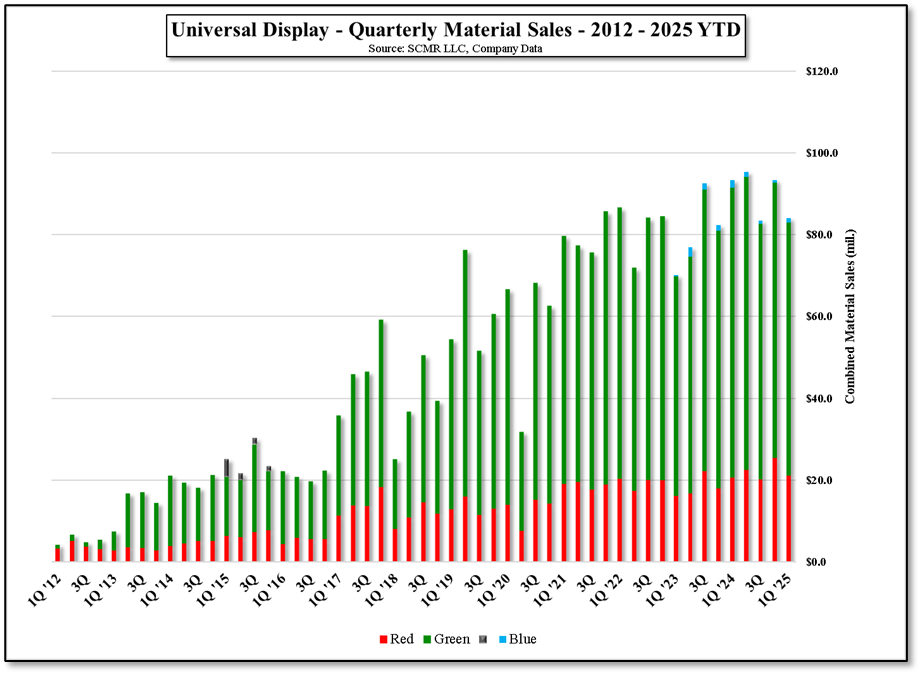

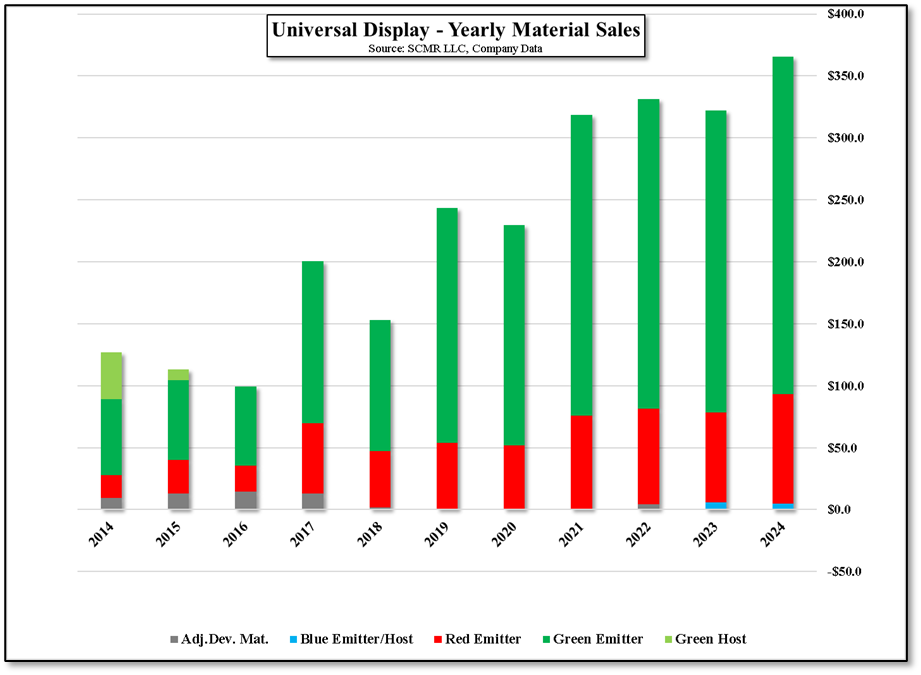

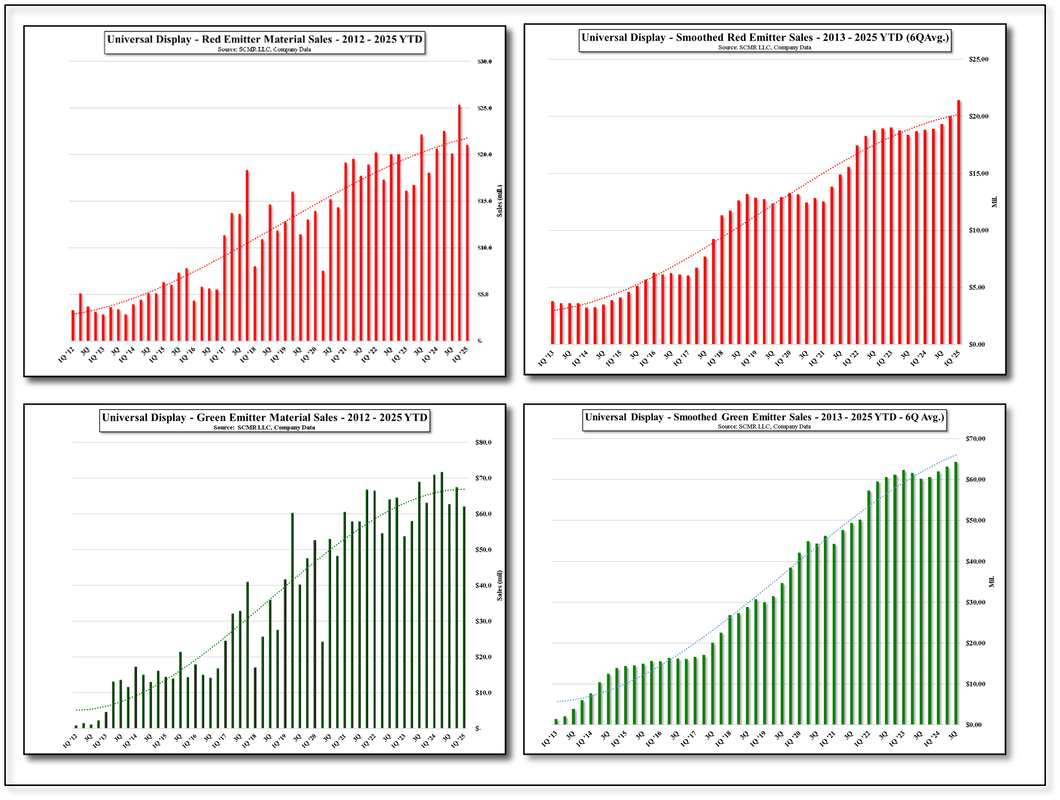

Not only do all of these issues need to be worked out, but they also need to be tested both at the pilot level and in a mass production setting, and this can take time. The issue then becomes where do they start? Does the OLED producer have enough ‘spare’ capacity that they can convert a line to producing all phosphorescent RGB OLED displays, or are they capacity constrained enough that they cannot afford to dedicate a line to all phosphorescent OLED production? As was the case when green phosphorescent emitter material became commercially available, adoption took time. With the first commercial product using a phosphorescent green emitter was released in 2013, UDC’s green emitter sales increased but then stayed relatively flat for ~15 quarters, being adopted by one of two major customers. In 2017, sales increased as a second large customer adopted the material and continued to grow quickly through 2021. While still growing to a lesser degree, as the industry has universally adopted green phosphorescent emitter material, growth is more tied to capacity expansion and new product applications, although the adoption of multi-layer OLED displays could lead to incremental material sales.

Adoption?

So the question now becomes will the adoption take 15 months, as it did with green or will it be faster or slower? These are essential questions for UDC’s longer-term prospects, as while OLED capacity growth continues, the addition of a third primary material revenue stream is a godsend for any material producer. We expect the adoption of blue will be faster, but with some caveats.

Why faster?

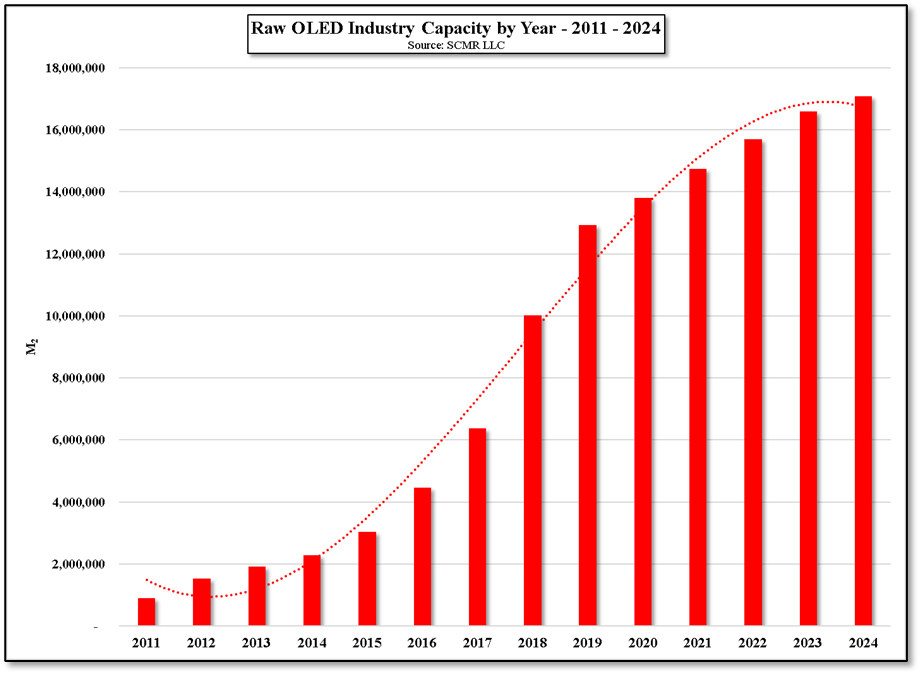

Numbers – in 2013 there were two OLED producers, Samsung Display and LG Display. Tianma (000050.CH) built their first OLED fab that year but did not ship commercial product and BOE (200725.CH), China’s largest OLED producer, did not build their first OLED fab until 2016, so the adoption of green phosphorescent emitter material was dependent on only two producing entities. Now there are over a dozen producers, all of whom are looking to differentiate their OLED displays from others and blue is a perfect differentiator.

Experience –Samsung Display and LG Display had been involved with OLED display development for over 10 years when green phosphorescent emitter material was released commercially by UDC, yet much OLED production was still problematic, and yield was always an issue. At that time making major changes to formulas, architecture, processes, and equipment meant a long learning curve before returning to decent production yields and carrying substantial losses that could erode potential funding and adoption. The current experience level across the industry is considerably higher than 10 years ago and producers are more likely to see a change that could give them an edge over the competition as one they are willing to take after years of managing commercial production.

Quality – A true blue phosphorescent emitter will give display designers a greater ability to balance their systems. As a more efficient material they can maintain brightness with less power and less power means longer battery life for mobile users and a longer lifetime for the material, putting a damper on the ever-present burn-in question. They can maintain the current power level and produce a brighter display to compete with other display modalities that are encroaching on the OLED space, or they can use blue as a differentiator that will separate their display from those without blue phosphorescent emitters.

Advertising – The idea of the display industry is to sell displays, and in order to sell displays there have to be lots of products that use them. As the display industry can find itself in a somewhat stagnant position, with few new enticements for consumers, any new technology affords the industry a shot at incremental unit sales. We expect the industry will be enamored with the promotion of blue when it starts and will start a new line of promotion for OLED devices to counteract Mini-LED, Quantum Dots, and eventually Micro-LED displays. However unless there is a truly discernable difference between all phosphorescent displays and what we have now, price will remain the most important factor to consumers as the blue enthusiasm wears down. UDC however will have a new revenue stream , one that can eventually be bigger than red or green.

Why bigger?

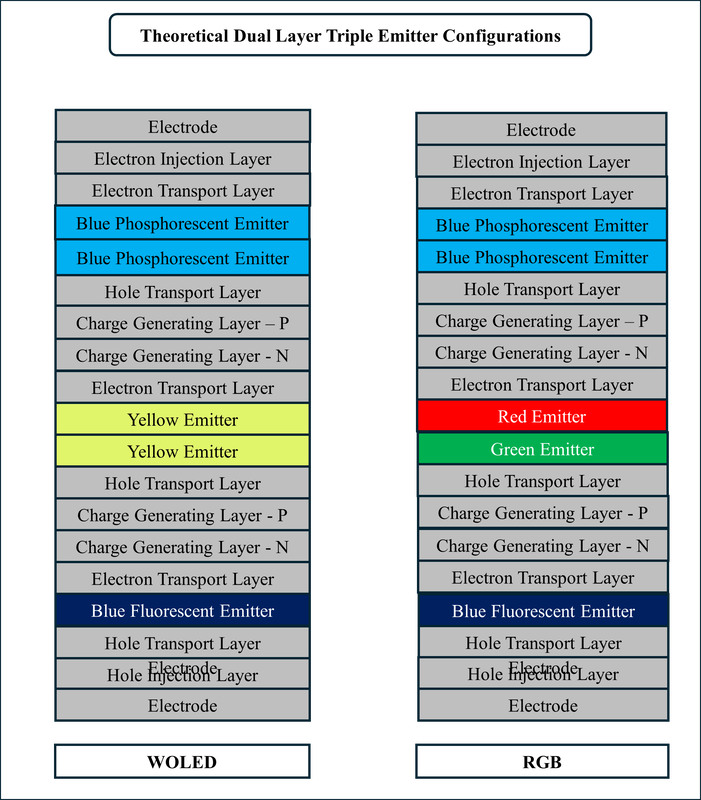

In order to produce white light in large OLED displays, one can combine a blue emitter and a yellow/green emitter and then send the light to a color filter to create red, green, and blue sub-pixels, essentially the way LG Display’s WOLED TV panels work. Samsung Display’s QD/OLED panel is similar but based on a blue[1] OLED material that gets converted to red and green by quantum dots. Smaller devices use individual red, green and blue sub-pixels, directly creating all colors. WOLED displays uses UDC’s yellow/green phosphorescent emitter with a blue fluorescent emitter. If a phosphorescent blue emitter became available, UDC would have the potential to be able to put both materials in every WOLED TV. In Samsung’s QD/OLED the blue material used is fluorescent, with UDC providing no substantial OLED emitter material. If a phosphorescent blue emitter became available, UDC would have that potential new stream. In RGB display (phones, tablets) the impact would not be as significant as UDC would only be adding a third phosphorescent emitter to the two they already supply, but the volumes are extremely high, so all in, UDC benefits unless someone comes up with a better phosphorescent blue. That said, even in that scenario UDC still has device patents that cover the use of phosphorescent emitters in OLED devices, so they might lose the OLED material sale to someone else but should still be able to capture a device royalty stream as before.

Why Not?

Cost – Fluorescent emitter materials tend to be less expensive than phosphorescent ones. In premium OLED displays, the additional cost can be absorbed, but as one migrates to lower price tiers, the cost will be more difficult to absorb, and adoption will be slower. We expect however that many brands will bite the bullet and eat the additional material cost in order to compete, at least for some products. The cost of converting formulas, structure, and process also must be considered, and some who have been producing OLED displays for years at a loss might hesitate, unless they can convince funding sources to foot the bill.

Complexity – While there are certainly issues that will make adding phosphorescent blue to OLED production more complex, at least at the onset, OLED producers are so used to phosphorescent materials that they will likely adapt to required changes more quickly

So?

We note also that UDC has contracts with all major OLED producers. Some are based on a flat fee license, and some are based on a per unit royalty, and some cover only current phosphorescent (red & green) emitters. In some cases UDC will have to strike new deals for blue that follow current contract formats. While developmental OLED materials are expensive their volumes are low, but when they become commercial, they tend to be priced according to volume, so large, early adopters could have an advantage over small lower volume producers, unless their current contracts cover ‘all phosphorescent materials’. UDC will have to balance their production cost and volume tiers against their desire to encourage blue adoption, ideally setting smaller price/volume increments in the early years against the opposite in later years.

All in, blue is good, especially for those who produce it, but regardless of the headlines that are calling for a new ‘blue’ era in the display world, we expect most investors will expect too much too soon. Panel producers need to make money and if they are producing at profitable utilization levels, they are going to want to keep doing so as long as possible, putting aside any changes that might reduce volume or profitability. Most will talk the ‘blue’ talk but the implementation might be a bit less than the rhetoric. We believe the adoption of blue phosphorescent emitter material will certainly be a positive for the industry and for the consumer, but technology hype is just that whether it is AI hype, metaverse hype, or 5G hype. How consumers see ‘blue’ will be the deciding factor as it always is.

[1] Actually a combination of fluorescent blue and phosphorescent green.

RSS Feed

RSS Feed