Fun with Data – New Semiconductor Fabs

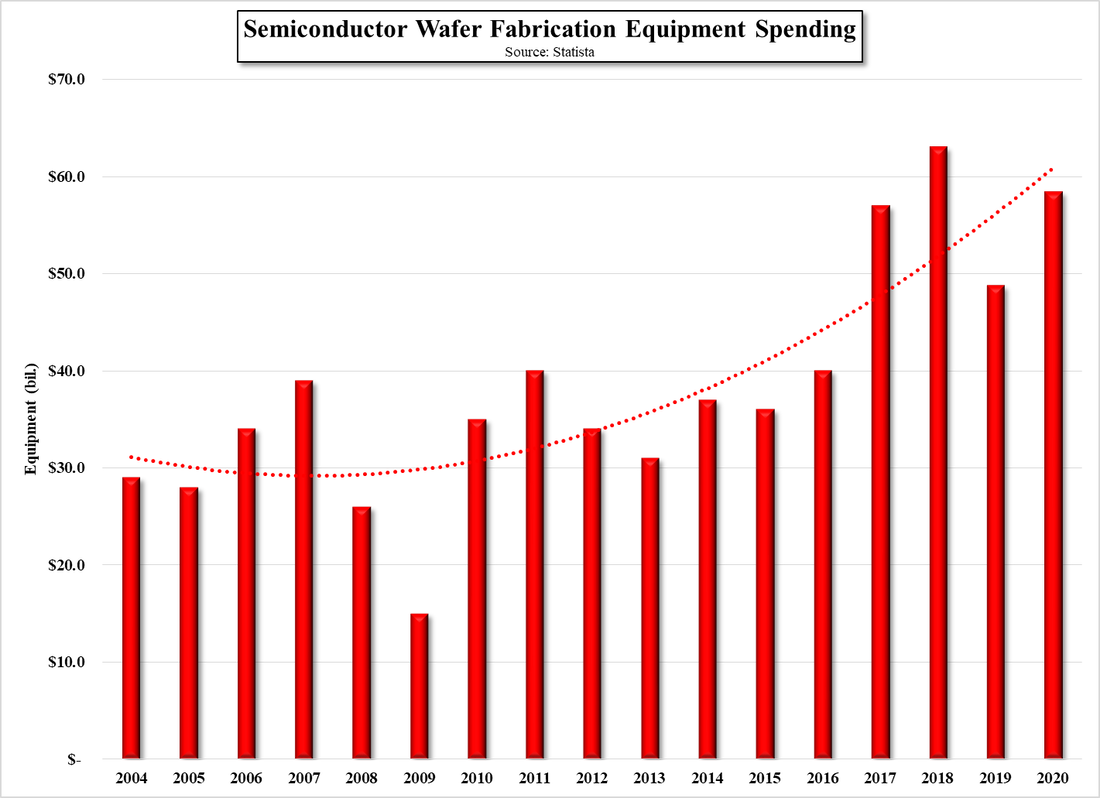

15 of the new fabs will be foundries with capacity ranging from 30,000 wpm to 200,000 wpm and 4 will be memory fabs with capacity ranging from 100,000 wpm to 400,000 (200mm equiv.) As the time frame for new fab construction is two years from groundbreaking to equipment install, even those beginning construction this year will likely not be producing until 2023, and we expect each project will have developed its own justification (automotive, telecom, etc) for the expansion. We show semiconductor fab equipment spending over the last 17 years in the chart below.

RSS Feed

RSS Feed