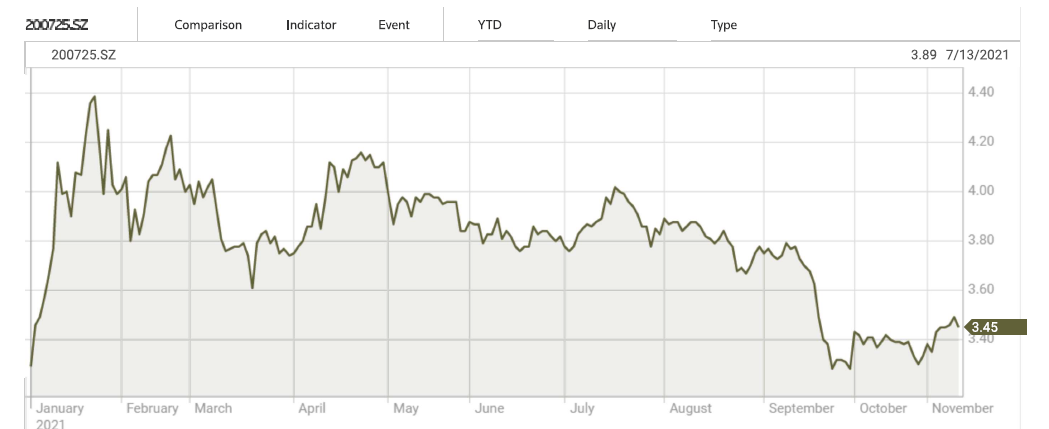

Correction – OlympicsOn 02/07/22 we noted that China’s BOE (200725.CH) was the responsible party for the massive LED display that served as the opening venue for the Winter Olympics. While we were correct to a degree, it turns out that BOE was not the only party involved in the development and construction of the display, and the other primary supplier, China’s Leyard (300296.CH) took umbrage at the assumption we, and many other made that BOE was totally responsible for the LED displays, likely given the massive BOE promotion signs placed around the stadium. As it turns out Leyard was responsible for 7,000 m2 of the 11,500 m2 stadium floor display (yellow portion in Figure 1), while BOE was responsible for 4,500 m2 (gray semicircles), and Leyard was 100% responsible for the 700m2 ‘ice cube’, 1200 m2 ‘ice waterfall’, and the two North and South Standing screens, for ~70% of the venue’s primary display area, and also provided the broadcast control system. As previously noted both companies worked under the China Aerospace Corporation (state).

0 Comments

Super Bowl Ring |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed