Notebook Who’s Who

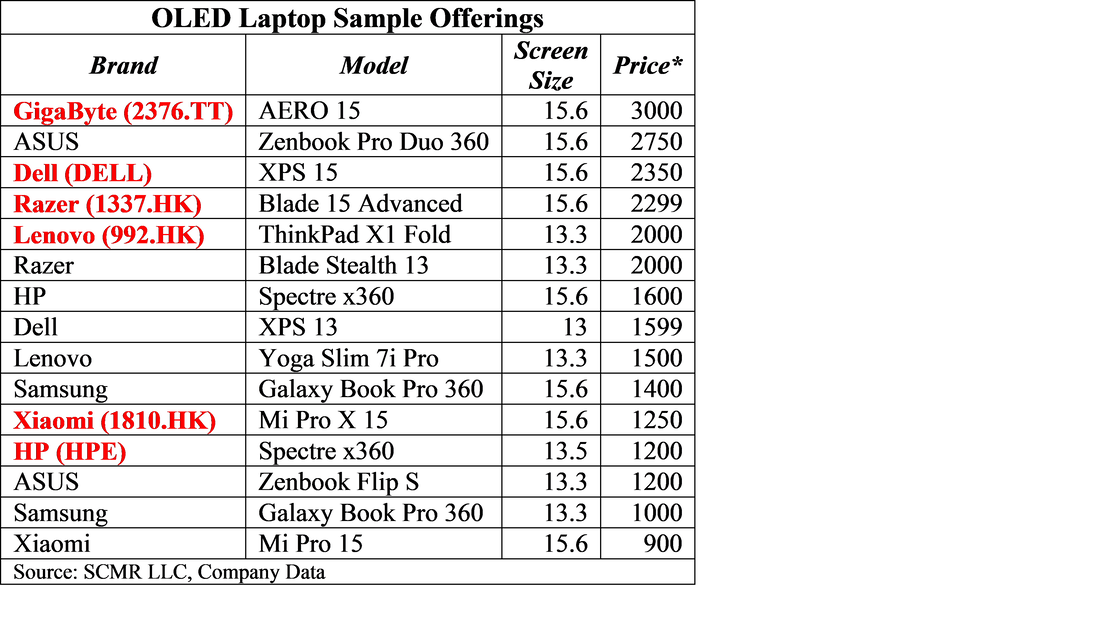

While LTPS is the most common backplane for smartphones, it has a small share of the notebook market, but one that should continue to grow. It is a simpler production process than Oxide and has a generally higher yield, but oxide has the benefit of lower power usage, which is an important feature in mobile devices, despite its higher cost. OLED is the new kid in town, as we have noted in the past, but is supported by Samsung Display (pvt) and parent Samsung Electronics (005930.KS), with Samsung targeting 4m units this year, ~11% above the projections below. Given the strength of the notebook market we would lean more toward Samsung’s projection, although based on the lower forecast (3.6m units) for this year, the projection for 2022 would imply 6.3m units, or ~75% unit growth. While Samsung Display is currently the sole supplier of OLED notebooks, China’s EverDisplay (688538.CH) is expected to begin commercial production sometime this year, although we would expect it will take some time to generate meaningful yields.

LTPS notebook displays are currently being supplied by AU Optronics, Chinastar (pvt) and Tianma (000050.CH), with AUO the dominant player and Innolux (3481.TT) expected to begin production later this year or early next year. Given the higher volumes for IGZO notebooks, there are a number of panel producers building out or converting capacity toward this modality but current leaders ate LG Display (LPL), BOE (200725.CH), Sharp (6753.JP), and Panda (600775.CH) with HKC (248.HK) and Chinastar as the potential newcomers.

Amorphous silicon based notebooks will remain the most common, and while the technology will see some share decline by the end of next year. That said, given the high volumes involved in a-Si notebooks and the infrastructure already in place, it will take a considerable amount of time to dislodge the technology from its dominant position, with Sharp and BOE offering the widest range of sizes and types.

All in over the longer-term, the high-end notebook market is the key to sustainability for panel producers, which does bode well for the newer backplane technologies, and the relatively limited number of producers gives those who were substantial producers before COVID-19 a distinct advantage, and with expectations of lower notebook shipments in 2022, the focus on those newer technologies to maintain ASP will be more intense. As gaming has grown, there has been a shift from generic notebook panel production to panels with higher specifications, for which gamers are willing to pay, while on a global basis, more simplistic Chromebooks have sated the need of many in the education market pushing less focus on the mid-priced notebook segment and more toward the upper and lower ties, allowing those newer and more expensive technologies to grow. Mini-LEDs will help to sustain all modalities other than OLED, which is self-emissive, but has just begun to build a real volume supply chain. Couple Mini-LEDs and quantum dot enhancement together in a notebook and you have a potential challenger to OLED, albeit with both being at the top end of the notebook market.

RSS Feed

RSS Feed