Universal Display – Big Beat – Eyes Open

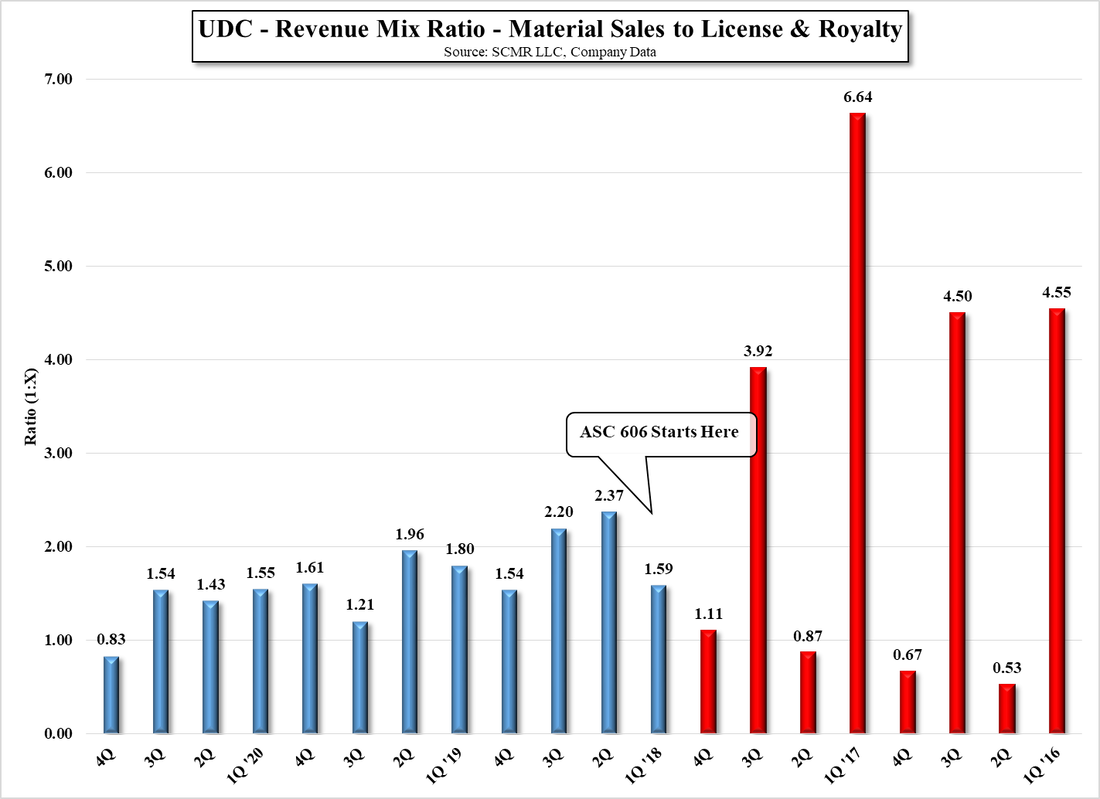

Before we go further, we believe it is worth deconstructing the UDC numbers a bit to get a better idea of how the company worked through 4Q and what was an unusual year. Since accounting rule ASC 606 was put into effect in 2018, rather than book license and royalty revenue when it is received, companies must recognize license and royalty on a pro rata basis, based on material sales and estimates of the total value of the contract over its life. While this rule goes toward smoothing out license and royalty revenue that varied significantly on a quarterly basis under previous rules, it also requires companies to estimate the total contract value regularly and how price changes and sell-through progress agree with previous ASC 606 estimates. If there are material changes to contract estimate variables, the ratio between material sales and license and royalty revenue gets ‘trued up’, which was the case with UDC this quarter. Approximately $17m of additional revenue was recognized in 4Q as part of the ‘true-up’, which the company stated was based on how COVID-19 affected their business over the 2020 year.

A more visual way to see the result of this true-up is to look at the ratio between material sales and license and royalty income (Fig. 1). Before ASC 606, License & Royalty revenue was sporadic, primarily a result of Samsung Display’s (pvt) bi-annual payments, different from all other L&R agreements. Since ASC 606 (blue), the ratio has become far less volatile, averaging 1.925, 1.645, and 1.357 in 2018, 2019, and 2020, with the previous four quarters averaging 1.53. The 4Q true-up caused the rationto drop to .83, meaning the 4Q examination indicated that the L&R revenue, as measured against expected material sales over the life of the contract, was too low, and hence the $17m of additional L&R revenue booked in the quarter. If there were no true-up and the 1.53 ratio was held into 4Q, the 4Q sales would have been ~107m, slightly below consensus. That said, UDC guided to a return to a 1:1.5 ratio for this year, barring any unusual circumstances that would cause another true-up. Fig. 2 shows the actual revenue segments, along with the ratio trend line and the ratio itself (gray).

While this seems quite logical, we caution investors that if the pandemic subsides, either due to a more careful society (not likely) or increasing immunity from vaccines, there is the possibility that a return to a more ‘external’ lifestyle could reduce the demand for TV set purchases. This caveat is less of an influence for TVs however, as while North America saw overall strength in TV sales last year, less was seen in other regions, leading to the possibility that while North American TV set sales last year could have included pull-ins of this year’s TV set sales and could see slow growth under a ‘COVID-19 recovery’ scenario, China could offset that with stronger growth. In either case, we expect UDC material sales, especially those to OLED TV manufacturers, will be greater in 2H again, but there are some scenarios where the 2nd half could see more moderate growth.

UDC’s regional and key customer breakdown also gives some insight into 4Q and full year results. The regional breakdown shows that in 4Q sales to the company’s Korean customers increased markedly, with both Samsung Display and LG Display seeing increased sales. We note that the $17m true-up mentioned above is embedded in the overall sales number and likely weighted toward at least one if not both South Korean customers, so 4Q in Fig. 7 might be a bit exaggerated and less reflective of absolute material sales to those customers. China sales on an overall basis were down a bit in 4Q, but the drop in sales to BOE (200725.CH) (down 63% q/q and 67.8% y/y), while not totally out of the ordinary, was a bit disconcerting, although the $6.4m q/q drop in sales to BOE was offset by an increase in sales to other Chinese customers of ~$3m, the net effect, a $3.5m drop in overall China sales in 4Q. While it is always concerning to see negative q/q growth in a top customer, variations in ordering patterns, especially from Chinese customers are commonplace and would only become a real concern if they extend for two or more quarters. That said, as a supplier to Huawei (pvt), we expect it could take BOE a bit to fill the lack of Huawei volume with long-term customers.

The other point that is of concern are margins, specifically material margins. UDC has indicated that it expects material margins to be in the range of 65% to 70% for the 2021 year. This is lower than the previous year’s expectations of 70% to 75% for material margins, and while overall company GM’s will still be ~80%, we believe the cost of some of the materials used in the formulation of UDC’s products have been rising. The price of Iridium, the metal that binds UDC’s organics together, has gone from $1,670/troy oz. on December 1, 2020 to $4,400 currently, and while the amounts are small that PPG (PPG), UDC’s material supplier would use, that is a very large increase.

UDC also stated that as their customer base continues to grow, customers demand customized materials that have to be developed by UDC in relatively small quantities until qualified and accepted by the customer. These ‘developmental’ materials are expensive to produce and as the expanding customer base requires more such projects, lower material margins are a result. While this is an acceptable explanation for lower material margins, along with higher raw material costs, even with UDC’s IP lock on phosphorescent OLED emitters OLED panel producers are pressing all of their suppliers for lower prices, and we expect UDC is no exception. UDC’s customers know there are many OLED material development projects underway, with some trying to develop alternative materials that do not have license or royalty fees attached, so we suspect there is also some material pricing pressure across the industry that could also lower UDC’s material margins in 2021. We also note that based on what we know of UDC’s pricing scale, as their customers grow their OLED material capacity and consequently their OLED material consumption, it takes less time for customers to reach price reduction goals, and while the volume is certainly the most important part of that equation, it also means less time at the higher price points.

While we always have our concerns about some of the blind sighted optimism the display industry and some investors have toward OLED (the segment and the company), our concerns are, at least currently, overridden by the overall growth in the OLED space, which is fueled by greater penetration in existing display markets and expanding capacity, both of which tend to override the nuances we mention each quarter. All in it was a good quarter for UDC and we expect the overall picture for OLED to continue to improve throughout the year, but we also note that technologies are shuffled around mare aggressively each year and every investor should keep their eyes wide open.

RSS Feed

RSS Feed