Universal Display – Erratic Behavior?

The stock has not done well this year, down 19.7% based on yesterday’s closing price, and will likely see additional pressure today, in a year where OLED displays have seen continued adoption and penetration into new markets. We do not look at UDC from the standpoint of relative value but from the company’s ability to generate sustainable growth, which gives us a bit of a different perspective than those looking to capitalize on short-term trends. This ‘bigger picture’ does encompass considerable variability in quarterly results, both to the upside and downside, and the stock is certainly not for those looking for price stability, but we see our objective as presenting UDC’s prospects, good and bad, giving investors the ability to see if the sum of those factors are suitable for their goals.

UDC’s business is selling OLED materials, which includes green and red phosphorescent emitters, including a yellow/green that is used in OLED TV panels. Their customers are those panel producers that have commercial OLED display fabs and to a lesser degree companies or institutions that are involved in OLED R&D projects or pilot production lines. The company’s top 4 customers have made up between 65% and 99% of the company sales, with that number averaging 87% over the last 8 quarters. This is even more concentrated when looking at the top two customers who together averaged 71% of sales over the same period.

This concentration, and the fact that UDC is really a JIT material supplier lead to the sales volatility that is part of UDC’s nature. Over the long-term this will lessen, but both Samsung Display (pvt) and LG Display (LPL), UDC’s two largest customers will likely continue to expand OLED production at a rapid pace with producers outside of South Korea also building capacity but implementing production at a slower pace. BOE (200725.CH), UDC’s 3rd largest customer, has been the most aggressive of the Chinese OLED producers and will see increased unit volumes in 2022 and 2023 as it joins Apple’s (AAPL) OLED supply chain, but on a raw OLED capacity basis lags considerably behind both SDC and LGD. While utilization rates at each OLED producer is another factor in determining their need for OLED materials, raw capacity would represent the best case scenario.

We see raw OLED capacity growth between 2021 and 2025 with a CAGR of 13.2%, however aside from the gross capacity and fab utilization rate, panel producers change the mix and proportions of the emitter materials in their displays. While the cost reduction objective is always there, OLED displays are promoted as having superior display characteristics as to display quality, and we believe that maintaining or improving that quality takes precedence over emitter material cost., so while the fear that panel producers will continue to find ways to reduce the amount of emitter material used per m2, we see other factors as more important, and look at emitter material sales on a longer-term basis. We show both absolute and smoothed (6 quarter average) for both green and red emitter materials below.

UDC’s green emitter has a dual function. It is part of the OLED stack in the abovementioned RGB devices but is also used, in a modified form, as the basis for most OLED TV displays, which are produced exclusively by LG Display. Again the unit volumes are far smaller than for smartphones, roughly 8m units will be produced this year, but using a weighted average, the surface area of an OLED TV would be the equivalent of 93 smartphones, which, at 8m units this year, would be the equivalent of 745m smartphones, equal to roughly a 50% share equivalent. Next year LGD is expecting to produce 10m units as it expands its large panel OLED capacity in China, which would represent a 20% surface area increase in yellow/green OLED material, aside from increases in other RGB product categories for green emitter material.

While panel producers evaluate emitter needs on a longer-term basis when planning, the production of OLED displays, both large and small, is full of timing variables, and those variables make predicting UDCs material sales on a short-term basis a very hit or miss proposition, however even with the caveat of higher efficiency OLED production processes, the long-term growth of UDC’s phosphorescent emitter business is tied to capacity, which itself is tied to OLED applications. As older applications see continued higher penetration rates, new applications bring a need for new capacity and that drives emitter material sales and therefore license and royalty recognition. While OLED penetration in the smartphone space will slow on a percentage basis, small penetration rate increases in notebooks and TVs will have a disproportionally larger effect on OLED surface area, which will demand more OLED emitter material, and while competition from existing LCD technologies will remain, we expect OLED technology will continue to grow for the next few years. As the de facto supplier of phosphorescent emitter materials UDC would be the primary benefactor from that growth.

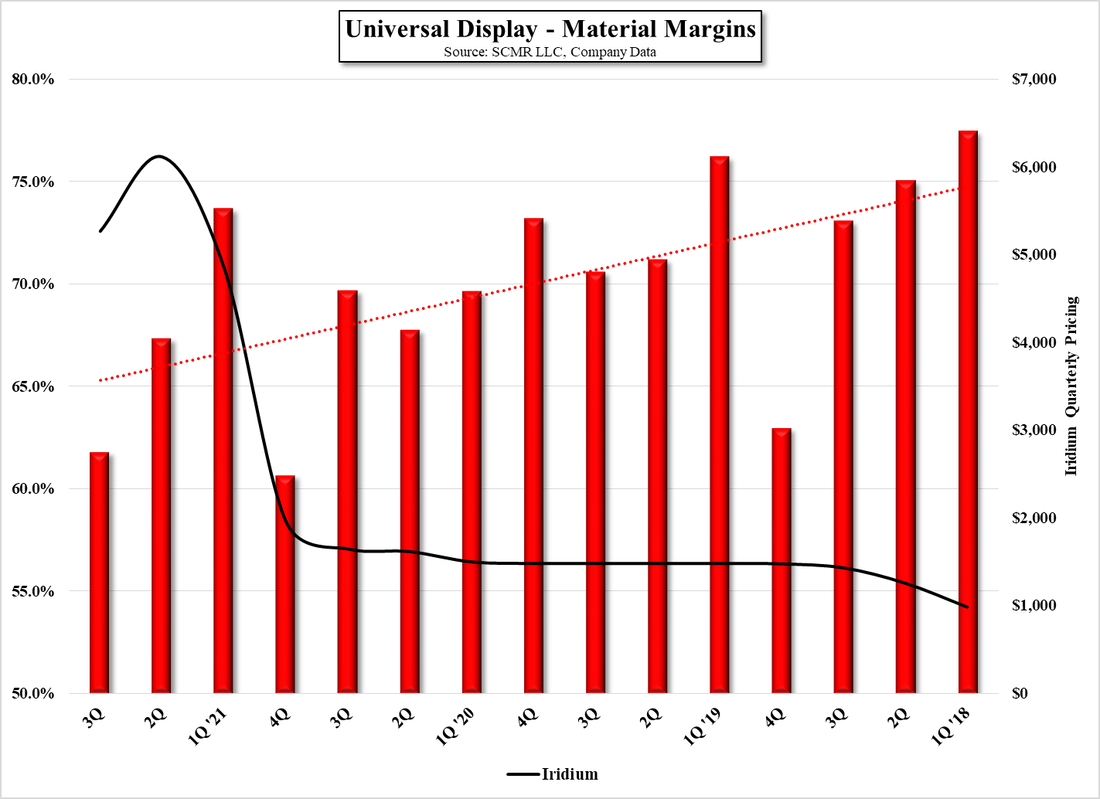

That’s the good news, despite the current investor disappointment with 3Q results, but there are points that can weigh on what looks to be a period of continuing OLED penetration in the display space. One such issue is margins, particularly material margins, which seem to counterbalance investor enthusiasm toward UDC’s growth prospects. On a quarterly basis, customer product mix plays into quarterly material margin variations, and that is a variable that cannot be easily quantified without internal customer data, but there are other considerations that come into play with material margins that we explore further below.

UDC bases its OLED emitter material pricing on a schedule based on volume, with price reductions triggered by meeting predetermined volume levels until a ‘terminal’ volume is reached when the price remains. Should UDC present a new emitter material to a customer that is adopted, the price of that material returns to its initial value and follows the same volume reductions as its predecessor. This makes it incumbent on UDC to continue to develop new and better emitter materials to bring individual customer emitter prices up and counteract any material efficiency improvement that OLED producers might derive but also adds to sales lumpiness as new emitter material adoption at OLED producers is an on-going process which does not always occur across all products or fabs, which can delay or obfuscate the price improvement until the producer fully adopts the new emitter material.

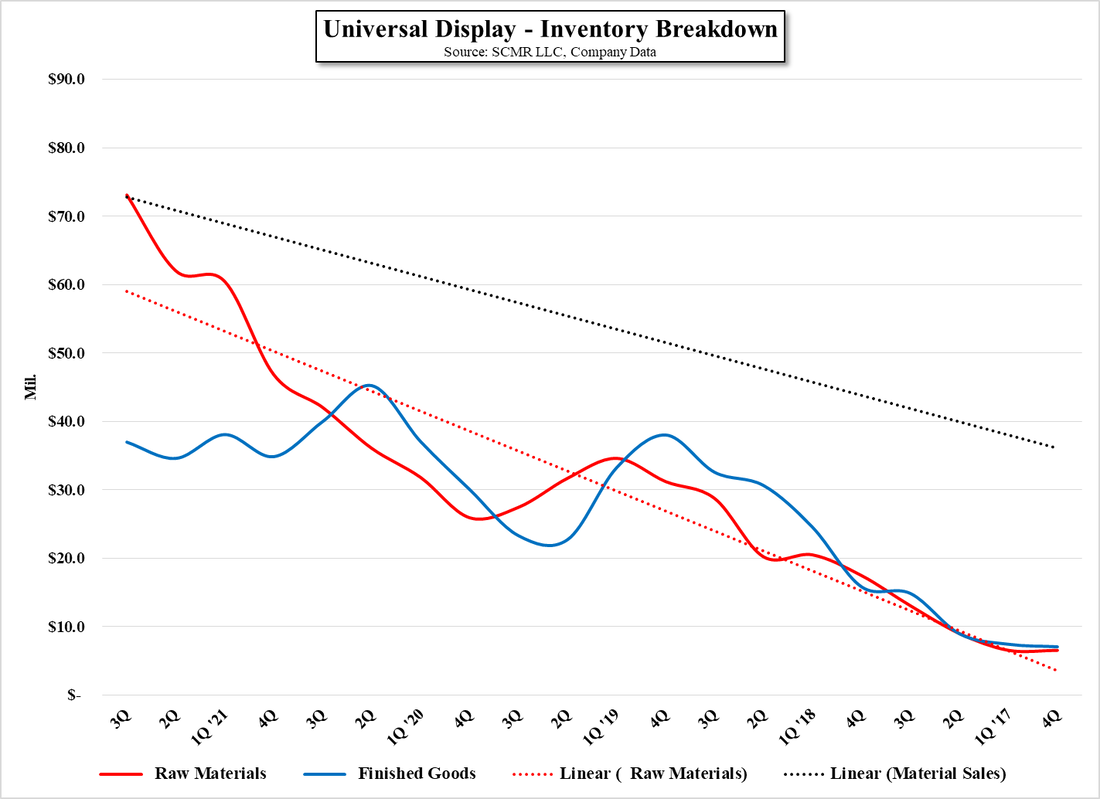

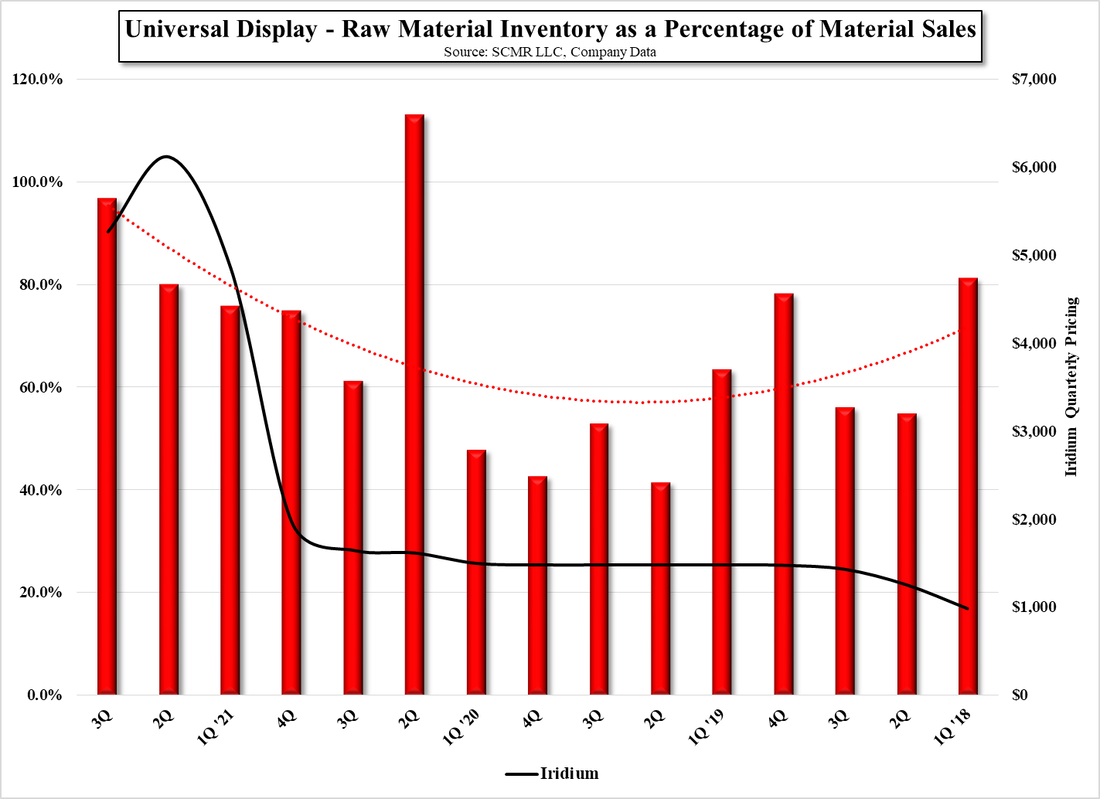

This method of pricing is good for both parties as it pushes UDC toward new emitter material development that improves OLED display quality, but it does have its downside and that is that such fixed volume price points do not allow UDC to renegotiate existing material pricing if raw material costs change, and with the heavy metal component of most phosphorescent emitter being Iridium, UDC has had to absorb the increase in Iridium prices seen this year. As UDC has been a longtime buyer of Iridium, they are sensitive and quite aware of the unusual pricing seen in Fig. 2 and Fig. 3, but have little choice but to purchase needed stock despite the higher cost, which is reflected in Fig. 5 which relates raw material inventory to material sales and depresses material margins (Fig. 6), as UDC is locked into a contractual price for the current set of emitters. If we understand the emitter pricing structure at UDC correctly, if raw material prices remain high, new materials will be able to pass those increases on to customers, something existing material pricing does not allow, so material margins would improve over the longer-term, even at the higher material cost.

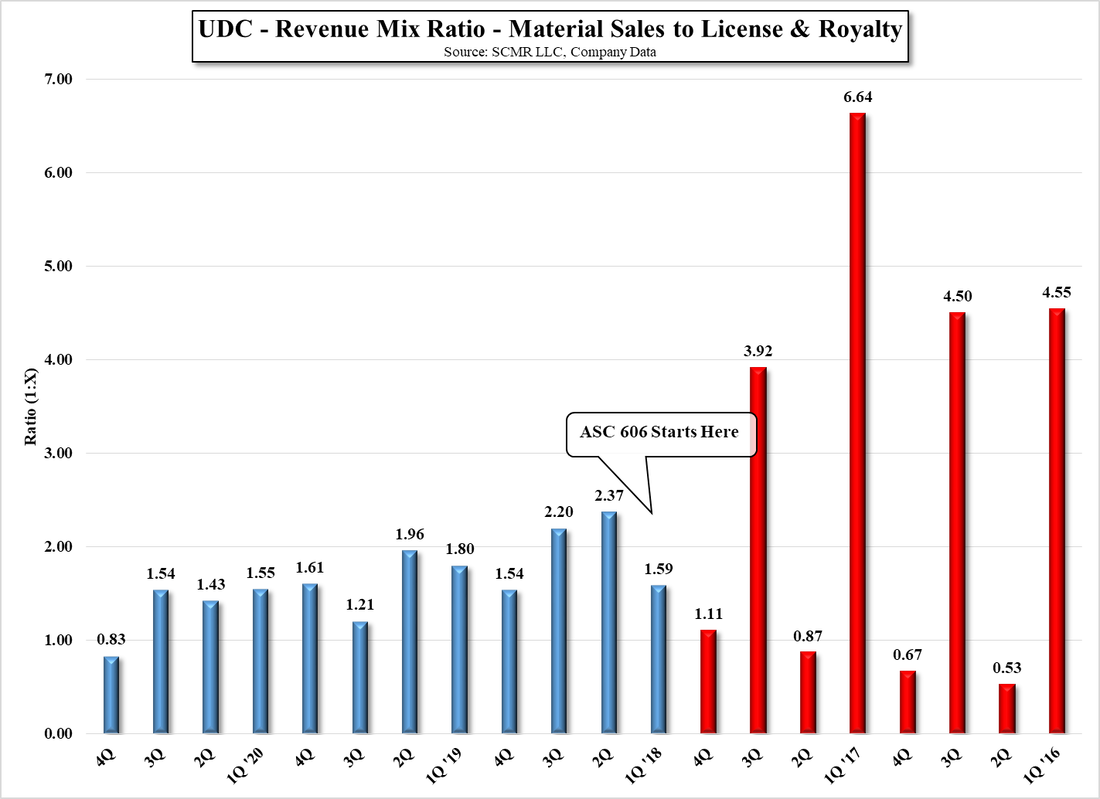

In a situation where a customer purchased considerable emitter stock in a previous quarter and used that stock to produce a large incremental unit volume in the current quarter, the increased royalty license revenue recognition would be tied to lesser material sales in the current quarter and would not give a true impression of the incremental royalty generated by increased unit volumes. Again this leads us to looking at all of UDC’s metrics on a longer-term basis and to suppress the desire to predict material sales and license/royalty on a short-term basis. Of course there will be issues that could affect even the longer-term metrics, but trying to predict the month to month material order patterns of three or four OLED producers is not only an impossible task but one that will inevitably miss the bigger picture. To us, knowing what to look at on a long-term basis is the key to understanding UDC’s business and how it will grow in the future.

RSS Feed

RSS Feed