2021 Demand Scenarios

Some were obliged to make predictions last year, only to change them a number of times as the variables shifted, which seems a bit counterintuitive, and we expect the same sources will do the same this year, despite the ‘unlevel’ playing field we are still on. We prefer to do something different, creating a number of scenarios that represent possible outcomes for the CE space and letting investors decide which looks most like their world view, since that what they would do with a single estimate regardless. By presenting and explaining each scenario, we believe investors can see how each progresses and the outcome of each and providing a away for us to update each scenario as the year progresses with actual data.

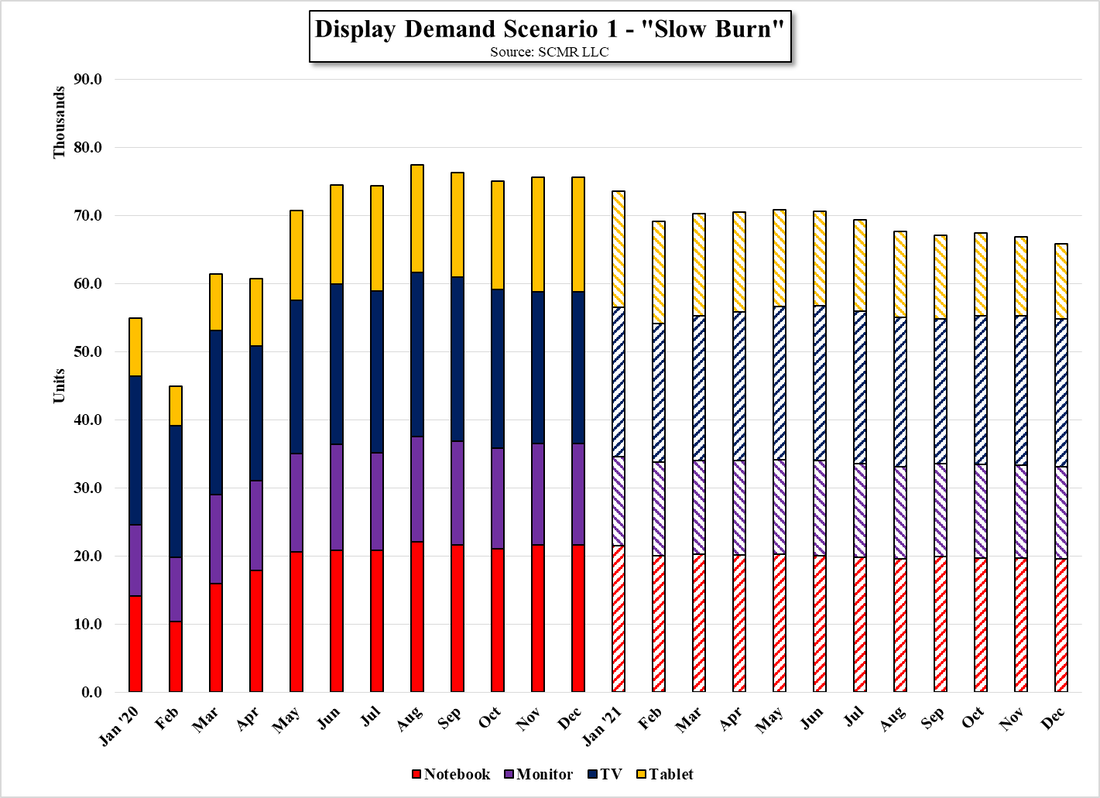

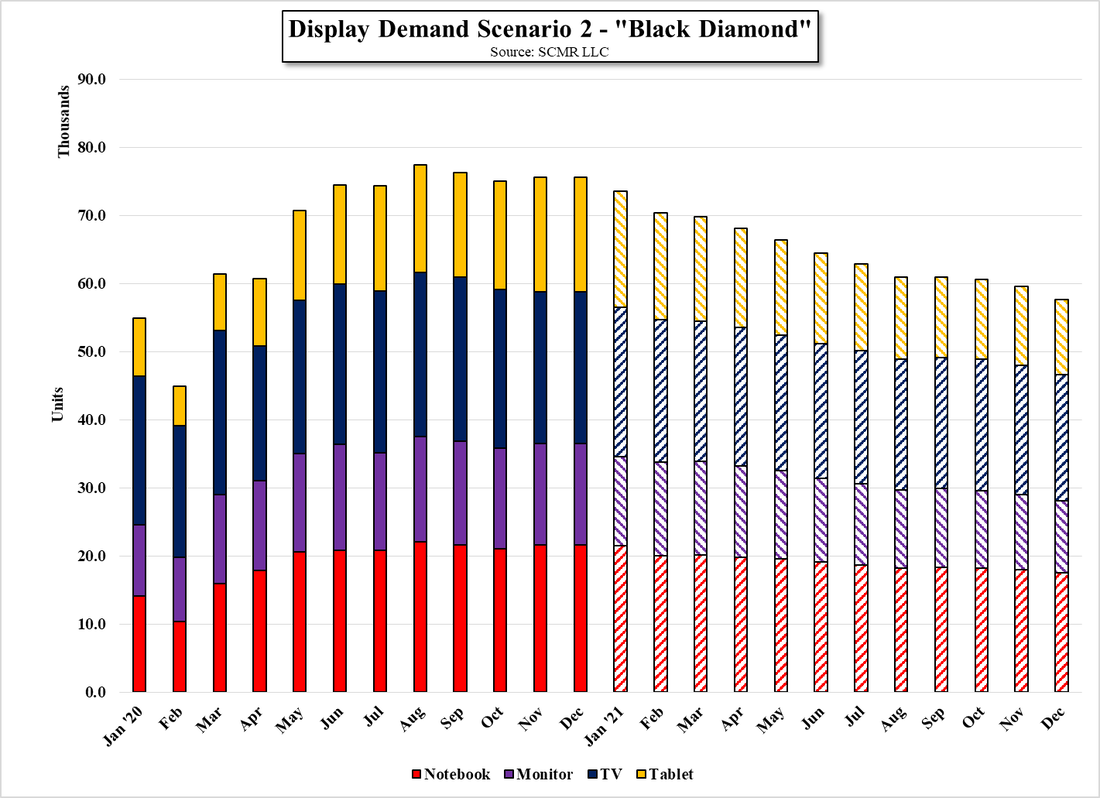

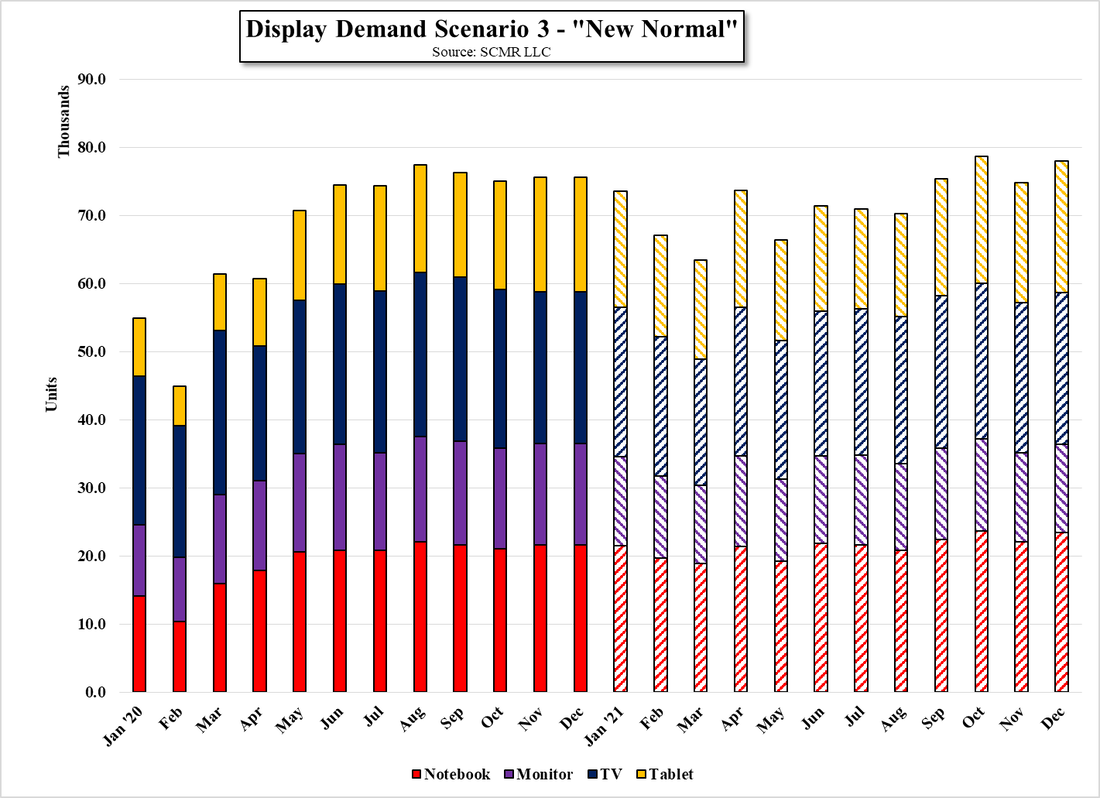

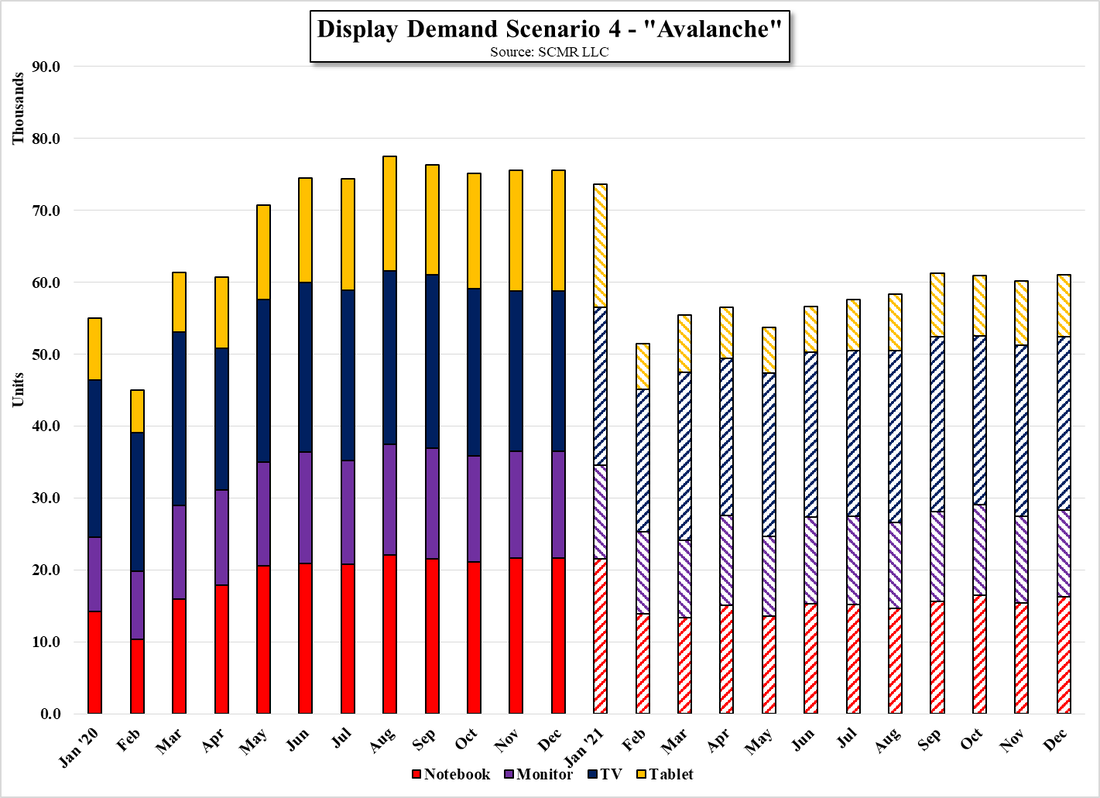

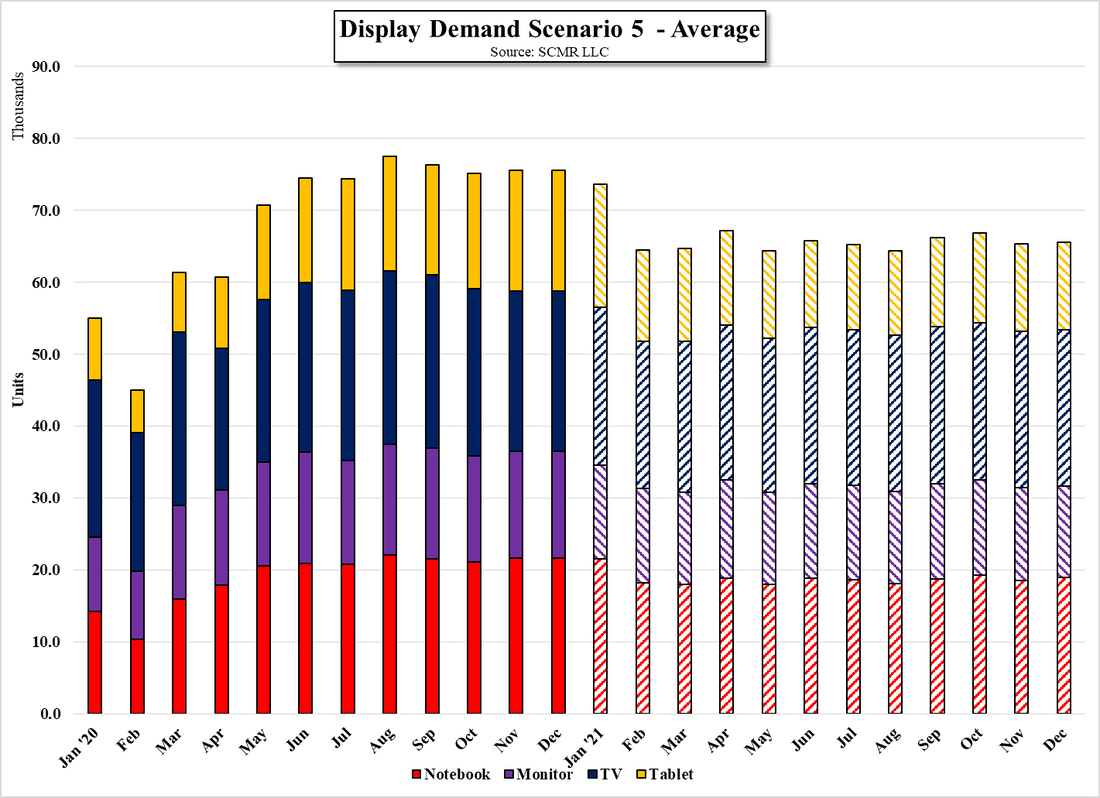

Each scenario is based on four device categories, notebooks, monitors, and tablet, which make up much of the CE space other than smartphones and wearables. The scenarios estimate monthly and quarterly display panel unit volume for each category along with 2020 data, which will be the same for all and a reference point. Each scenario tracks the monthly progress of panel demand based on that particular set-up and we summarize the data for each at the end.

Scenario 1 – “Slow Burn”

- COVID-19 weakens a bit early in the year but remains a part of the global landscape throughout 2021.

- Notebook demand weakens slightly early in the year but remains strong as work-at-home remains active as an alternative to crowded offices and forced transportation.

- Based on the above, monitor demand weakens slightly as office demand does not improve.

- TV demand weakens as students return to physical classes in the Spring.

- Tablet demand continues to rise as an alternative to more expensive notebook purchases, leading to an overall gain in panel demand of 0.9%.

- COVID-19 weakens slowly throughout 2021, leading to a strong 1H (y/y) and a weak 2H.

- Notebook demand is strong in 1H but weakens considerably in 2H.

- Monitor demand is up a bit in 1H but down considerably in 2H as 2020 demand has pulled in much of 2021 2H demand.

- TV demand weakens in both halves as less stay-at-home means less need to replace or upgrade TVs

- Tablet demand is strong in 1H but turns negative as COVID-19 wans.

- COVID-19 variants present a significant challenge to vaccines and short-lived return to normalcy is replaced with travel and socialization restrictions

- Notebook demand grows rapidly in 1H but slows in 2H as pent-up demand is satified.

- Monitor demand weakens as prices continue to rise

- TV demand also weakens as panel price increases begin to slow demand.

- Tablet demand is unusually strong in 1H as alternative to tight notebook market.

- COVID-19 weakens quickly as vaccines prove effective.

- Notebook demand weakens, especially in 2H as the necessity for work-at-home and remote learning ends.

- Monitor demand weakens as previously purchased notebooks replace monitors in office situations.

- TV demand increases as TV panel prices decline and sets become more attractive

- Overbought tablet market sees large volume decreases as necessity ends.

While this is not a scenario in itself, as it does not have specific parameters, we thought it helpful to take an average of all four scenarios to see what that looks like on its own.

RSS Feed

RSS Feed