5G Data Point

Recent data for Chinese domestic smartphone SoC (System on Chip) brands seems to indicate that the overall weakness is continuing into April. The top 3 SoC brands in China represent ~94.2% of the total, so the extreme y/y weakness at HiSilicon (pvt), an affiliate of Huawei (pvt) that remains under US trade sanctions, and the large y/y increase at UNISOC (000938.CH) have relatively little impact on the metrics. While SoCs are used in many applications, the data here is specific to smartphones, which would point directly to production levels and indicate another weak month for Chinese smartphone production in April. While we expect this could produce another weak month for Chinese 5G smartphone shipments, we expect the 5G market in China to be the only real growth driver this year, even if growth is more moderate.

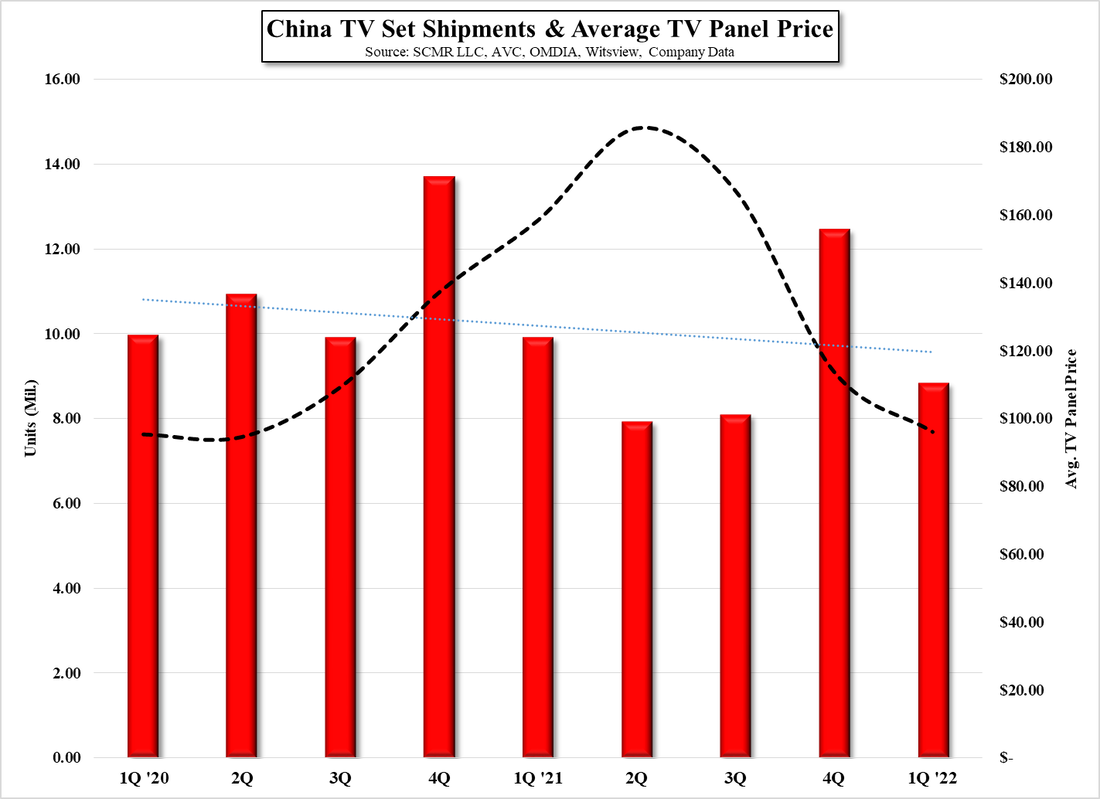

With a number of global smartphone brands reducing earlier optimistic shipment targets, it is no surprise that the weakness in the global smartphone market continues, with the hope that Chinese brands follow through on target reductions and start working down inventory levels. Hopefully Chinese small panel display producers will lower utilization rates in keeping with the reduced demand and also lower inventory levels, but that has not been the case with Chinese large panel LCD display producers, who maintain high inventory levels and have made only token production reductions. It is hard to imagine what more Chinese panel producers must see to ‘encourage’ them to take more realistic steps toward reducing inventory, but we expect the fear of not being able to maintain share if the market rebounds in 2H is a major factor in their reticence.

RSS Feed

RSS Feed