5G Ecosystem – February & More

Over the last three months, while primary indicators are still well above trend line, as they have been since July of last year, they have begun to level off a bit. Again as the seasonal data is still relatively small, it is difficult to tell whether this is a global trend, a Chinese trend, or just a more typical seasonal trend as 5G matures, however while global seasonality should pick up in 2Q, Chinese 5G seasonality should see a more significant bounce in March and April data if the seasonal data is an indication, so we should be able to get a better picture for 5G trends over the next 60 days.

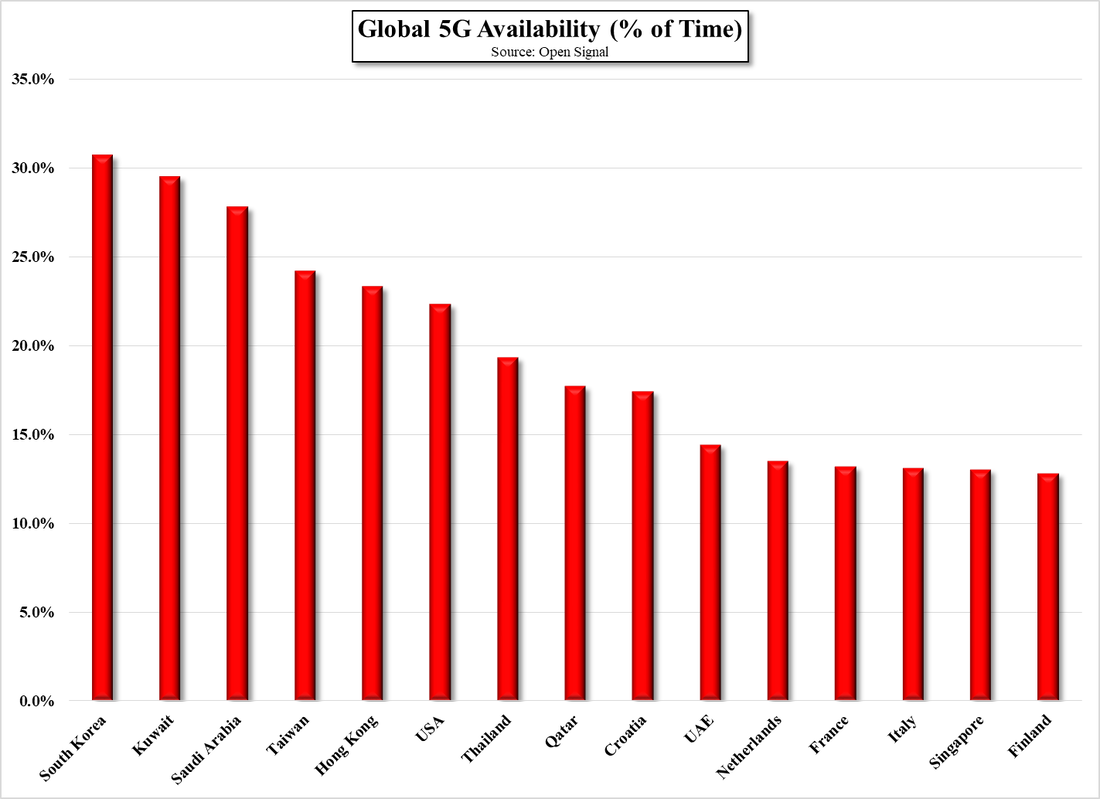

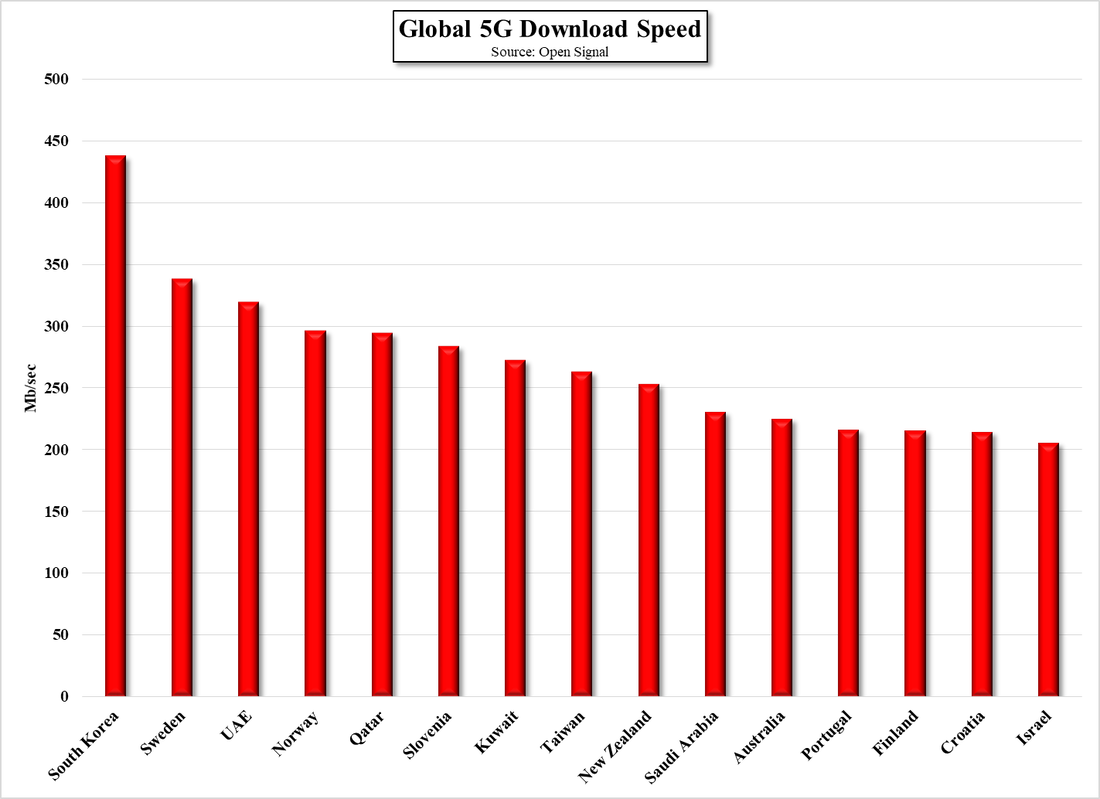

As 5G continues to expand its global footprint, we look at a number of factors that give some understanding as to how prevalent the technology has become around the globe. In Figure 5 we show the countries where 5G is commonly available and a combination of both the amount of time 5G is available (Figure 6) and the download speed (Figure 7), which is called the ‘5G experience’. South Korea, while they are almost exclusively sub6 (low and mid 5G bands) has the highest download speeds by quite a bit, and makes 5G available to a large part of the population on mobile networks, meaning as you roam, the 5G signal remains rather than dropping back to 4G. We do note that while the US ranks 4th in 5G availability, we do not know how the statistics from Open Signal take into consideration the area of the country, so we are cautious about using that particular data set as a basis for understanding deployment across the globe. That said, given that China has considerably more 5G base stations than any other country but does not show in Figure 5, we assume that area or population is considered in some way.

Download speed however is not conditional on area or population but on the spectrum used and equipment and in most cases is focused only on 5G low and mid band spectrum (sub-6 – in red). While the table below does not show 5G connection speed, the rule of thumb is that the potential connection speed increases with the frequency range but the transmission distance decreases as frequency increases, so for those carriers interested in coverage, the tendency is for using the lower 5G bands, allowing for less base station, while those looking for speed would emphasize the higher bands, although the number of base stations would increase. Each carrier in the US and other countries took an initial stance as to what kind of customer they were initially interested in attracting in the early days of 5G but most have migrated toward mid-range frequencies as the provide a mix of higher speeds and extended coverage. This makes some of the country speed statistics a bit less valid as a carrier using a lower 5G band would be able to gain coverage albeit at a slower speed, however as even the low band 5G speeds tend to be higher than 4G, and the incremental cost to consumers is low in most instances, carriers only need to meet customer expectations, which in the residential/mobile world are relatively low.

RSS Feed

RSS Feed