5G – mmWave Details

Most 5G carriers have focused their attention on the mid-band spectrum (3.3Ghz – 3.8Ghz) as it offers a reasonable balance of coverage and speed, but both low bands and high bands will become essential to building out real 5G networks over the next few years. MmWave (high band) can offer vast amounts of spectrum, high speed and low latency in locations where coverage is not an issue, while the low bands, with wide coverage, would be most effective for areas where populations are sparse, so we expect carriers to work toward diversifying their networks according to need, but to fully exploit the benefits of 5G, mmWave would provide the best possible performance experience.

That said, mmWave does have some issues that have not been faced by carriers previously. mmWave signals travel relatively short distances and are easily blocked by simple physical structures, trees, and even glass and wood. This makes mmWave less than ideal for carriers looking to cover as many new users as possible, but there are also a number of positive that make mmWave a longer-term solution for 5G. As 5G traffic increases, low-band and mid-band spectrum will become crowded, and those looking for high speed applications will find that they might not be getting the performance originally intended for those frequency bands.

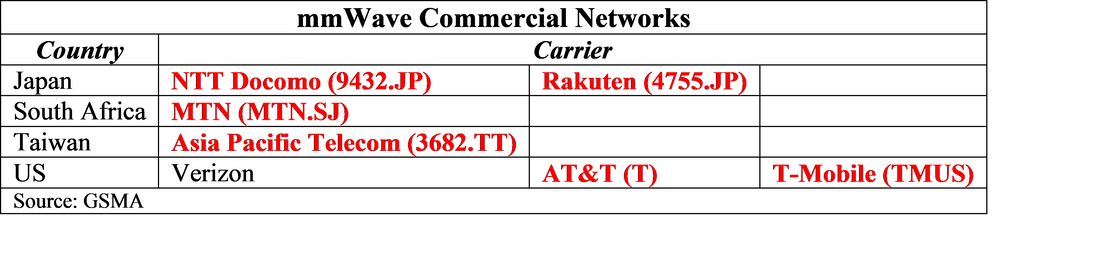

Because mmWave has such a broad spectrum, it will become the place where such applications will migrate over time if they need the peak speed, lowest latency, and more efficient network usage, but from the carrier perspective, building out mmWave must be cost effective or there is no reason to focus on that band. In the US, Verizon (VZ) has been a mmWave champion, looking to attract commercial customers to the service rather than the more typical mobile customers, but in order to maintain coverage, has also expanded its mid-band offerings, while most other US carriers have gone in the opposite direction, starting with low or mid-band, and moving slowly into mmWave.

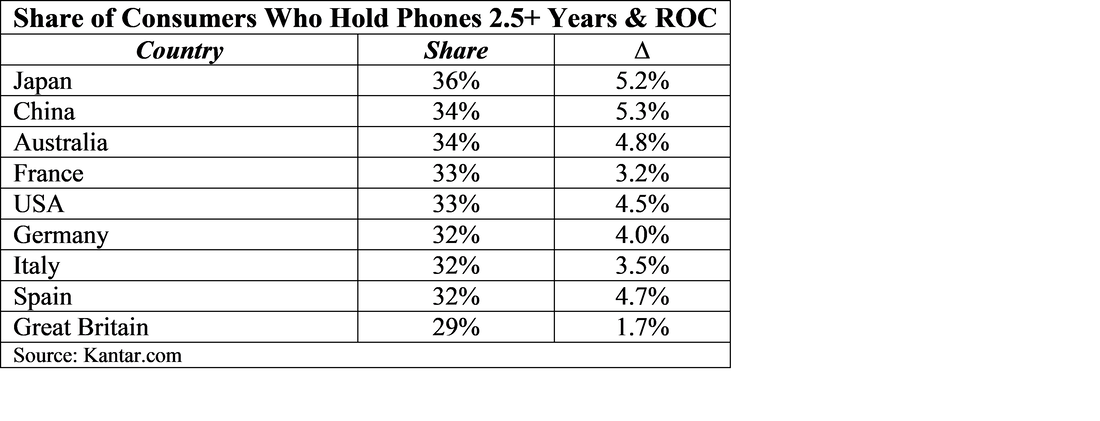

On a global basis, according to GSM, as of 3Q 2020, new 5G spectrum had been assigned in 35 markets between 121 operators, with 27.6% in the low band, 52.3% in the mid-band, and 20.1% in the high band (mmWave),, with the US leading the global market in the use of mmWave. The US FCC made that spectrum available to carriers earlier than most countries (1/1/2019) and has promoted its use, while China, with its vast area and user base, has been focused on mid-band. That said, China is currently conducting trials for mmWave so it will be able to demonstrate it high band capabilities by the February 2022 start of the Winter Olympics to be held in Beijing.

Europe however has seen only two countries that have assigned mmWave spectrum with neither offering commercial mmWave service yet, but at least EU members are working toward developing a common set of technical conditions for mmWave to make it easily compatible across the region. Among ideas for consideration are exempting small cell antennas from planning permission requirements in order to speed up deployment. While Europe lags in mmWave commercial deployment, there are seven carriers that have launched commercial mmWave networks.

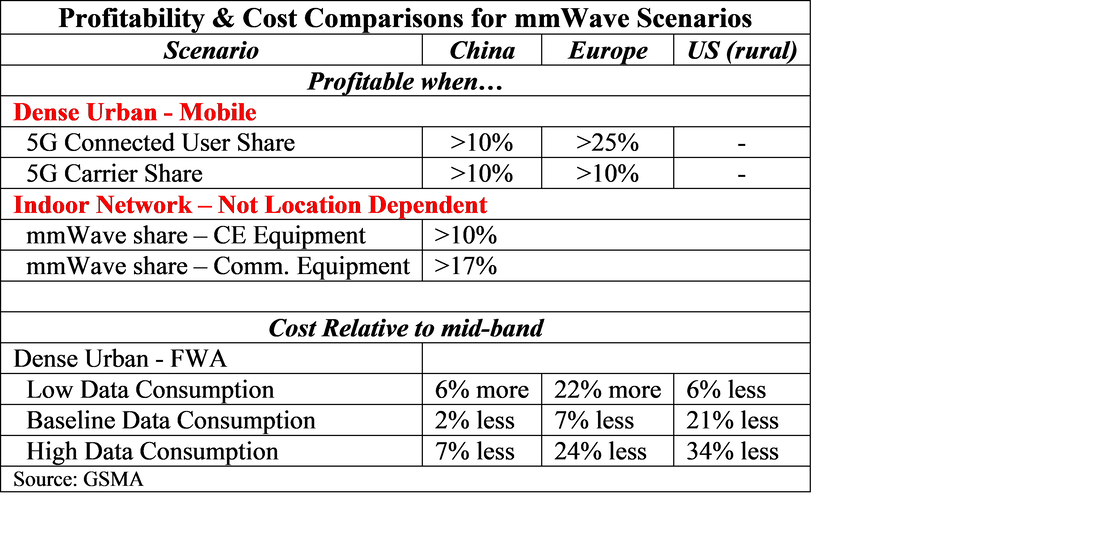

According to the GSMA, in a dense urban environment, with mmWave overlaid on a mid-band 5G network, mmWave becomes profitable in China when the 5G user share exceeds 10% and the carriers 5G share also exceeds 10%, while in Europe user share must exceed 25% for the network to be profitable. The difference between the two locations is in China estimated traffic density is higher as is the population density, along with expectations of higher bandwidth in China. This would indicate that using mmWave in conjunction with mid-band 5G in China would become profitable as soon as the mmWave band is made available to carriers, while in Europe profitability would be more dependent on maintaining high outdoor mobile traffic rates.

In the category of FWA (Fixed Wireless Access), where businesses or residences have an antenna that receives the mmWave 5G signal and brings it indoors to avoid signal blockage issues, much of the cost analysis of mmWave is based on data rates, and while 5G penetration rates needed in such a rural scenario would have to be at least 18% by 2025 under the low data rate scenario, even higher relative cost savings (~70%) could be calculated if penetration rates reached 50%, according to the data.

Understandably, the data provided by GSMA might be a bit biased toward the positive given the organization is an advocate for the industry, however the increasing level of data traffic forecasted over the next 5 years (3.6x the 2020 rate on a monthly basis) could push carriers to look for ways to keep from facing network bottlenecks during periods of peak demand, with mmWave as a viable overlay on a mid-band network. We are less sure as to using mmWave in a rural environment because of the higher cost and lower coverage density required, but if the world really becomes as interconnected as some predict, mmWave would be a viable alternative in almost any situation eventually.

RSS Feed

RSS Feed