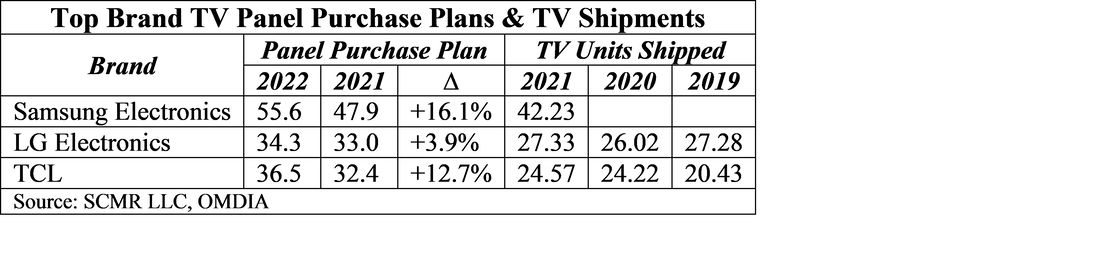

Aggressive Goals for TV Brands

Samsung Electronics (005930.KS) is the most aggressive in its panel purchase expectations for this year, up 16.1% over last year’s purchase estimate and up 31.6% over last year’s estimated TV shipments, while TCL’s panel purchase plans are up 12.7% over last year’s plan and up 48.6% over last year’s TV shipments. LG Electronics is only expecting to increase TV panel purchases this year by 3.9%, which would be an increase of 25.5% over last year’s TV set shipments.

LG Electronics (066590.KS) seems to be taking a different tact toward TV set sales this year, which is reflected in its panel ordering plans. LGE is concentrating more on profitability than volumes by focusing more on the premium TV set segment and less on generic TV models. It is expected that they will be purchasing ~5m premium TV panels consisting of ~1m Mini-LED TV panels (up from .9m) and 4m quantum dot panels (up from 3m), increasing their focus on the premium LCD segment and also increasing their purchase of OLED TV panels that also contribute to the premium TV product tier.

The change in focus by LGE leaves room for China’s TCL (000100.CH) to push forward and potentially become the 2nd largest TV set brands globally. While this would certainly be headline producing, especially in China, while units are commendable, sales leadership and profitability are more so and TCL’s emphasis on undercutting both competitors on price will be a challenge should LGE be successful in building its premium TV business further. That said, TCL will also increase its LCD TV panel purchases from affiliate Chinastar (pvt) from 18.4m units last year to 22.5m units this year, a portion of which will come from the LCD fab it purchased from Samsung Display in 2020 for $1.08b (Samsung used some of the capital to buy a 12.3% stake in TCL at the time). In theory this should help TCL to be competitive as it uses more of its own capacity to fill its panel needs.

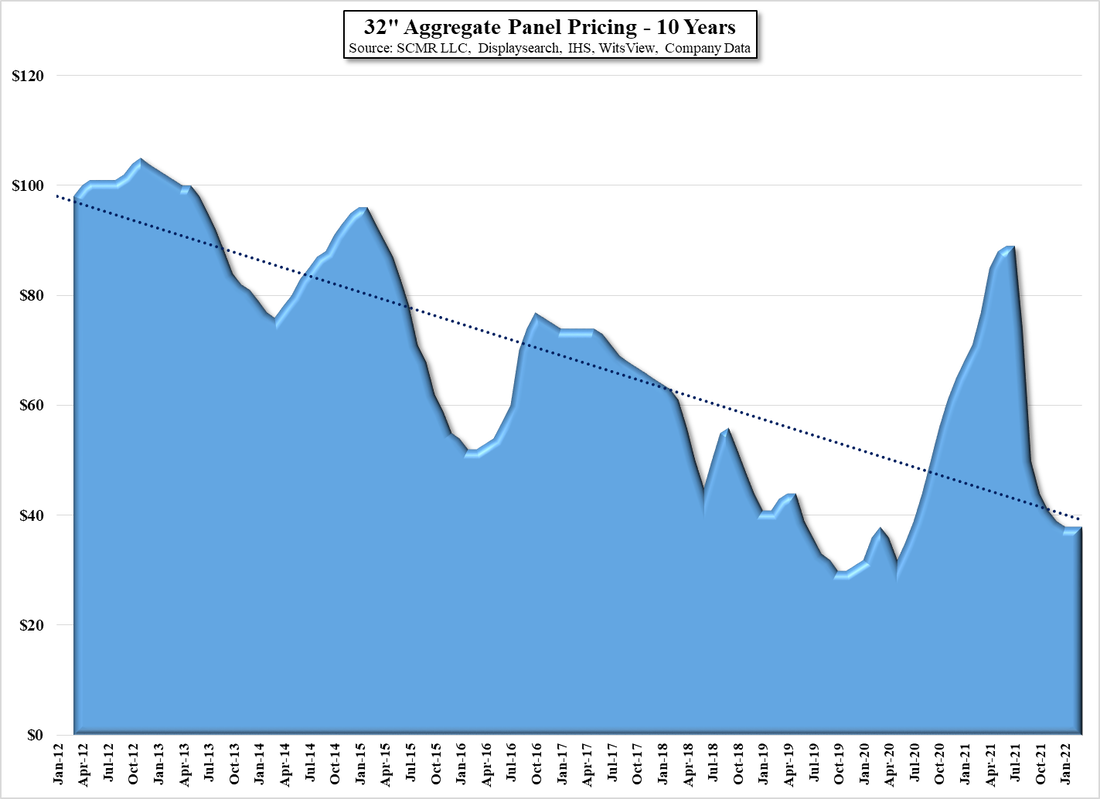

While all three TV set brands roll the dice each year in reference to panel prices, Samsung has the most leverage, in both directions. When Samsung Display was a major LCD TV panel supplier, positive panel price movements caused SDC to see higher utilization rates and become more profitable, while Samsung’s TV business struggled with weaker demand and an inability to completely pass on those higher prices. When panel prices declined, SDC saw low profitability while Samsung’s TV business saw stronger demand. While that balance was never perfect, it no longer exists for the LCD TV category at Samsung as SDC will be out of the LCD TV panel business entirely this year, meaning Samsung will be buying almost all of its TV panels from outside panel producers. If TV panel prices rise, TV set sales will weaken but will have less impact on SDC, with small panel OLED displays being their primary product, while Samsung’s TV segment will see lower profitability, however if TV panel prices remain low or weaken, Samsung’s TV segment should see better shipments without the negative offset of weakness at SDC.

Again, no scenario is perfect but it seems that Samsung has made the bet that overall it can do better by purchasing LCD TV panels in the open market than it can by producing them itself, which would indicate that Samsung’s long-term picture for LCD TV panel prices is down, while TCL seems to be going in the opposite direction by increasing its own panel production capabilities. There is validity in both theories, although we favor the Samsung scenario a bit more when looking at the 10 year price chart for 32” TV panels, which represent ‘generic’ TV sets, but the bigger question is whether the panel procurement goals set by these major TV set manufacturers are realistic or will be subject to change during the year.

We are perhaps a bit less optimistic about how the TV set space will play out than the three brands, but we also have no vested interest in the actual results, other than from an intellectual standpoint, but lower large panel TV prices have been the reality since August of last year, giving some hope toward those purchase goals, but we still see some cannibalization of demand last year eating into unit demand this year, which we expect will cause those procurement goals to be lowered at least once this year. That said, the dollar value of TV set sales should increase a bit this year, at a rate greater than unit volume, as the premium segment grows, so while units might be a focus point for headlines in the trade press, again the winner will be the most profitable, which we expect will be one of the South Korean brands, depending on promotional spending and component availability.

RSS Feed

RSS Feed