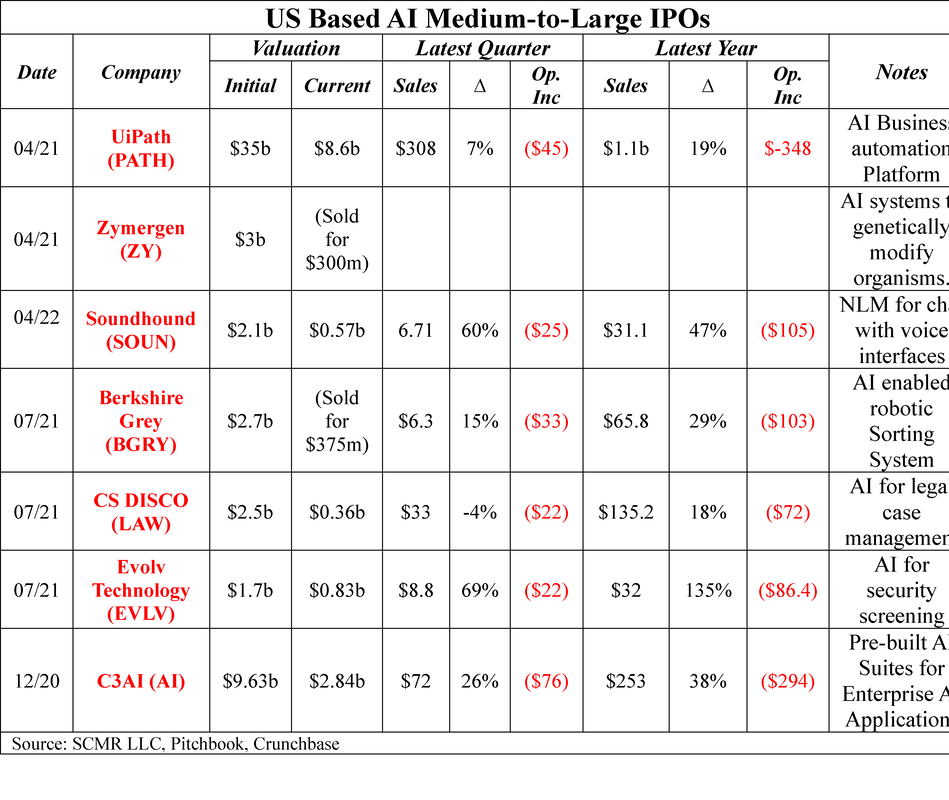

AI ValuationWe have noted that AI is the topic of the day in tech circles recently, but it has been the focus of the private investment community for a much longer time. Global AI start-up funding has increased from ~$26.6b in 2019 to $52.1b last year, only 20% less that the value of the entire AI market in 2020. Along with VC funding excitement, which continues currently, a number of AI companies have gone public, some at unusually high valuations. We were curious to see how those valuations have been maintained as the AI craze continues and were surprised to see that they have not held up as well as one might have thought given the level of publicity. In the table below, we look at a number of medium to large AI related IPOs and how the valuations have changed. This is not a complete list, as there have been a number of smaller AI related company IPOs, and we have excluded all foreign AI company IPOs. We show the latest quarter sales and operating income, and the latest full year sales and operating income, and a brief description of the company. Columns 3 and 4 tell the whole story, and with the two acquired companies the valuation slides from ~$57b to ~$14b, a decline of ~75%, although many of these deals were done near a general tech peak in 2021. As these are typically relatively young companies, they might one day, be able to grow into those lofty AI valuations, but we expect many AI VCs have realized that they were able to cash out of at least some of their AI investments before the cycle began to turn and have been a bit more conservative about valuations since.

0 Comments

Leave a Reply. |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed