Alternatives – Part II

As we noted in Part I, historically, the display industry has tended to focus on one major technology advance at a time, which, when proven commercially viable, became the immediate focus for large panel producers and a later focus for smaller producers unless it happened to be one that the smaller producer had chosen as their ‘go to’ R&D project, such as Sharp’s (6753.JP) development of IGZO that resulted in its lead in the technology starting back in late 2012. However, with the number of new potential display technologies being developed, and the potentially shorter timelines to a final mass production decision, the decision for smaller panel producers is more toward developing new product categories using existing infrastructure than it is developing new display technology. In some cases the development of new product categories does entail new equipment or process changes, but most new product categories can be based on existing process lines or minor modifications, with more research done on the development of a marketing strategy and developing new customer relationships than leading edge technology.

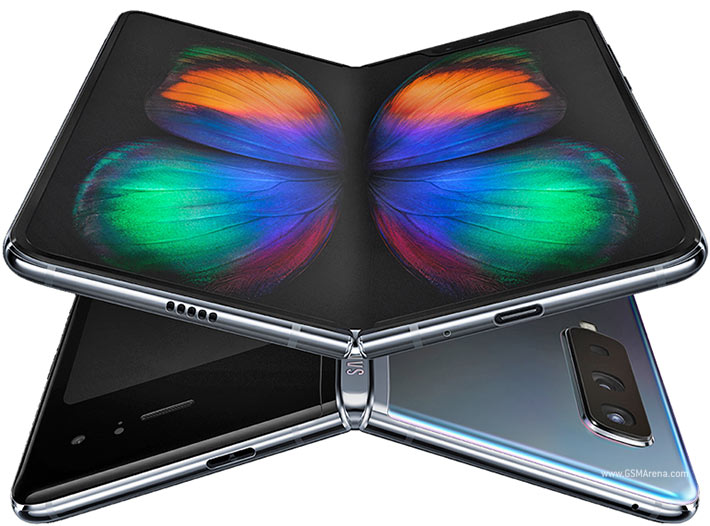

The display industry has in the past categorized display panel products as ‘large’ and ‘small’, essentially categorizing large as panels over 10” (diagonal) and small as anything under 10”, with ‘large’ categories broken down into monitors, notebooks, and TV panels, and the ‘small’ category representing primarily feature phones (inexpensive with few features) and smartphones. Over the years those categories became more defined, especially as OLED technology became a significant part of the ‘small’ category. With the first LCD display on a phone appearing in 1994 (see Figure 5), LCD panel producers increased LCD display size, colors, and quality until OLED smartphones displays became a new category for ‘small’ displays back in 2005, although all small OLED displays were ‘rigid’ in that they were based on a glass substrate. That changed in 2010 when Samsung Display released the 1st flexible OLED display used in the Galaxy Note Edge and only 4 years later when Samsung released the first commercial foldable smartphone display, the Galaxy Z Fold.

The timelines between these technology milestones continues to contract, which makes the R&D process even more critical to both large and small panel producers, with Figure 4 representing only small panel displays. Large panel displays have undergone similar technology changes and now face a multitude of potential game changing display technologies that are at various stages of development toward commercialization. With only a few panel producers able to spend the R&D dollars necessary to examine all of those potential display technologies, smaller panel producers are taking the ‘road less traveled’ and building out new display applications such as automotive or ultra high-resolution displays, especially as more generic panel categories see declining prices. We expect this ‘bifurcation’ in the display space to continue as Samsung Display, LG Display (LPL), and BOE (200725.CH) push technological boundaries, and smaller panel producers more toward niche product development, with the pace of change in both regards, continuing to increase.

In Part III we look at large panel display technologies, their timelines, and the new display technologies being developed. Stay tuned

RSS Feed

RSS Feed