Anatomy of a Micro-Display Company

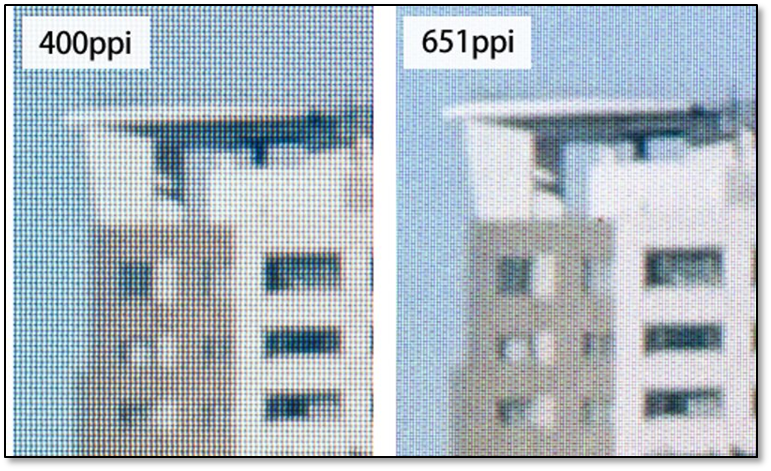

Example: A 0.23” display with 640 x 400 resolution has a higher PPI than a larger 0.5” display with a resolution of 1280 x 960, or a 0.5” display with a resolution of 1600 x 1200 has a higher PPI than a 0.7” display with a resolution of 1920 x 1080.

As the PPI or pixel density increases, the distance between the pixels becomes smaller and the ‘screen door’ effect becomes less, especially given that such displays are so close to the users eye, so micro-display companies are always striving for the highest pixel density possible. As those pixel densities increase the pixels obviously need to be smaller and as they become smaller they become harder to pattern on a display and therefore more costly, but there is another factor that also plays into producing a high value micro-display and that is brightness, which is a far greater issue for AR than VR. As AR headsets can be used indoors or out, they require ultra-high brightness displays to compete with sunlight, while VR headsets compete against the opposite, a black background, but still need to generate enough light to make a scene look realistic and detailed, somewhere between 500 nits and 3,000 nits for current VR headsets. As LCD displays generate their brightness through the backlight, they tend to be inherently brighter than self-emissive (OLED) displays and are less expensive to produce, particularly as most OLED micro-displays employ WOLED technology, a single color (white) OLED sub-pixel with a color filter, a process that reduces light output, but considerable work is being applied toward upgrading the process toward RGB OLED micro-displays, essentially smaller and more compact versions of OLED smartphone displays.

While these and other display details are essential for the AR/VR space to become truly viable, the companies involved in the development of micro-displays vary considerably in size and scope. Much of the early development for micro-displays was done under government projects with a bias toward military applications, and only within the last 5 years has the focus broadened to include AR and VR applications. Such military projects were intended to develop relatively low volume, high priced specialty items, and many smaller micro-display companies still retail such a customer base. However the attraction of a higher volume consumer oriented product has attracted some more recognizable names to the micro-display market, such as Sony (SNE), Samsung Display (pvt), BOE (200725.CH), and Japan Display (6740.JP), which has pushed some of the smaller companies to look toward more specialized micro-display technology that can give them an edge over those that are in the mass production business.

Micro-display development companies like eMagin (EMAN) and Kopin (KOPN) have been in the public market arena for a number of years but recently a company located in France filed a registration statement likely the basis for an IPO on the Paris or other Euronext exchanges, but more to the point, it gives some insight into the inner workings of such relatively small micro-display companies and the development of their products.. The company Microoled (pvt) which has been in business since 2007, specializes in micro-OLED displays, with applications ranging from the abovementioned near-eye products to those used in camera viewfinders or surgical (endoscopic) tools and a variety of defense and security applications. The company also has its own line of displays designed for sports glasses (ActiveLook®) that are used in a number of external brand applications. Between 2018 and 2020 security & defense applications generated ~60% of sales while sports optics generated ~30%, with the remaining 10% from high-value small run products, with two distributors, Creator Technology (pvt) in China and Collins Aerospace (RTX) in North America, representing ~61% of sales in 2020. A proposed JV with Creator to build out a dedicated production line would likely influence that split if finalized.

MIcrooled uses STMicroelectronics (STM) and X-Fab (XFAB.FP) to create the TFT backplane necessary for its displays but does the OLED deposition on its own production lines in Grenoble, which has the capacity to produce 4,000 wafers/year (between 200,000 and 2m displays, depending on size) and is developing plans for a new line to be put in service in 2023. The in-house lines are responsible for OLED material deposition and encapsulation, then passing on the displays back to STM or Toppan (7911.JP) in Japan, where the color filters are applied, then to Chinese or Taiwanese (lower end displays) contractors for assembly and final test, with the company overseeing the final steps for premium displays.

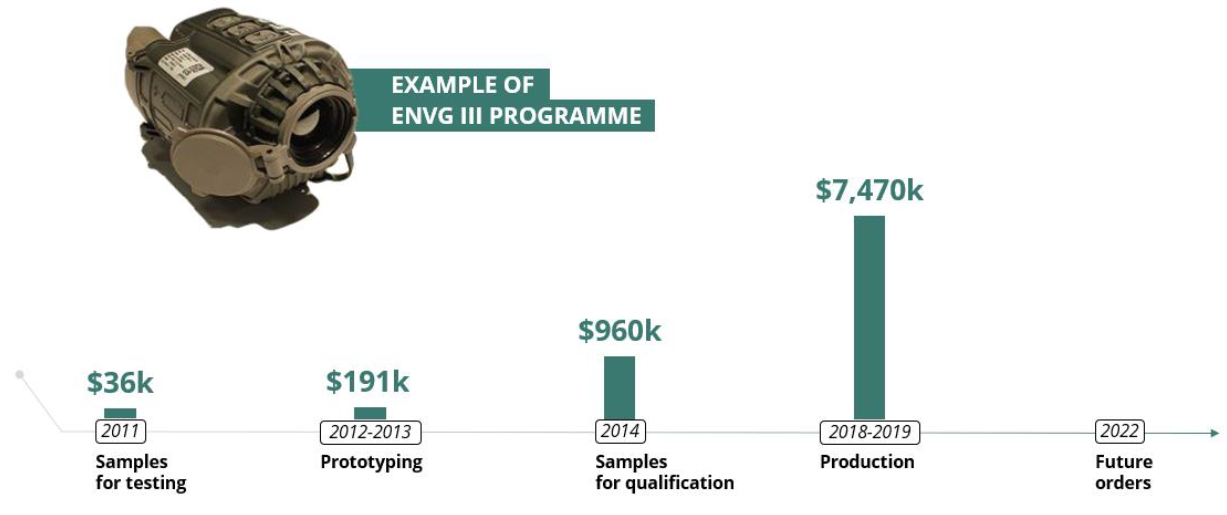

Product cycles are long for micro-displays used in non-consumer applications, with customer testing and product iterations taking 4 to 5 years in the defense space, and another extended waiting period between final approval and order placement, however this does give the company visibility of about a year and a long tail once the initial order has been secured, with the 2022 order book at ~$20m US.. To illustrate the sales development cycle for a project, Microoled offers the ENVG III night vision rifle sight project timeline and revenue stream in Figure 3. While the tail can be as long as 5 years for such projects, one can see the attractiveness of consumer products, whose timelines are appreciably shorter and volumes higher. This pushed Microoled into developing a micro-display module that contains a micro-display and optical system that projects a virtual transparent image a few feet in front of the user, and is specially designed to fit on the nose bridge of glasses. The company’s proprietary low power, high brightness micro-display, allows the display to communicate with a smartphone or smartwatch via Bluetooth Low Energy, drawing minimal power that would give the device a 12 to 15 hour lifetime with a weight of 7 grams (.25 oz.) (module), as opposed to typical VR headsets that weigh between 180 grams (0.4 lbs) and 700g (1.5lbs.) and typical AR headsets that weigh between 50g (0.11lbs.) and 250g (0.55lbs).

If and when the company issues public shares they will use some of the capital to bring the color filter process in house, a 3 year process including 18 months to develop a color filter pilot line and another 18 months to develop a color filter production line. As mentioned above, additional capital will go toward the development of a 3rd production line, toward the formation of a JV with Creator to build a dedicated production line, and to expand the ActiveLook ecosystem through the company’s US subsidiary, Engo Eyewear.

While we have looked at the company’s financials in detail, we will not show or comment on such here so as not to give the impression that we are favorable or unfavorable to the company’s prospects, but the idea here is for investors to better understand how the micro-display industry segment works, at least for smaller companies, and to better understand what that will mean for the industry should the Metaverse grow rapidly as some predict. That said, micro-display companies have been around for years and have seen commercial cycles come and go, so just because the CE industry wants the Metaverse to become the next ‘internet’ doesn’t mean it will or in any reasonable timeframe. The good news is that the headlines generated by Metaverse talk, has led to an increasing number of funding sources, and while this has also led to increased valuations, it will help to push the development of micro-display technology along a bit faster.

“Any fool can know. The point is to understand.”

― Albert Einstein

Note: SCMR LLC, has no interest in or any connection to any companies mentioned herein and any information presented is either from public sources or our proprietary research. We have not public opinion as to the value of companies mentioned here and offer the information presented for educational purposes only.

[1] 2021 released VR product catalog.

RSS Feed

RSS Feed