AUO Reports March results

Typical March sales on a m/m basis for AUO have been up 24.1% (5 year) although eliminating the anomaly year (2012) would show a more realistic gain of 27.0% (4 year), so based on the comparative data we would characterize the March results as weak. That said, the consensus estimate for AUO’s 1st quarter 2017 is NT$83.16b, which was lower than February’s consensus of NT$85.454b. Based on the newer consensus, AUO would have been expected to report NT$25.65b, which they obviously beat, so, from a consensus standpoint, the March results were better than expected.

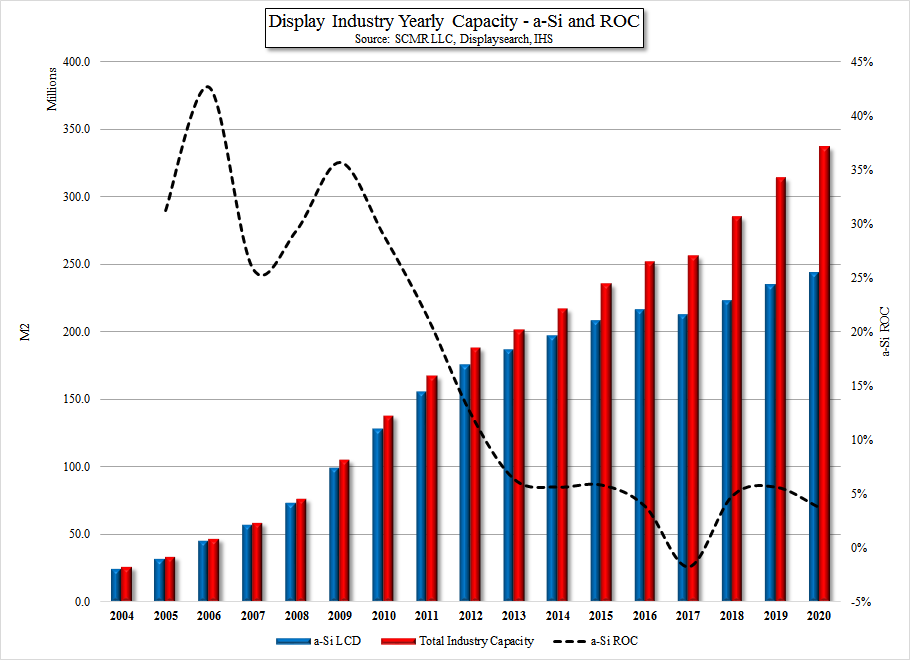

Again, we expect AUO and other panel producers to continue to show positive y/y results after such a dismal 1H last year, but the true test will be whether there will be y/y growth in 2H 2017. Panel producers also have a unique situation this year, as a number of older LCD fabs have been closed in order to convert that capacity from a-Si LCD panel production to small panel OLED production. This sets up a situation where a-Si LCD capacity will decline for the year by almost 2% according to our industry model, although total capacity across all backplane types will still be up ~2%. We note that a-Si LCD capacity has never declined on a y/y basis, at least since 2004, so this is a unique situation that indicates, at the very least, a change in the display industry, and while the growth of a-Si LCD backplane capacity will resume in 2018, it has led to a tighter pricing market than might otherwise have been seen.

Knowing that the easy comparisons will be ending in 2H, and a-Si LCD capacity growth will be resuming in 2018, sets an unusual circumstance for investors, as those two factors could return the industry back to the relatively ‘normal’ situation where panel prices decline on a regular basis, but the timing will be tricky as we approach the mid-year point. Those who believe will hold out hope for at least a strong holiday season, giving panel producers the benefit of the doubt, and those that do not will sell the panel stocks before the potential difficulties begin. While history tells us it is usually better to anticipate a change in the display space, as the stocks move very quickly as it becomes apparent that a change is coming, on a general basis, the panel stocks have been quite resilient, and the next few months will likely be a point where the binary approach to panel stock ownership will end.

RSS Feed

RSS Feed