China rumored to be considering a ban on Korean panel purchases

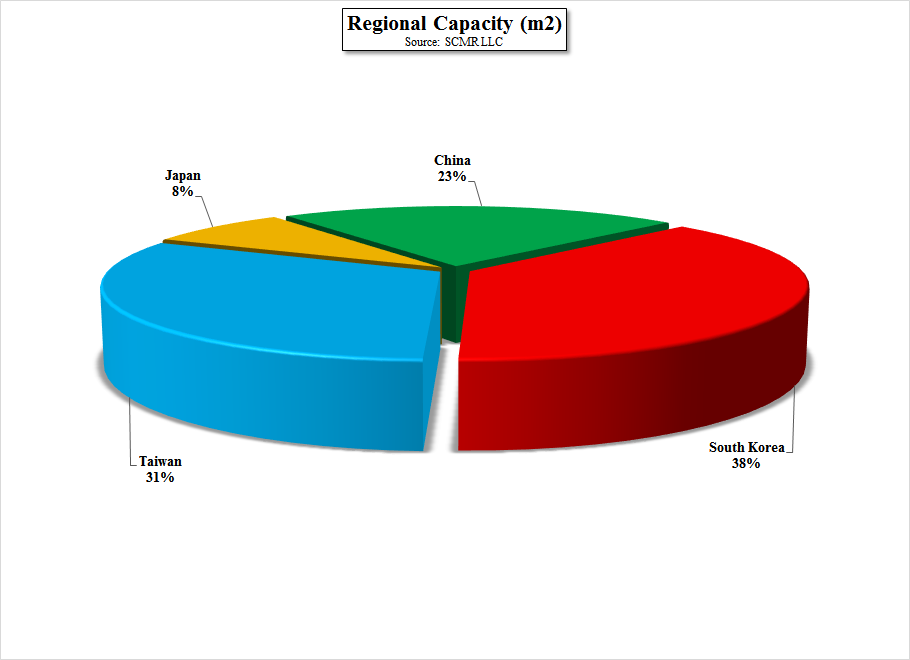

South Korean panel producers have the largest share of the display market based on m2 capacity, at 37.8% (1Q 2017), with Taiwan 2nd at 31.4%, China 3rd at 22.7%, and Japan 4th at 8.1%, and while China and Taiwan do not always agree on whether the country is a sovereign nation, the suggestion is that Chinese brands source from Taiwan, rather than South Korea. Taiwan’s panel producers are AU Optronics (AUO), Chunghwa Picture Tube (aka CPT) (2475.TT), Hannstar (6116.TT), and Innolux (3481.TT), with Innolux having the greatest capacity (49.0%), followed by AU Optronics (42.4%), CPT (5.5%), and Hannstar (3.0%), but back to South Korea, LG Display has a very significant exposure to Chinese brands, as the primary panel supplier to 3 of the 5 top Chinese CE brands, and Samsung Display, the primary supplier to the other two Chinese brands. There are, of course, a number of other South Korean companies that have significant exposure to China, including a number of display supply chain participants like LG Chem (051910.KS) and Cheil (pvt) but we believe LG Display has the most exposure to China in the direct display space, at almost 70%.

Thus far we have only heard that the idea is being considered, and likely being used to leverage negotiations between the US and China, but the underlying concept of Chinese display independence has been in both the current 5-year plan and the longer-term goals set by the government. Those ends are aided by the very generous subsidies and other ‘encouragements’ offered to Chinese panel producers to entice them to expand capacity and enter the world display markets, including free infrastructure, regional and local financing, and ‘gifts’ such as the millions of dollars of coal rights granted to BOE (200725.CH) in order to entice them to build a display production facility in Outer Mongolia. However, excluding South Korean companies from the Chinese display supply chain would be a difficult task, especially in a tight panel pricing market, which leads us to believe that little, other than some newsworthy sabre rattling, will be implemented as China has yet to develop the supply chain resources to be independent. Maybe we see a bit of panel business being shifted to Taiwan from South Korea, but only under circumstances where price equivalents were offered.

RSS Feed

RSS Feed