LG to supply flexible OLED displays to Chinese Smartphone producers

As it turns out, LG Display has already been supplying what are called flexible displays to its parent, LG Electronics (066570.KS), and to the same Chinese smartphone brand that is now the focus of the excitement, Xiaomi (pvt), for its Mi Note 2, released in November 2016. As we have noted many times in the past, what is called flexible here is actually ‘conformed’, essentially a rounded edge to a smartphone display that was originally championed by Samsung Electronics (005930.KS) for its more recent Galaxy smartphones and cannot be modified by the user. LG has actually released what we call a ‘somewhat flexible’ phone (LG G flex & G Flex2) which can flex a bit without breaking, but the truly flexible smartphone that has been the goal of display manufacturers for years, remains outside of commercial mass production today (note we said ‘today’). So ‘flexible’ in marketing terms can be equated to ‘organic’ in the food industry where the word can mean almost anything.

Xiaomi Mi Note 2 - Source: GSMarena

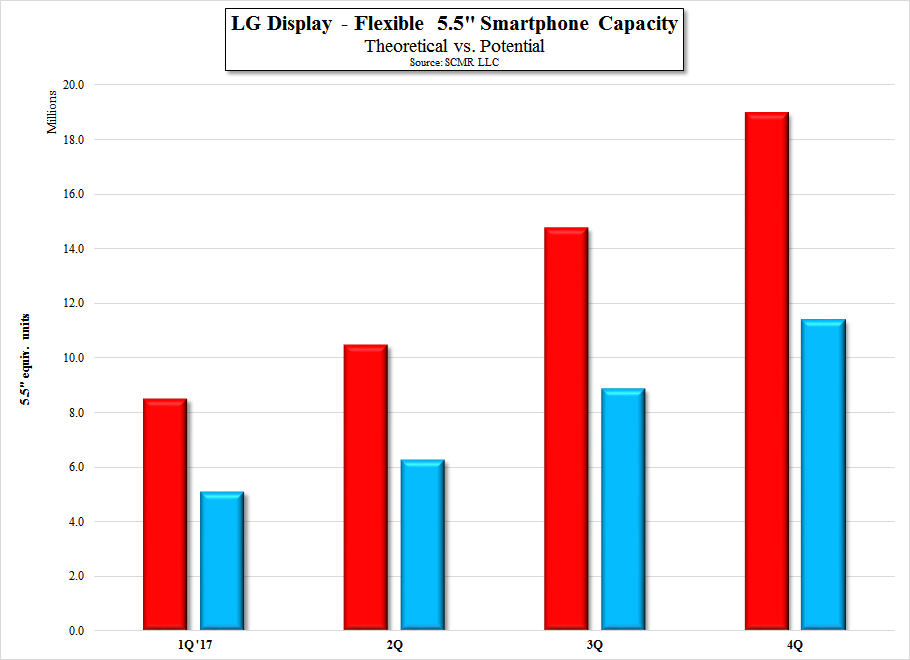

Xiaomi Mi Note 2 - Source: GSMarena LG Display produces LTPS flexible substrate products at its E2 Gen 4 Gumi fab, which theoretically could produce ~12m 5’5” units/quarter (100% yield), and its E5 LTPS G6 Paju line, which is in ramp up mode. When completed (phase 1 this year – phase 2 in 2018) we believe this fab will be able to produce ~18m 5.5” units/quarter (100% yield), giving LG Display a theoretical capacity of 30m units/quarter by mid-2018. Potentially, LG Display has plans for another flexible OLED fab, E6, which could theoretically produce ~48m units/quarter, but decisions for such additional capacity have not been finalized. It should be noted that these are theoretical numbers, and have little to do with actual production. Fabs are usually brought on-line in two or three phases that are spaced at least 9 to 12 months apart. This allows the panel producer to look for manufacturing problems in the phase 1 line, and avoid duplicating them in phase 2. Fabs also do not turn on at full production levels and depending on the technology can take a year to move from day 0 to full factory efficiency, and of course, there is product yield, which can start as low as 25% and also take months to improve to levels above 50%.

Making matters even more difficult is the fact that OLED technology is still in its early stage of manufacturing, with only a few companies in production, and most with only small volumes, and adding insult to injury, we add that flexible OLED commercial production is at an even earlier stage in commercial manufacturing, tempering theoretical production numbers by even greater amounts. We model 5.5” smartphone flexible unit volume in Fig. 3 using a 60% average product yield, and aggressive phase completion and ramp parameters (actual results may vary…), all of which would be difficult goals to achieve this year and potentially also difficult in 2018, depending on the complexity of the ‘flexible’ display itself, with more flexibility significantly lowering product yield.

The purpose here is not to discourage investors, but to create timelines that are closer to commercial display production realities than quoting maximum fab specs, as most press articles do. We commend LG Display for continuing to pursue small panel OLED production in light of Samsung Display’s dominance, and believe they have almost as good a chance at developing a truly flexible smartphone as Samsung. Of course, then the question becomes do consumers actually want a flexible smartphone…

RSS Feed

RSS Feed