Sharp gets OLED help from former rival

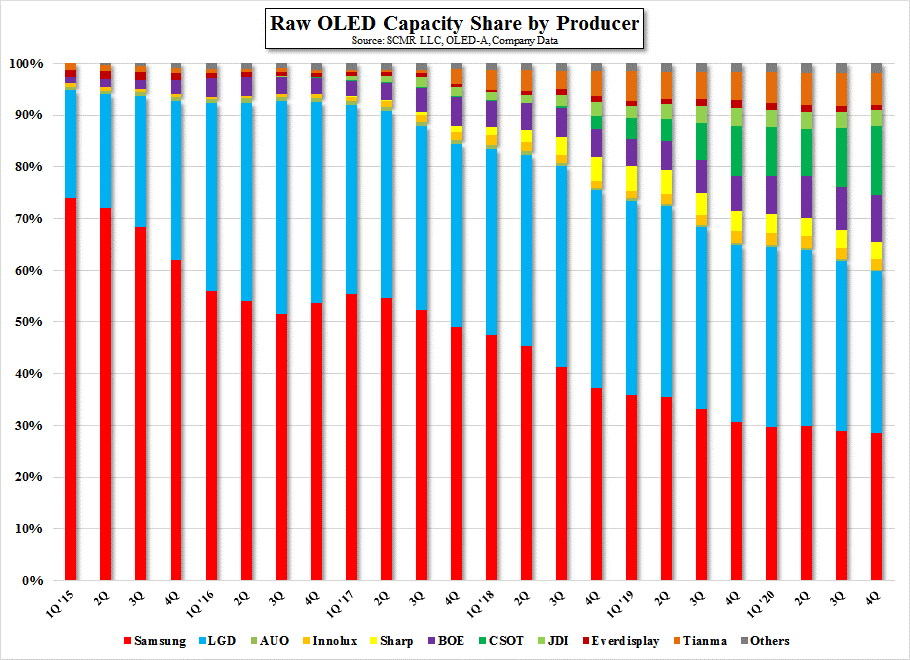

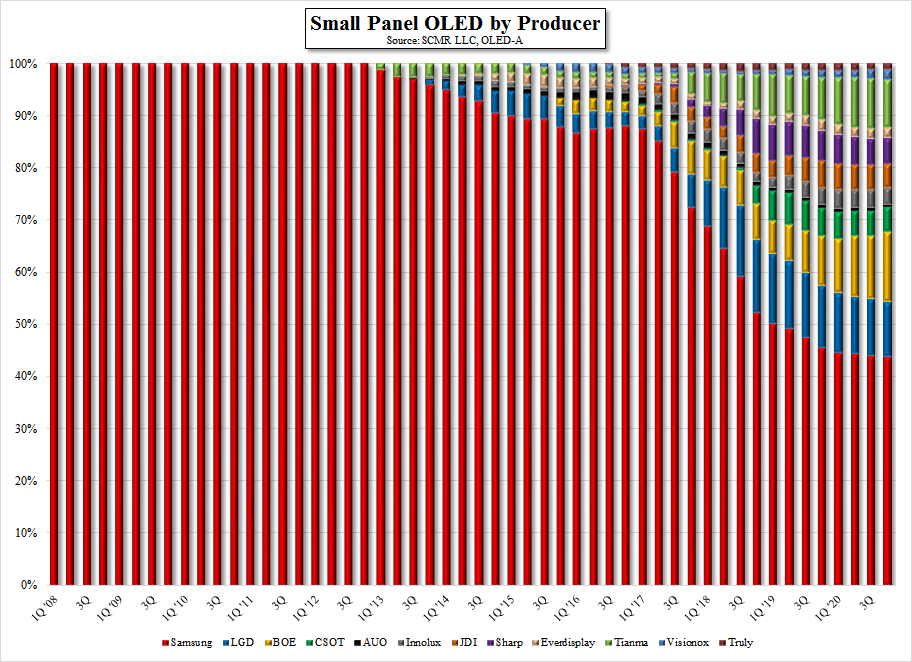

The new combination of Innolux and Sharp, in terms of gross display capacity, would be ranked just slightly behind capacity leader LG Display (22.3%) at 22.1%, and significantly above rival Samsung Display’s 12.6%, however when looking at OLED capacity, the combined Innolux and Sharp barely register at 1.4% against Samsung Display’s 54.7% and LG Display’s 36.0%. As Apple is expected to enter the OLED display space as a potential user of OLED for its iPhone line, all panel producers are scrambling to expand their efforts and prove to the industry (read, Apple) that they too can become a supplier of small panel OLED displays, despite their lack of previous funding in most cases, and certainly at Innolux and Sharp. Fig. 4[1] shows our OLED industry share expectations based on current capex, construction timelines, and producer experience, although actual available capacity would be smaller, particularly for those with little OLED mass production experience. Hopefully, the OLED engineers being sent from Innolux to Sharp will help to accelerate the combined company’s OLED R&D program, but there is a lot of ground to cover before being able to catch up to the leaders who will not be standing still.

[1] Innolux and Sharp are represented by the two yellow chart segments

RSS Feed

RSS Feed